- India

- /

- Paper and Forestry Products

- /

- NSEI:ABREL

What Type Of Returns Would Century Textiles and Industries'(NSE:CENTURYTEX) Shareholders Have Earned If They Purchased Their SharesThree Years Ago?

Century Textiles and Industries Limited (NSE:CENTURYTEX) shareholders should be happy to see the share price up 24% in the last month. But that doesn't change the fact that the returns over the last three years have been disappointing. Regrettably, the share price slid 71% in that period. So it's good to see it climbing back up. While many would remain nervous, there could be further gains if the business can put its best foot forward.

Check out our latest analysis for Century Textiles and Industries

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

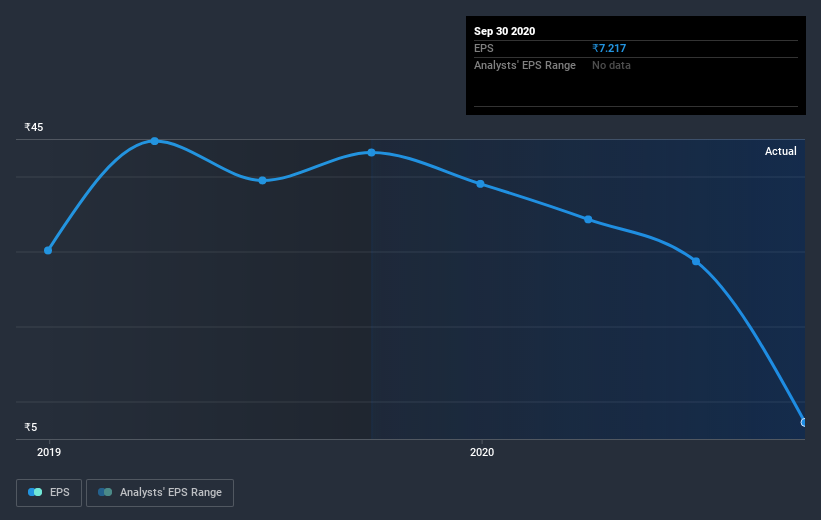

During the three years that the share price fell, Century Textiles and Industries' earnings per share (EPS) dropped by 31% each year. This change in EPS is reasonably close to the 33% average annual decrease in the share price. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. It seems like the share price is reflecting the declining earnings per share.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Century Textiles and Industries' earnings, revenue and cash flow.

A Different Perspective

Investors in Century Textiles and Industries had a tough year, with a total loss of 19% (including dividends), against a market gain of about 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Century Textiles and Industries is showing 3 warning signs in our investment analysis , and 1 of those is concerning...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade Century Textiles and Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:ABREL

Aditya Birla Real Estate

Manufactures and sells textiles, and pulp and paper products in India and internationally.

Exceptional growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives