Stock Analysis

- India

- /

- Diversified Financial

- /

- NSEI:IRFC

Indian Railway Finance (NSE:IRFC) stock performs better than its underlying earnings growth over last year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Indian Railway Finance Corporation Limited (NSE:IRFC) share price is 86% higher than it was a year ago, much better than the market return of around 11% (not including dividends) in the same period. That's a solid performance by our standards! Indian Railway Finance hasn't been listed for long, so it's still not clear if it is a long term winner.

Since the stock has added ₹58b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Indian Railway Finance

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

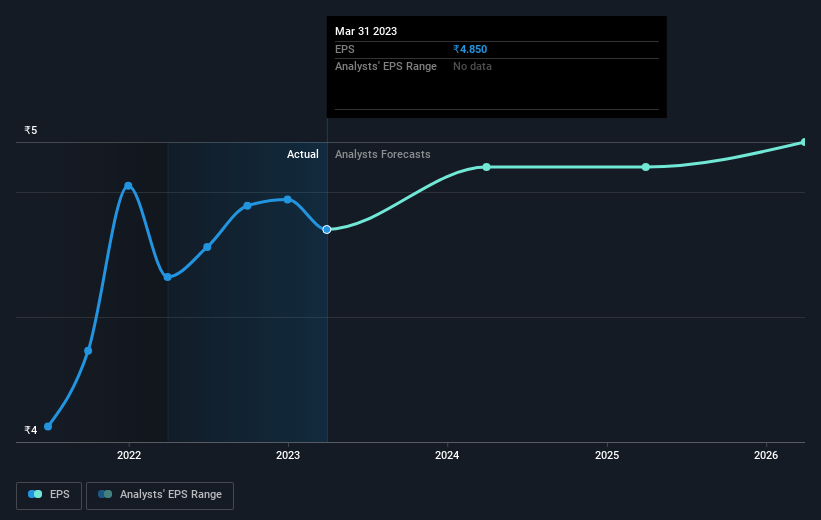

Indian Railway Finance was able to grow EPS by 4.1% in the last twelve months. This EPS growth is significantly lower than the 86% increase in the share price. So it's fair to assume the market has a higher opinion of the business than it a year ago.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Indian Railway Finance's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Indian Railway Finance the TSR over the last 1 year was 98%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Indian Railway Finance shareholders should be happy with the total gain of 98% over the last twelve months, including dividends. That's better than the more recent three month gain of 16%, implying that share price has plateaued recently. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Indian Railway Finance (at least 1 which is significant) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Indian Railway Finance is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IRFC

Indian Railway Finance

Indian Railway Finance Corporation Limited engages in borrowing funds from the financial markets to finance the acquisition/creation of assets that are leased out to the Indian Railways as finance lease in India.

Acceptable track record with imperfect balance sheet.