Stock Analysis

Do SBI Life Insurance's (NSE:SBILIFE) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like SBI Life Insurance (NSE:SBILIFE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide SBI Life Insurance with the means to add long-term value to shareholders.

View our latest analysis for SBI Life Insurance

How Quickly Is SBI Life Insurance Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. SBI Life Insurance managed to grow EPS by 6.5% per year, over three years. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that SBI Life Insurance's revenue from operations did not account for all of their revenue last year, so our analysis of its margins might not accurately reflect the underlying business. While SBI Life Insurance may have maintained EBIT margins over the last year, revenue has fallen. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

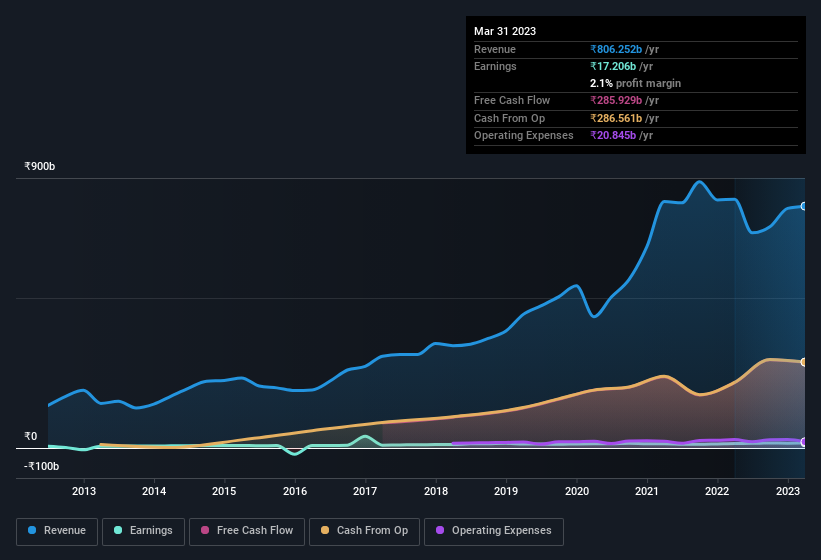

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for SBI Life Insurance?

Are SBI Life Insurance Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. For companies with market capitalisations over ₹656b, like SBI Life Insurance, the median CEO pay is around ₹113m.

SBI Life Insurance's CEO only received compensation totalling ₹4.7m in the year to March 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add SBI Life Insurance To Your Watchlist?

One positive for SBI Life Insurance is that it is growing EPS. That's nice to see. On top of that, our faith in the board of directors is strengthened by the fact of the reasonable CEO pay. All things considered, SBI Life Insurance is definitely worth taking a deeper dive into. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing SBI Life Insurance's ROE with industry peers (and the market at large).

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether SBI Life Insurance is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SBILIFE

SBI Life Insurance

Operates as a private life insurance company in India.

Excellent balance sheet with proven track record.