- India

- /

- Oil and Gas

- /

- NSEI:AEGISLOG

Aegis Logistics Limited (NSE:AEGISCHEM) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

Aegis Logistics Limited (NSE:AEGISCHEM) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 28%.

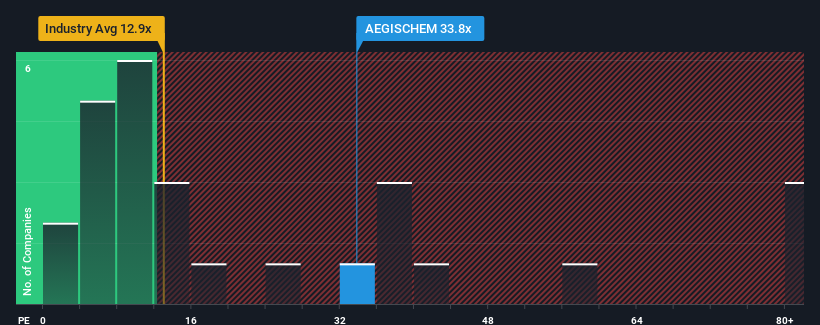

Although its price has surged higher, it's still not a stretch to say that Aegis Logistics' price-to-earnings (or "P/E") ratio of 33.8x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 31x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Aegis Logistics' earnings growth of late has been pretty similar to most other companies. The P/E is probably moderate because investors think this modest earnings performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

See our latest analysis for Aegis Logistics

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Aegis Logistics' is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 23%. The latest three year period has also seen an excellent 161% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 11% during the coming year according to the six analysts following the company. That's shaping up to be materially lower than the 24% growth forecast for the broader market.

In light of this, it's curious that Aegis Logistics' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Aegis Logistics' P/E

Aegis Logistics appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Aegis Logistics currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Aegis Logistics, and understanding these should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AEGISLOG

Aegis Logistics

Operates as an oil, gas, and chemical logistics company primarily in India.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives