Stock Analysis

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in Jindal Poly Films' (NSE:JINDALPOLY) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Jindal Poly Films, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

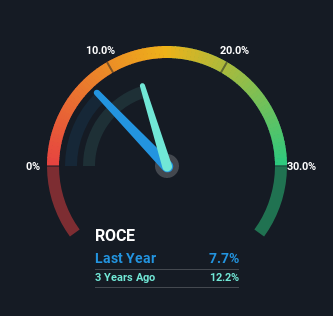

0.077 = ₹6.8b ÷ (₹104b - ₹16b) (Based on the trailing twelve months to December 2022).

Therefore, Jindal Poly Films has an ROCE of 7.7%. Ultimately, that's a low return and it under-performs the Chemicals industry average of 17%.

See our latest analysis for Jindal Poly Films

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Jindal Poly Films, check out these free graphs here.

SWOT Analysis for Jindal Poly Films

- Earnings growth over the past year exceeded the industry.

- Debt is well covered by earnings.

- Earnings growth over the past year is below its 5-year average.

- Dividend is low compared to the top 25% of dividend payers in the Chemicals market.

- Current share price is above our estimate of fair value.

- JINDALPOLY's financial characteristics indicate limited near-term opportunities for shareholders.

- Lack of analyst coverage makes it difficult to determine JINDALPOLY's earnings prospects.

- Debt is not well covered by operating cash flow.

- Paying a dividend but company has no free cash flows.

How Are Returns Trending?

We're glad to see that ROCE is heading in the right direction, even if it is still low at the moment. The data shows that returns on capital have increased substantially over the last five years to 7.7%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 44%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

On a related note, the company's ratio of current liabilities to total assets has decreased to 16%, which basically reduces it's funding from the likes of short-term creditors or suppliers. This tells us that Jindal Poly Films has grown its returns without a reliance on increasing their current liabilities, which we're very happy with.

The Bottom Line On Jindal Poly Films' ROCE

To sum it up, Jindal Poly Films has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. Since the stock has returned a staggering 164% to shareholders over the last five years, it looks like investors are recognizing these changes. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

On a separate note, we've found 1 warning sign for Jindal Poly Films you'll probably want to know about.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're helping make it simple.

Find out whether Jindal Poly Films is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NSEI:JINDALPOLY

Jindal Poly Films

Jindal Poly Films Limited manufactures and sells biaxially oriented polyethylene terephthalate (BOPET) films, and BOPP films in India and internationally.

Average dividend payer with mediocre balance sheet.