Jubilant Industries Limited's (NSE:JUBLINDS) Shares Climb 39% But Its Business Is Yet to Catch Up

Jubilant Industries Limited (NSE:JUBLINDS) shares have had a really impressive month, gaining 39% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 78%.

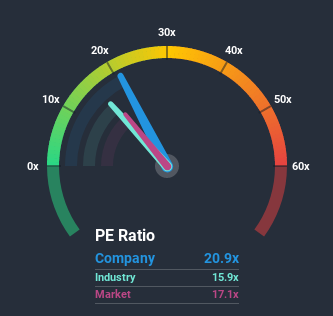

After such a large jump in price, Jubilant Industries may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 20.9x, since almost half of all companies in India have P/E ratios under 17x and even P/E's lower than 8x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Jubilant Industries has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Jubilant Industries

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Jubilant Industries would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a worthy increase of 3.0%. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Jubilant Industries is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

The large bounce in Jubilant Industries' shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Jubilant Industries revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Jubilant Industries has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

You might be able to find a better investment than Jubilant Industries. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

When trading Jubilant Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:JUBLINDS

Jubilant Industries

Engages in manufacturing and sale of performance polymers and agricultural products in India and internationally.

Excellent balance sheet low.

Market Insights

Community Narratives