- India

- /

- Basic Materials

- /

- NSEI:KAKATCEM

Investors Holding Back On Kakatiya Cement Sugar and Industries Limited (NSE:KAKATCEM)

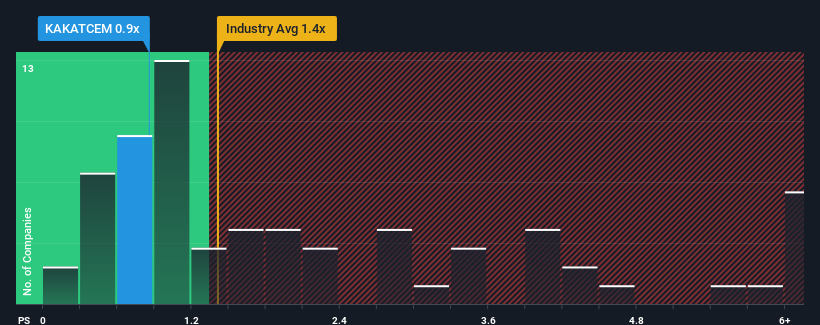

With a price-to-sales (or "P/S") ratio of 0.9x Kakatiya Cement Sugar and Industries Limited (NSE:KAKATCEM) may be sending bullish signals at the moment, given that almost half of all the Basic Materials companies in India have P/S ratios greater than 1.4x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Kakatiya Cement Sugar and Industries

How Kakatiya Cement Sugar and Industries Has Been Performing

Revenue has risen firmly for Kakatiya Cement Sugar and Industries recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kakatiya Cement Sugar and Industries will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Kakatiya Cement Sugar and Industries' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. Pleasingly, revenue has also lifted 42% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 12% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's quite peculiar that Kakatiya Cement Sugar and Industries' P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at the figures, it's surprising to see Kakatiya Cement Sugar and Industries currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

It is also worth noting that we have found 3 warning signs for Kakatiya Cement Sugar and Industries (2 shouldn't be ignored!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kakatiya Cement Sugar and Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KAKATCEM

Kakatiya Cement Sugar and Industries

Produces, manufactures, refines, and sells Portland cement in India.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives