- India

- /

- Consumer Finance

- /

- NSEI:SHRIRAMFIN

Most Shareholders Will Probably Agree With Shriram Transport Finance Company Limited's (NSE:SRTRANSFIN) CEO Compensation

Shareholders may be wondering what CEO Umesh Revankar plans to do to improve the less than great performance at Shriram Transport Finance Company Limited (NSE:SRTRANSFIN) recently. At the next AGM coming up on 24 June 2021, they can influence managerial decision making through voting on resolutions, including executive remuneration. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for Shriram Transport Finance

How Does Total Compensation For Umesh Revankar Compare With Other Companies In The Industry?

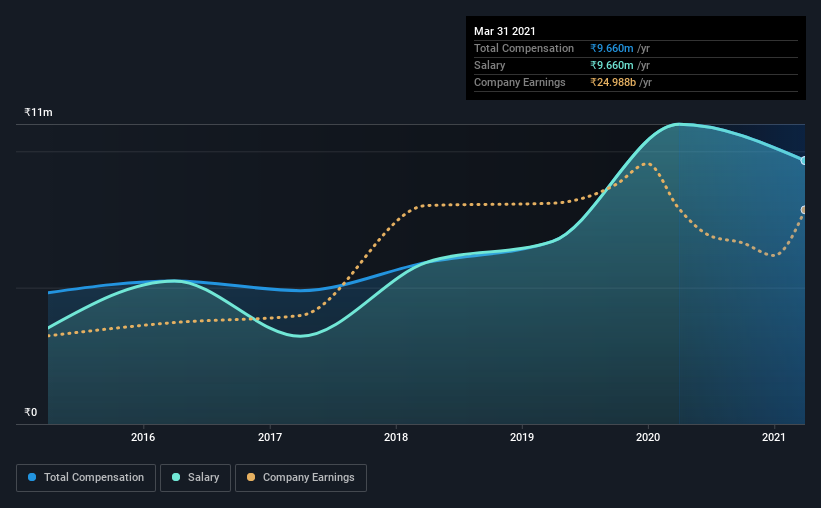

At the time of writing, our data shows that Shriram Transport Finance Company Limited has a market capitalization of ₹377b, and reported total annual CEO compensation of ₹9.7m for the year to March 2021. Notably, that's a decrease of 12% over the year before. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹9.7m.

For comparison, other companies in the same industry with market capitalizations ranging between ₹293b and ₹880b had a median total CEO compensation of ₹154m. That is to say, Umesh Revankar is paid under the industry median.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹9.7m | ₹11m | 100% |

| Other | - | - | - |

| Total Compensation | ₹9.7m | ₹11m | 100% |

On an industry level, it's fascinating to see that all of total compensation represents salary and non-salary benefits do not factor into the equation at all. Speaking on a company level, Shriram Transport Finance prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Shriram Transport Finance Company Limited's Growth

Over the last three years, Shriram Transport Finance Company Limited has shrunk its earnings per share by 3.3% per year. The trailing twelve months of revenue was pretty much the same as the prior period.

Overall this is not a very positive result for shareholders. And the flat revenue is seriously uninspiring. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Shriram Transport Finance Company Limited Been A Good Investment?

Shriram Transport Finance Company Limited has generated a total shareholder return of 1.2% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Shriram Transport Finance rewards its CEO solely through a salary, ignoring non-salary benefits completely. While it's true that shareholders have seen decent returns, it's hard to overlook the lack of earnings growth and this makes us wonder if the current returns can continue. Shareholders might want to question the board about these concerns, and revisit their investment thesis for the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for Shriram Transport Finance (of which 1 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Shriram Transport Finance, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SHRIRAMFIN

Shriram Finance

A non-banking finance company, primarily engages in the provision of financing services in India.

Good value average dividend payer.