Over the last 7 days, the Indian market has remained flat, with notable gains of 3.5% in the Utilities sector. Despite this short-term stagnation, the market has seen an impressive 44% rise over the past 12 months and earnings are forecast to grow by 17% annually. In such a dynamic environment, identifying stocks with strong growth potential can offer significant opportunities for investors looking to capitalize on India's economic momentum.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 42.61% | 42.95% | ★★★★★★ |

| Pearl Global Industries | 72.24% | 19.89% | 41.91% | ★★★★★☆ |

| Indo Amines | 82.32% | 17.15% | 19.98% | ★★★★★☆ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| Share India Securities | 24.23% | 37.59% | 48.98% | ★★★★☆☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Action Construction Equipment (NSEI:ACE)

Simply Wall St Value Rating: ★★★★★★

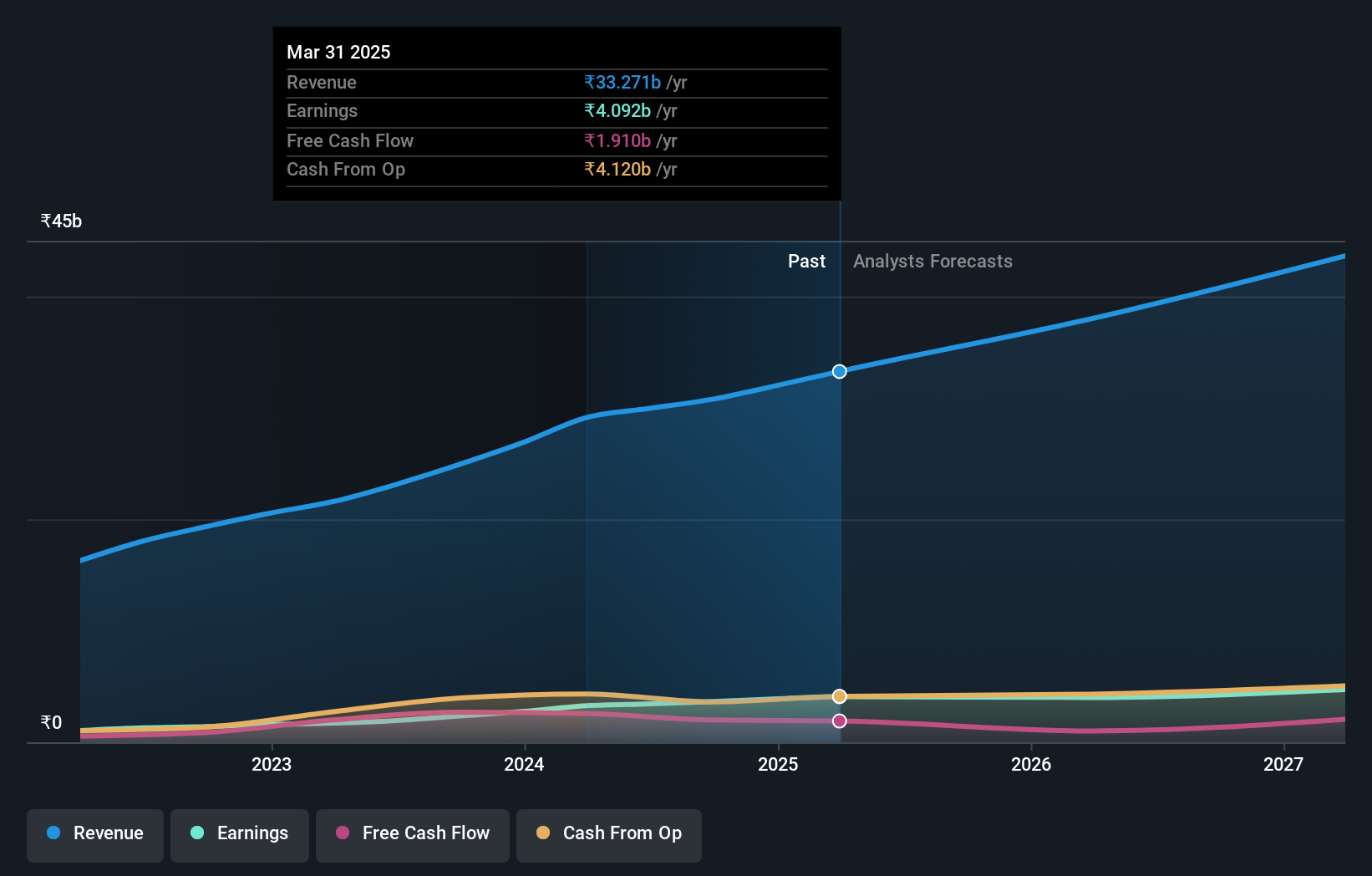

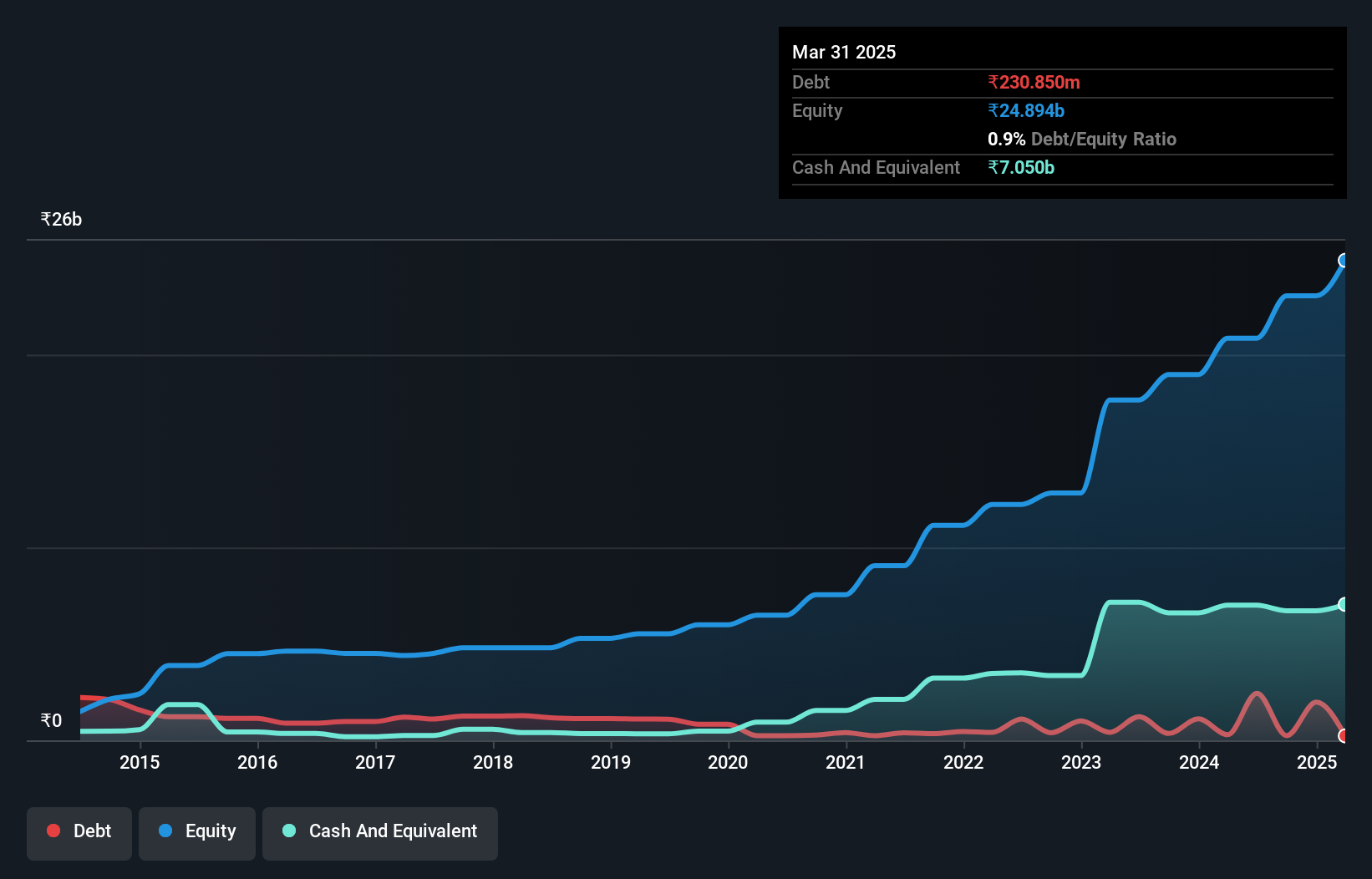

Overview: Action Construction Equipment Limited manufactures and sells material handling and construction equipment primarily in India, with a market cap of ₹166.42 billion.

Operations: Action Construction Equipment Limited generates revenue primarily from the sale of material handling and construction equipment, with additional contributions from agriculture equipment amounting to ₹2.05 billion. The segment adjustment stands at ₹27.92 million.

Action Construction Equipment (ACE) has shown robust financial health with a debt to equity ratio dropping from 18.5% to 0.4% over the past five years, indicating prudent debt management. Their earnings surged by 76.2% last year, outpacing the Machinery industry's growth of 25.1%. Additionally, ACE reported net income of INR 841.8 million for Q1 2024 compared to INR 675.5 million a year ago and declared a final dividend of INR 2 per share for FY2024, reflecting strong shareholder returns and confidence in future prospects.

Maharashtra Scooters (NSEI:MAHSCOOTER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Maharashtra Scooters Ltd. manufactures and sells pressure die casting dies, jigs, fixtures, and die casting components primarily for the two and three-wheeler industry in India, with a market cap of ₹139.39 billion.

Operations: Maharashtra Scooters Ltd. generates revenue primarily from investments (₹2.14 billion) and manufacturing (₹108.10 million). The company's financial performance is influenced by these two key segments, with investments contributing significantly more to the overall revenue compared to manufacturing operations.

Maharashtra Scooters, a profitable entity with high-quality earnings, has shown impressive annual growth of 19.3% over the past five years. The company is debt-free and has maintained this status for the last five years, ensuring no concerns over interest coverage. Recent board changes include the resignation of Anish Amin and the appointment of Jasmine Chaney as an Independent Director. Additionally, an interim dividend of INR 110 per share was declared for FY2025, reflecting strong financial health and shareholder value focus.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, is involved in the research, manufacturing, marketing, and sale of pharmaceutical formulations across various international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand; it has a market cap of ₹144.26 billion.

Operations: Marksans Pharma generates revenue primarily from its pharmaceutical segment, amounting to ₹22.68 billion.

Marksans Pharma, a smaller player in the pharmaceuticals sector, has shown impressive earnings growth of 21.7% over the past year, outpacing the industry average of 19.2%. The company's debt-to-equity ratio improved from 19.9% to 11.7% in five years, highlighting prudent financial management. Recent quarterly net income stood at ₹887 million compared to ₹687 million last year. Additionally, Marksans is exploring M&A opportunities to expand into European markets and enhance its growth trajectory further.

- Take a closer look at Marksans Pharma's potential here in our health report.

Review our historical performance report to gain insights into Marksans Pharma's's past performance.

Summing It All Up

- Unlock our comprehensive list of 476 Indian Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ACE

Action Construction Equipment

Manufactures and sells material handling and construction equipment primarily in India.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives