Future Consumer (NSE:FCONSUMER) Share Prices Have Dropped 86% In The Last Three Years

It's not possible to invest over long periods without making some bad investments. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of Future Consumer Limited (NSE:FCONSUMER), who have seen the share price tank a massive 86% over a three year period. That'd be enough to cause even the strongest minds some disquiet. The more recent news is of little comfort, with the share price down 61% in a year. Unhappily, the share price slid 1.8% in the last week.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Future Consumer

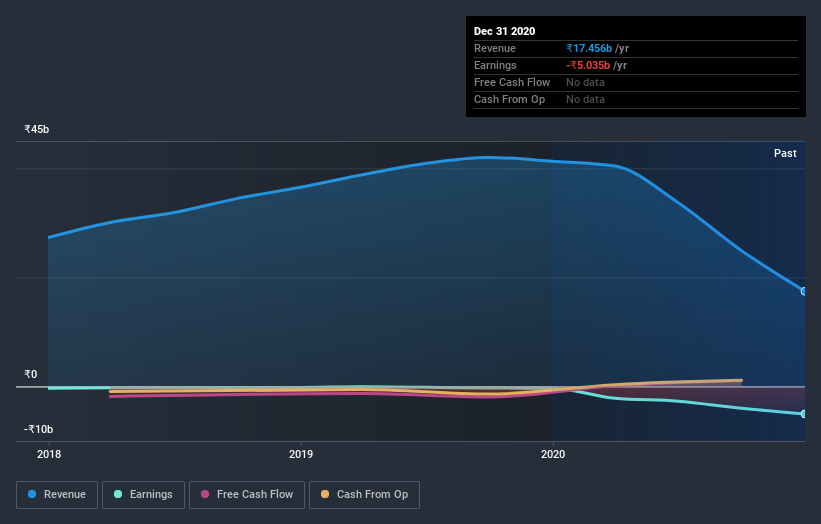

Because Future Consumer made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Future Consumer's revenue dropped 3.1% per year. That is not a good result. The share price fall of 23% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. This business clearly needs to grow revenues if it is to perform as investors hope. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Future Consumer's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 28% in the last year, Future Consumer shareholders lost 61%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Future Consumer better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Future Consumer (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Future Consumer or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:FCONSUMER

Future Consumer

Engages in the sourcing, manufacture, branding, marketing, and distribution of food and processed food products, and health and personal care products in India.

Low and slightly overvalued.