- India

- /

- Personal Products

- /

- NSEI:WALPAR

If EPS Growth Is Important To You, Walpar Nutritions (NSE:WALPAR) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Walpar Nutritions (NSE:WALPAR). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Walpar Nutritions

Walpar Nutritions' Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Walpar Nutritions has achieved impressive annual EPS growth of 54%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

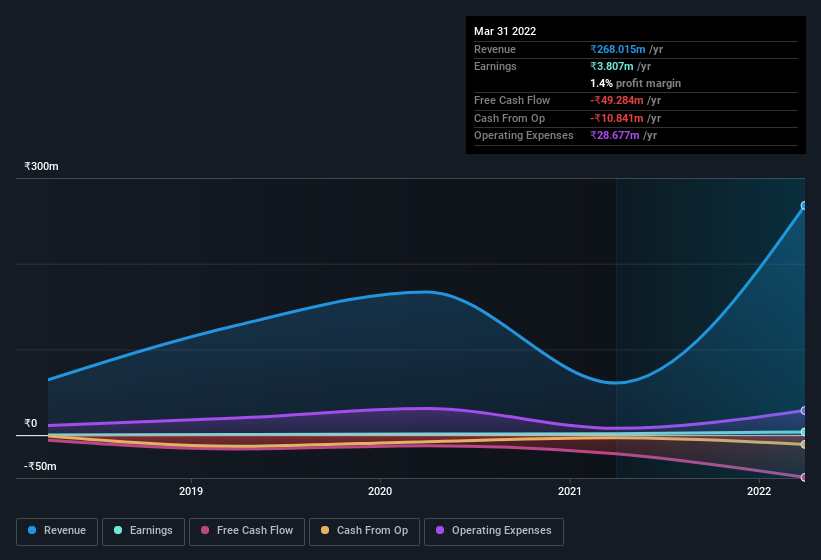

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While Walpar Nutritions did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Walpar Nutritions is no giant, with a market capitalisation of ₹284m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Walpar Nutritions Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Walpar Nutritions shares, in the last year. Add in the fact that Sejal Ladhawala, the Executive Director & CFO of the company, paid ₹2.4m for shares at around ₹34.77 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

On top of the insider buying, we can also see that Walpar Nutritions insiders own a large chunk of the company. To be exact, company insiders hold 71% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Although, with Walpar Nutritions being valued at ₹284m, this is a small company we're talking about. So this large proportion of shares owned by insiders only amounts to ₹203m. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Kalpesh Ladhawala, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Walpar Nutritions with market caps under ₹16b is about ₹3.3m.

Walpar Nutritions' CEO only received compensation totalling ₹210k in the year to March 2021. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Walpar Nutritions Worth Keeping An Eye On?

Walpar Nutritions' earnings per share growth have been climbing higher at an appreciable rate. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Walpar Nutritions belongs near the top of your watchlist. Still, you should learn about the 6 warning signs we've spotted with Walpar Nutritions (including 3 which are a bit concerning).

The good news is that Walpar Nutritions is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Walpar Nutritions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:WALPAR

Walpar Nutritions

Manufactures and trades pharmaceutical, nutraceutical, herbal, and ayurvedic commodities in India.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026