Investors Still Aren't Entirely Convinced By Triveni Engineering & Industries Limited's (NSE:TRIVENI) Earnings Despite 28% Price Jump

Triveni Engineering & Industries Limited (NSE:TRIVENI) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 43% in the last year.

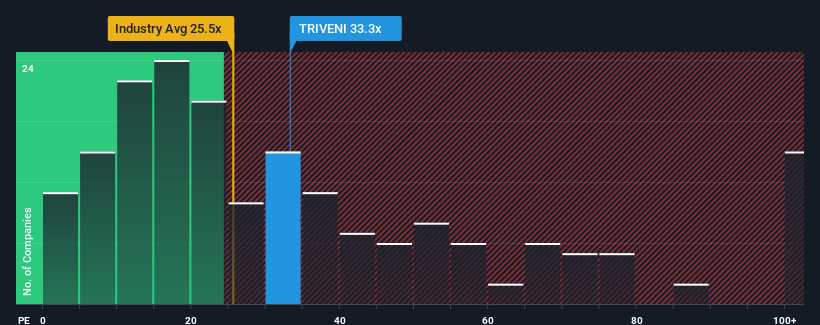

In spite of the firm bounce in price, it's still not a stretch to say that Triveni Engineering & Industries' price-to-earnings (or "P/E") ratio of 33.3x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 33x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Triveni Engineering & Industries' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Triveni Engineering & Industries

Does Growth Match The P/E?

Triveni Engineering & Industries' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 5.7% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 26% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 19% per year, which is noticeably less attractive.

In light of this, it's curious that Triveni Engineering & Industries' P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Triveni Engineering & Industries appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Triveni Engineering & Industries currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 1 warning sign for Triveni Engineering & Industries that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Triveni Engineering & Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TRIVENI

Triveni Engineering & Industries

Engages in the sugar and allied businesses, and engineering businesses in India and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives