- India

- /

- Basic Materials

- /

- NSEI:BIGBLOC

Bigbloc Construction Limited (NSE:BIGBLOC) Stocks Shoot Up 29% But Its P/S Still Looks Reasonable

Bigbloc Construction Limited (NSE:BIGBLOC) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 41% over that time.

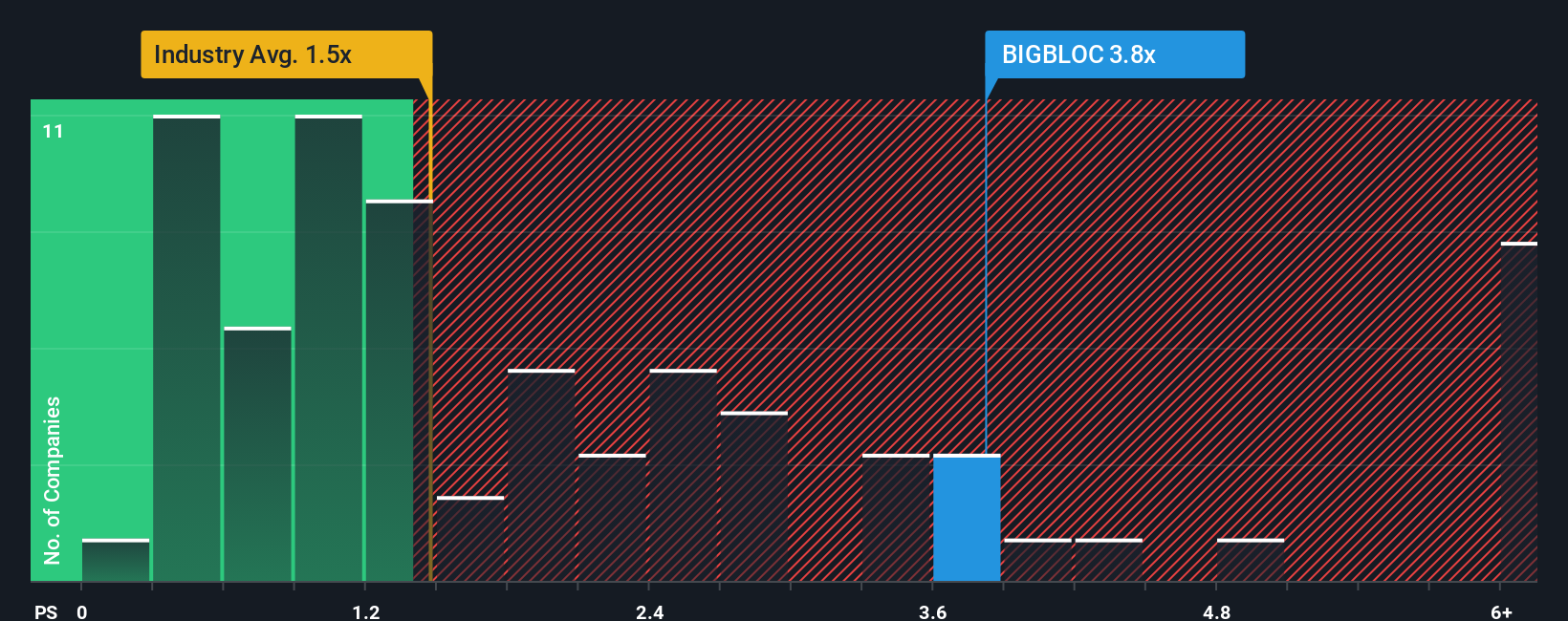

Since its price has surged higher, when almost half of the companies in India's Basic Materials industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Bigbloc Construction as a stock not worth researching with its 3.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Bigbloc Construction

How Bigbloc Construction Has Been Performing

Bigbloc Construction has been doing a decent job lately as it's been growing revenue at a reasonable pace. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Bigbloc Construction will help you shine a light on its historical performance.How Is Bigbloc Construction's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Bigbloc Construction's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 5.3% gain to the company's revenues. Revenue has also lifted 17% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 3.1% shows it's a great look while it lasts.

With this in mind, it's clear to us why Bigbloc Construction's P/S exceeds that of its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

The Bottom Line On Bigbloc Construction's P/S

Shares in Bigbloc Construction have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Bigbloc Construction revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Bigbloc Construction that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bigbloc Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BIGBLOC

Bigbloc Construction

Engages in the manufacturing, sales, and marketing of aerated autoclave concrete blocks in India.

Imperfect balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success