Shareholders May Not Be So Generous With Clariant Chemicals (India) Limited's (NSE:CLNINDIA) CEO Compensation And Here's Why

Under the guidance of CEO Adnan Ahmad, Clariant Chemicals (India) Limited (NSE:CLNINDIA) has performed reasonably well recently. As shareholders go into the upcoming AGM on 12 August 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for Clariant Chemicals (India)

How Does Total Compensation For Adnan Ahmad Compare With Other Companies In The Industry?

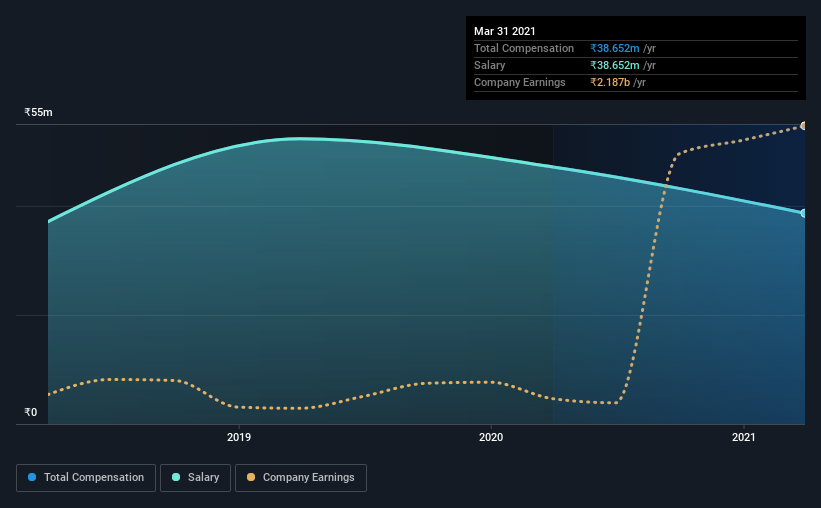

According to our data, Clariant Chemicals (India) Limited has a market capitalization of ₹14b, and paid its CEO total annual compensation worth ₹39m over the year to March 2021. We note that's a decrease of 18% compared to last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹39m.

For comparison, other companies in the same industry with market capitalizations ranging between ₹7.4b and ₹30b had a median total CEO compensation of ₹16m. Hence, we can conclude that Adnan Ahmad is remunerated higher than the industry median.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹39m | ₹47m | 100% |

| Other | - | - | - |

| Total Compensation | ₹39m | ₹47m | 100% |

Speaking on an industry level, nearly 89% of total compensation represents salary, while the remainder of 11% is other remuneration. Speaking on a company level, Clariant Chemicals (India) prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Clariant Chemicals (India) Limited's Growth Numbers

Clariant Chemicals (India) Limited's earnings per share (EPS) grew 116% per year over the last three years. Its revenue is down 3.5% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Clariant Chemicals (India) Limited Been A Good Investment?

We think that the total shareholder return of 122%, over three years, would leave most Clariant Chemicals (India) Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Clariant Chemicals (India) pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 3 warning signs for Clariant Chemicals (India) you should be aware of, and 1 of them is a bit unpleasant.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Clariant Chemicals (India), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Heubach Colorants India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:HEUBACHIND

Heubach Colorants India

Engages in the manufacture and sale of specialty chemicals in India and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives