Stock Analysis

- India

- /

- Diversified Financial

- /

- NSEI:AGSTRA

AGS Transact Technologies (NSE:AGSTRA) shareholders are up 14% this past week, but still in the red over the last year

AGS Transact Technologies Limited (NSE:AGSTRA) shareholders should be happy to see the share price up 18% in the last month. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 25% in one year, under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for AGS Transact Technologies

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year AGS Transact Technologies grew its earnings per share, moving from a loss to a profit.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. So it makes sense to check out some other factors.

In contrast, the 8.9% drop in revenue is a real concern. Many investors see falling revenue as a likely precursor to lower earnings, so this could well explain the weak share price.

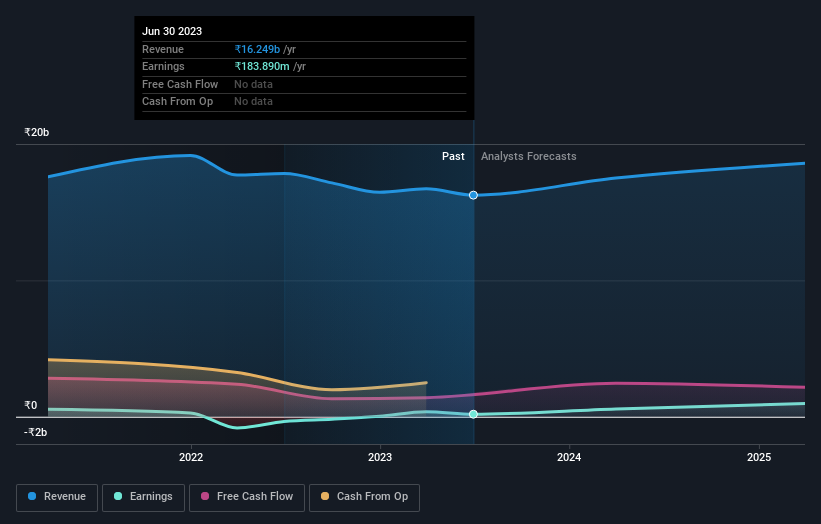

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that AGS Transact Technologies has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While AGS Transact Technologies shareholders are down 25% for the year, the market itself is up 10%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 14%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for AGS Transact Technologies (of which 1 doesn't sit too well with us!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether AGS Transact Technologies is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AGSTRA

AGS Transact Technologies

AGS Transact Technologies Limited, together with its subsidiaries, provides integrated omni-channel payment solutions in India.

Adequate balance sheet and slightly overvalued.