I Ran A Stock Scan For Earnings Growth And Gulshan Polyols (NSE:GULPOLY) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Gulshan Polyols (NSE:GULPOLY). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Gulshan Polyols

Gulshan Polyols's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud Gulshan Polyols's stratospheric annual EPS growth of 60%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

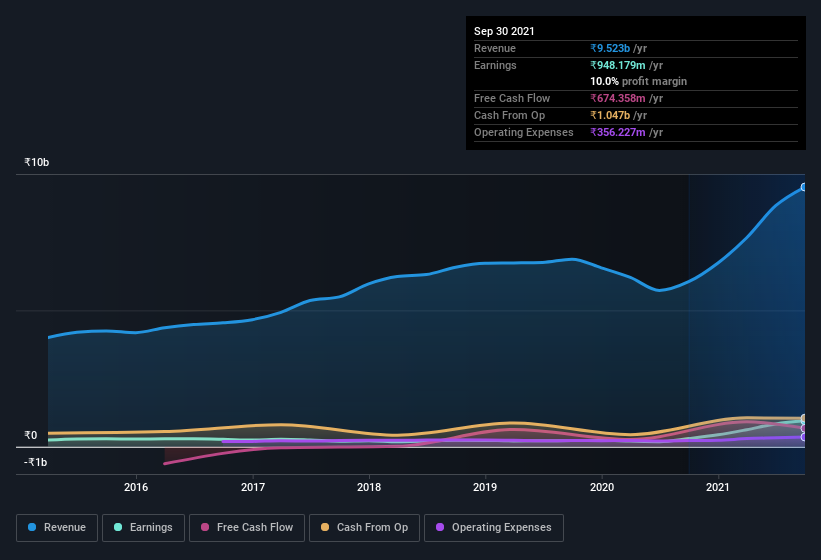

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Gulshan Polyols is growing revenues, and EBIT margins improved by 6.1 percentage points to 14%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Gulshan Polyols isn't a huge company, given its market capitalization of ₹20b. That makes it extra important to check on its balance sheet strength.

Are Gulshan Polyols Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Insiders both bought and sold Gulshan Polyols shares in the last year, but the good news is they spent ₹1.2m more buying than they netted selling. So, on balance, the insider transactions are mildly encouraging. It is also worth noting that it was Arun Jain who made the biggest single purchase, worth ₹10m, paying ₹139 per share.

The good news, alongside the insider buying, for Gulshan Polyols bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have ₹2.2b worth of shares. That's a lot of money, and no small incentive to work hard. That amounts to 11% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Ashwani Vats is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Gulshan Polyols with market caps between ₹7.4b and ₹30b is about ₹13m.

The Gulshan Polyols CEO received ₹7.8m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Gulshan Polyols Deserve A Spot On Your Watchlist?

Gulshan Polyols's earnings have taken off like any random crypto-currency did, back in 2017. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Gulshan Polyols belongs on the top of your watchlist. Before you take the next step you should know about the 2 warning signs for Gulshan Polyols that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Gulshan Polyols, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GULPOLY

Gulshan Polyols

Engages in the mineral and grain processing, and ethanol distillery businesses in India and internationally.

Proven track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives