Stock Analysis

- India

- /

- Diversified Financial

- /

- NSEI:APTUS

The one-year underlying earnings growth at Aptus Value Housing Finance India (NSE:APTUS) is promising, but the shareholders are still in the red over that time

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Aptus Value Housing Finance India Limited (NSE:APTUS) share price is down 19% in the last year. That's well below the market return of 13%. Aptus Value Housing Finance India hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Aptus Value Housing Finance India

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the Aptus Value Housing Finance India share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

With a low yield of 1.5% we doubt that the dividend influences the share price much. Aptus Value Housing Finance India's revenue is actually up 31% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

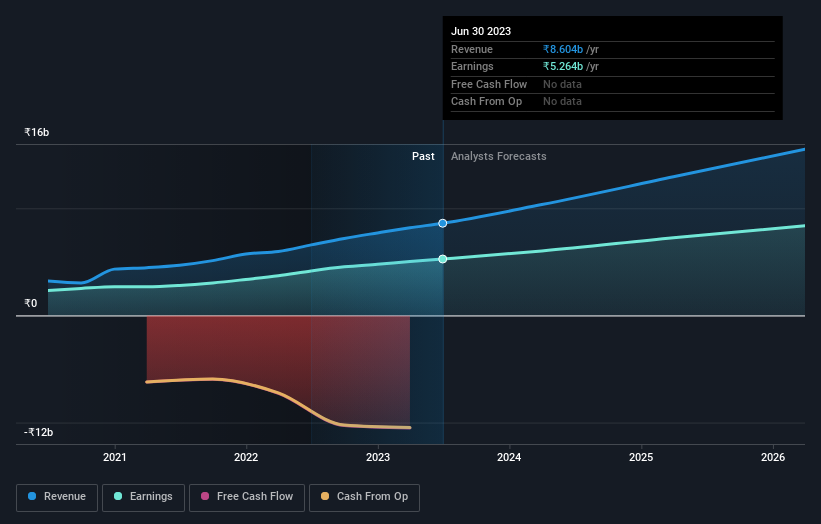

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Aptus Value Housing Finance India

A Different Perspective

Given that the market gained 13% in the last year, Aptus Value Housing Finance India shareholders might be miffed that they lost 18% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 4.4% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Aptus Value Housing Finance India better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Aptus Value Housing Finance India (of which 1 is significant!) you should know about.

But note: Aptus Value Housing Finance India may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Aptus Value Housing Finance India is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:APTUS

Aptus Value Housing Finance India

Aptus Value Housing Finance India Limited operates as a home loan company in India.

Reasonable growth potential with acceptable track record.