Here's Why Tilaknagar Industries (NSE:TI) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Tilaknagar Industries (NSE:TI), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Tilaknagar Industries with the means to add long-term value to shareholders.

We've discovered 1 warning sign about Tilaknagar Industries. View them for free.Tilaknagar Industries' Improving Profits

Tilaknagar Industries has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. In previous twelve months, Tilaknagar Industries' EPS has risen from ₹8.75 to ₹9.49. That's a fair increase of 8.4%.

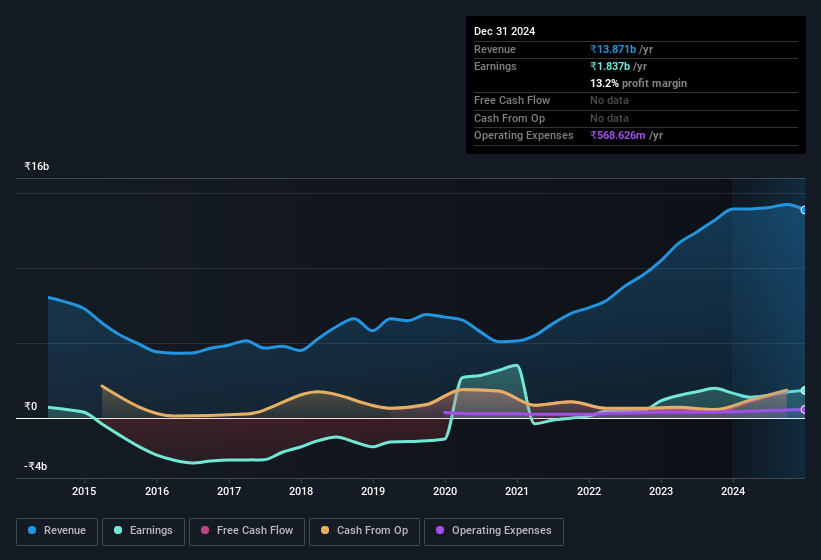

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Despite the relatively flat revenue figures, shareholders will be pleased to see EBIT margins have grown from 12% to 15% in the last 12 months. Which is a great look for the company.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

See our latest analysis for Tilaknagar Industries

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Tilaknagar Industries Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Tilaknagar Industries will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 36% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. At the current share price, that insider holding is worth a staggering ₹17b. That level of investment from insiders is nothing to sneeze at.

Should You Add Tilaknagar Industries To Your Watchlist?

One important encouraging feature of Tilaknagar Industries is that it is growing profits. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. We don't want to rain on the parade too much, but we did also find 1 warning sign for Tilaknagar Industries that you need to be mindful of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Tilaknagar Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TI

Tilaknagar Industries

Engages in the manufacture and sale of Indian made foreign liquor and its related products in India.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives