- India

- /

- Consumer Services

- /

- NSEI:NIITLTD

NIIT Limited's (NSE:NIITLTD) Shares Climb 38% But Its Business Is Yet to Catch Up

NIIT Limited (NSE:NIITLTD) shares have continued their recent momentum with a 38% gain in the last month alone. The last month tops off a massive increase of 119% in the last year.

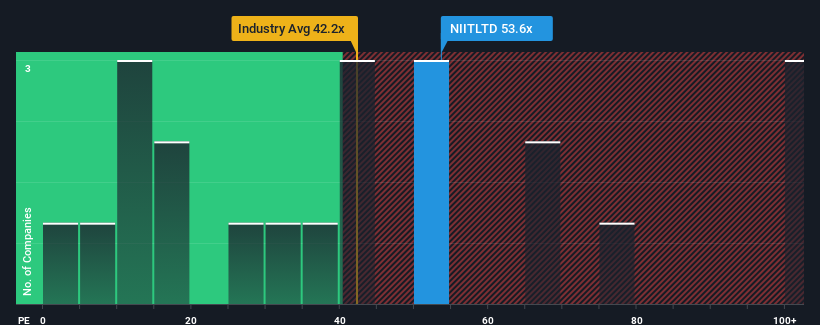

After such a large jump in price, NIIT may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 53.6x, since almost half of all companies in India have P/E ratios under 34x and even P/E's lower than 19x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been advantageous for NIIT as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for NIIT

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, NIIT would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 233% gain to the company's bottom line. Still, incredibly EPS has fallen 75% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 24% during the coming year according to the sole analyst following the company. With the market predicted to deliver 26% growth , the company is positioned for a comparable earnings result.

With this information, we find it interesting that NIIT is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From NIIT's P/E?

The strong share price surge has got NIIT's P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of NIIT's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with NIIT, and understanding these should be part of your investment process.

If you're unsure about the strength of NIIT's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if NIIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NIITLTD

NIIT

Engages in providing learning and knowledge solutions to individuals, enterprises, and various institutions internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026