- India

- /

- Paper and Forestry Products

- /

- NSEI:ABREL

Aditya Birla Real Estate Limited's (NSE:ABREL) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

To the annoyance of some shareholders, Aditya Birla Real Estate Limited (NSE:ABREL) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Still, a bad month hasn't completely ruined the past year with the stock gaining 31%, which is great even in a bull market.

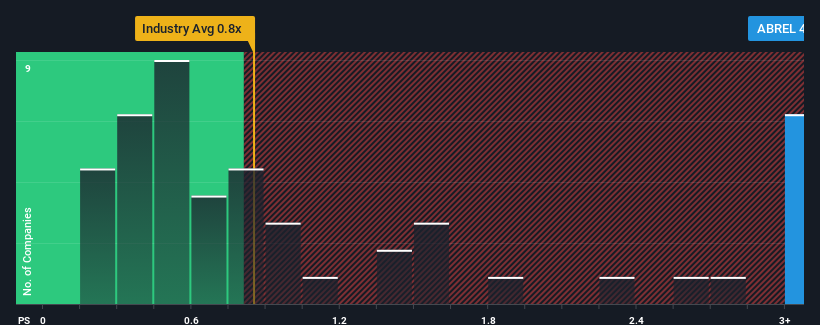

In spite of the heavy fall in price, when almost half of the companies in India's Forestry industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider Aditya Birla Real Estate as a stock not worth researching with its 4.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Aditya Birla Real Estate

What Does Aditya Birla Real Estate's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Aditya Birla Real Estate has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Aditya Birla Real Estate will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Aditya Birla Real Estate's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.9% last year. Pleasingly, revenue has also lifted 33% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 0.7% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 9.2%, which is noticeably more attractive.

In light of this, it's alarming that Aditya Birla Real Estate's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Aditya Birla Real Estate's P/S

Aditya Birla Real Estate's shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Aditya Birla Real Estate trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 4 warning signs for Aditya Birla Real Estate you should be aware of, and 1 of them makes us a bit uncomfortable.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ABREL

Aditya Birla Real Estate

Develops and leases real estate properties primarily in India.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives