Stock Analysis

Avoid Triveni Engineering & Industries And Explore One Better Dividend Stock Option

Reviewed by Sasha Jovanovic

Dividend-paying stocks are often pursued for their potential to provide a consistent income stream. However, the stability of these dividends is crucial; fluctuations can indicate underlying financial challenges. For instance, Triveni Engineering & Industries has experienced significant dividend cuts, raising concerns about the reliability of its payouts and making it a less attractive option for those seeking dependable dividend investments. Today, we will compare this with another stock that shows more promise in maintaining its dividends.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Balmer Lawrie Investments (BSE:532485) | 4.14% | ★★★★★★ |

| Bhansali Engineering Polymers (BSE:500052) | 2.89% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 3.84% | ★★★★★☆ |

| ITC (NSEI:ITC) | 3.21% | ★★★★★☆ |

| Castrol India (BSE:500870) | 3.09% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.50% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.27% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.69% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.27% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.66% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top Dividend Stocks screener.

Let's review one of the notable picks from our screened stocks and one not so great.

Top Pick

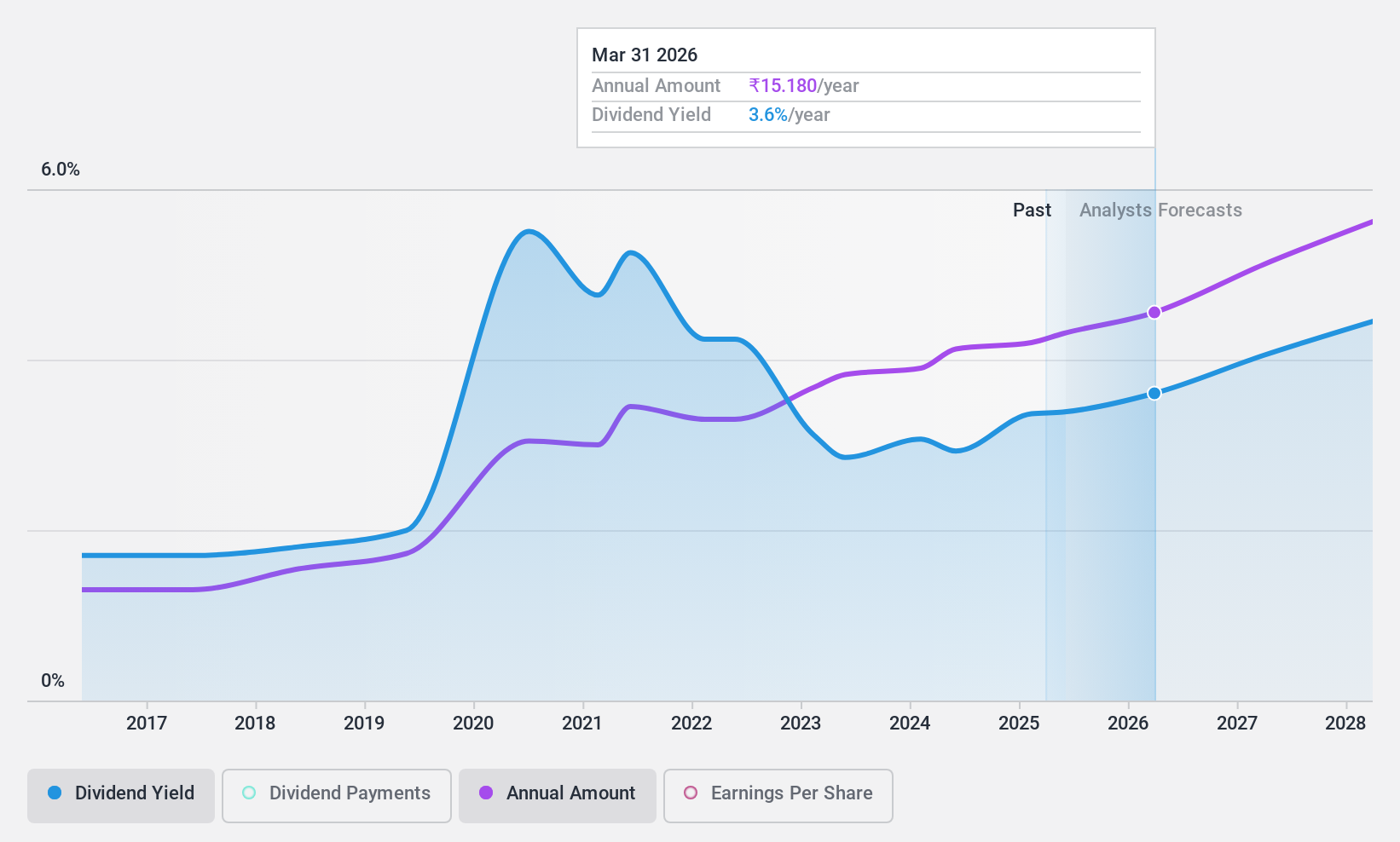

ITC (NSEI:ITC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ITC Limited operates in diverse sectors including fast-moving consumer goods, hotels, paperboards and paper, packaging, agriculture, and information technology across India and globally, with a market cap of approximately ₹5.35 trillion.

Operations: ITC's revenue is derived from several segments including ₹336.68 billion from FMCG - Cigarettes, ₹210.02 billion from FMCG - Others, ₹161.24 billion from Agri Business, ₹83.44 billion from Paperboards, Paper & Packaging, and ₹31.03 billion from Hotels.

Dividend Yield: 3.2%

ITC has demonstrated a stable dividend track record over the past decade, contrasting sharply with companies experiencing significant cuts. Although its dividend yield stands at a competitive 3.21%, challenges persist as the 126.1% cash payout ratio and 83.7% earnings payout ratio indicate potential sustainability issues, despite recent financial growth with net income increasing to INR 204,587.8 million from INR 191,916.6 million last year and consistent dividend increments announced in May 2024.

- Get an in-depth perspective on ITC's performance by reading our dividend report here.

- Our valuation report unveils the possibility ITC's shares may be trading at a premium.

One To Reconsider

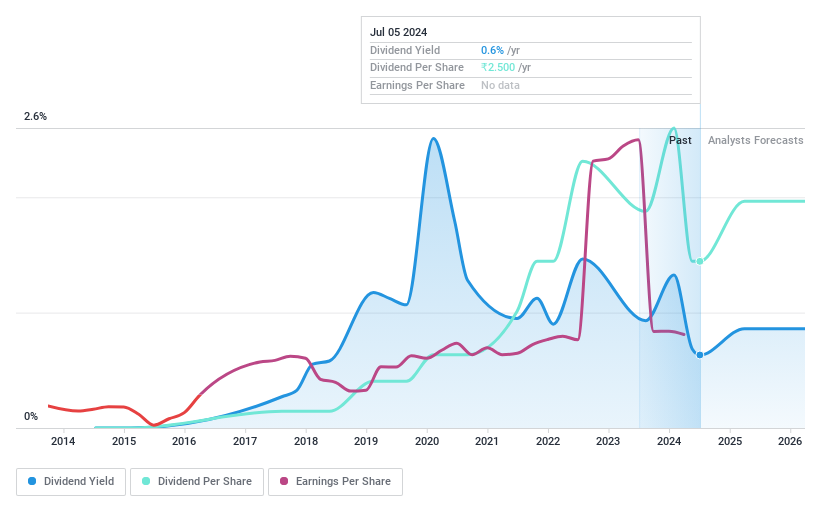

Triveni Engineering & Industries (NSEI:TRIVENI)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Triveni Engineering & Industries Limited operates in the sugar and engineering sectors both in India and globally, with a market capitalization of approximately ₹85.80 billion.

Operations: The company's revenue is primarily derived from its Sugar and Allied Business, with the Sugar (including Co-Generation) segment generating ₹38.58 billion and the Distillery segment contributing ₹22.05 billion, alongside revenues from Engineering Businesses in Water and Power Transmission amounting to ₹2.46 billion and ₹2.92 billion respectively.

Dividend Yield: 0.6%

Triveni Engineering & Industries Limited, despite a recent dividend proposal of INR 1.25 per share, showcases unstable dividend trends with significant reductions and unreliable payments over the past seven years. This instability is compounded by a lack of free cash flows and earnings that do not adequately cover dividends. Additionally, recent financial results reveal declining year-over-year revenues and net income, alongside a penalty for GST discrepancies, further questioning the sustainability of future dividends.

Turning Ideas Into Actions

- Gain an insight into the universe of 18 Top Dividend Stocks by clicking here.

- Are any of these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Triveni Engineering & Industries is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TRIVENI

Triveni Engineering & Industries

Engages in the sugar and engineering businesses in India and internationally.

Reasonable growth potential with adequate balance sheet.