Should You Be Adding Zydus Wellness (NSE:ZYDUSWELL) To Your Watchlist Today?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Zydus Wellness (NSE:ZYDUSWELL). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Zydus Wellness

Zydus Wellness's Earnings Per Share Are Growing.

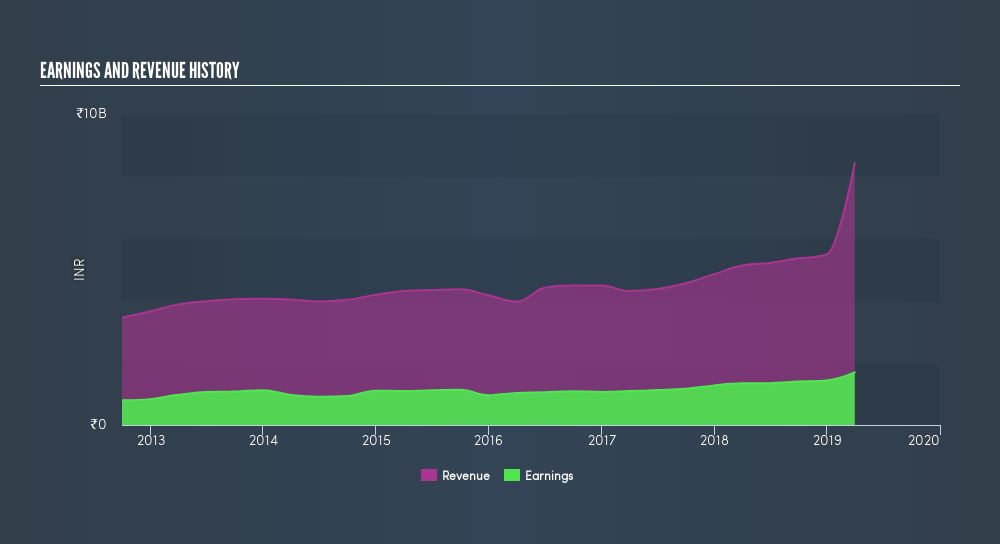

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years Zydus Wellness grew its EPS by 15% per year. That's a pretty good rate, if the company can sustain it.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Zydus Wellness did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Zydus Wellness?

Are Zydus Wellness Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold -₹569.0k worth of shares. But that's far less than the ₹3.0b insiders spend purchasing stock. I find this encouraging because it suggests they are optimistic about the Zydus Wellness's future. We also note that it was the , Pankaj Patel, who made the biggest single acquisition, paying ₹3.0b for shares at about ₹1,385 each.

Along with the insider buying, another encouraging sign for Zydus Wellness is that insiders, as a group, have a considerable shareholding. With a whopping ₹3.9b worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to make me think that management will be very focussed on long term growth.

Does Zydus Wellness Deserve A Spot On Your Watchlist?

As I already mentioned, Zydus Wellness is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Zydus Wellness.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Zydus Wellness, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:ZYDUSWELL

Zydus Wellness

Engages in the development, production, marketing, and distribution of health and wellness products in India.

Flawless balance sheet with questionable track record.