Stock Analysis

- India

- /

- Metals and Mining

- /

- BSE:526371

Examining 3 Top Dividend Stocks In India With Yields Up To 4.1%

Reviewed by Kshitija Bhandaru

Amidst a backdrop of positive global market cues and a consecutive upward trend in the Indian equity benchmarks, Sensex and Nifty 50, investors are keenly watching the performance of various sectors. In such an optimistic market environment, dividend stocks become particularly attractive as they offer potential for steady income alongside capital appreciation opportunities.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Bhansali Engineering Polymers (BSE:500052) | 3.89% | ★★★★★★ |

| Castrol India (BSE:500870) | 3.60% | ★★★★★☆ |

| Balmer Lawrie Investments (BSE:532485) | 4.81% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.48% | ★★★★★☆ |

| ITC (NSEI:ITC) | 3.03% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.78% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.00% | ★★★★★☆ |

| Gujarat Narmada Valley Fertilizers & Chemicals (NSEI:GNFC) | 4.33% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.37% | ★★★★★☆ |

| Rashtriya Chemicals and Fertilizers (NSEI:RCF) | 3.69% | ★★★★★☆ |

Click here to see the full list of 25 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

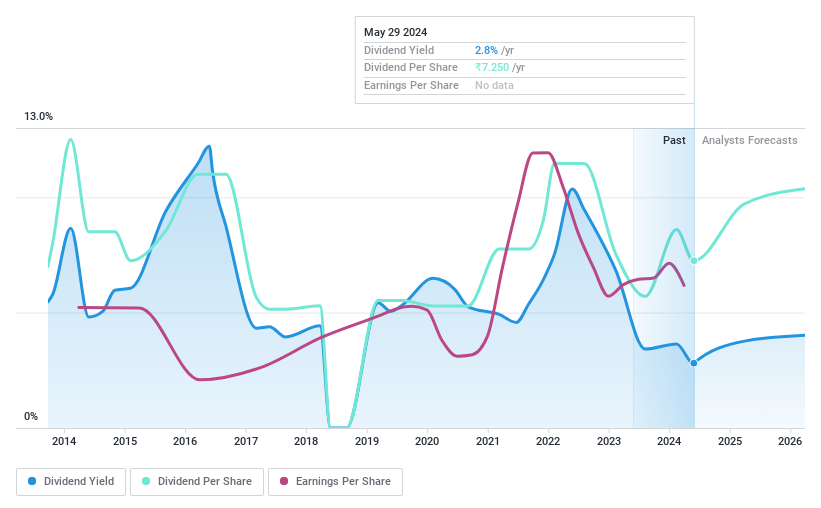

VST Industries (BSE:509966)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: VST Industries Limited operates in the manufacturing, trading, and marketing of cigarettes and tobacco products both in India and internationally, with a market capitalization of approximately ₹61.25 billion.

Operations: VST Industries Limited generates its revenue primarily from the sale of tobacco and related products, totaling ₹13.47 billion.

Dividend Yield: 3.8%

VST Industries, trading at a 5.1% discount to its estimated fair value, offers a dividend yield of 3.78%, placing it in the top 25% of Indian dividend payers. Despite this attractive yield, the sustainability is questionable as dividends are not well supported by free cash flow; however, with a payout ratio of 70.8%, earnings do cover the payments. The company has maintained stable and reliable dividends over the past decade and has seen growth in these distributions during this period. Recently, VST appointed Sanjay Wali as COO, potentially bolstering its strategic operations.

- Dive into the specifics of VST Industries here with our thorough dividend report.

- According our valuation report, there's an indication that VST Industries' share price might be on the expensive side.

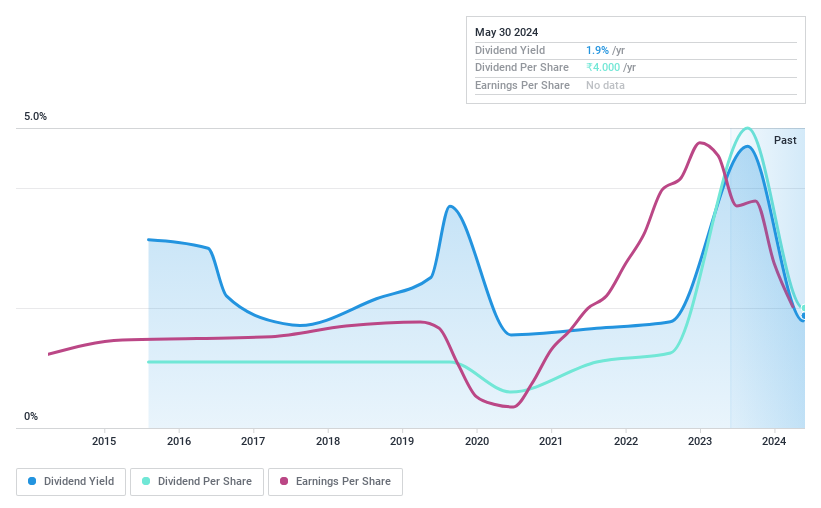

Gujarat State Fertilizers & Chemicals (BSE:500690)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gujarat State Fertilizers & Chemicals Limited, operating in India, is engaged in the manufacturing and sale of fertilizers and industrial products with a market capitalization of approximately ₹95.10 billion.

Operations: Gujarat State Fertilizers & Chemicals Limited generates ₹72.64 billion from fertilizer products and ₹23.10 billion from industrial products.

Dividend Yield: 4.2%

Gujarat State Fertilizers & Chemicals experienced a significant decrease in sales and net income in the third quarter of 2023, with sales dropping to IN₹20.08 billion from IN₹34.79 billion year-over-year and net income falling to IN₹1.18 billion from IN₹4.10 billion. Despite this downturn, the company maintains a dividend yield of 4.19%, ranking in the top quartile of Indian dividend payers. The dividends are reasonably covered by both earnings, with a payout ratio of 31.5%, and cash flows, at 44.2%. However, its dividend history is marked by volatility and inconsistency over the past nine years, raising concerns about future reliability amidst recent executive changes including a new managing director as of February 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Gujarat State Fertilizers & Chemicals.

- Upon reviewing our latest valuation report, Gujarat State Fertilizers & Chemicals' share price might be too pessimistic.

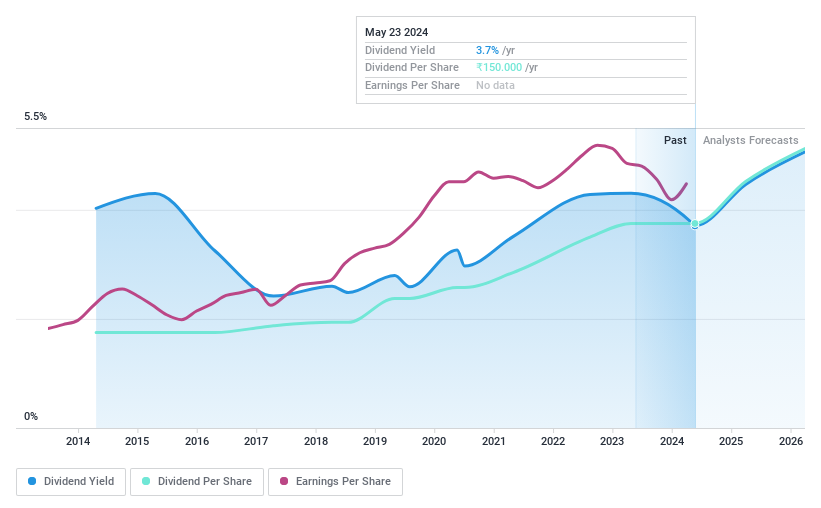

NMDC (BSE:526371)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NMDC Limited, primarily engaged in the exploration and production of iron ore in India, has a market capitalization of approximately ₹687.23 billion.

Operations: NMDC Limited generates ₹204.17 billion from its iron ore operations and ₹2.51 billion from pellets, other minerals, and services.

Dividend Yield: 3.7%

NMDC Limited has shown a robust financial performance with significant growth in sales and net income as reported in the third quarter of 2023, with sales reaching IN₹54.10 billion and net income at IN₹14.84 billion. Despite its strong earnings, NMDC's dividend history exhibits volatility over the past decade, which might concern stability-focused investors. However, its dividends are well-supported by both earnings and cash flows, with payout ratios of 39.2% and 43.4% respectively, suggesting sustainability from a financial perspective. The recent resignation of director Shri Sanjay Tandon due to personal commitments is noted but appears non-disruptive to operations.

- Click here to discover the nuances of NMDC with our detailed analytical dividend report.

- According our valuation report, there's an indication that NMDC's share price might be on the cheaper side.

Next Steps

- Delve into our full catalog of 25 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether NMDC is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BSE:526371

NMDC

NMDC Limited, together with its subsidiaries, explores for and produces iron ore in India.

Outstanding track record with excellent balance sheet and pays a dividend.