- India

- /

- Food and Staples Retail

- /

- NSEI:PATELRMART

These 4 Measures Indicate That Patel Retail (NSE:PATELRMART) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Patel Retail Limited (NSE:PATELRMART) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Patel Retail's Net Debt?

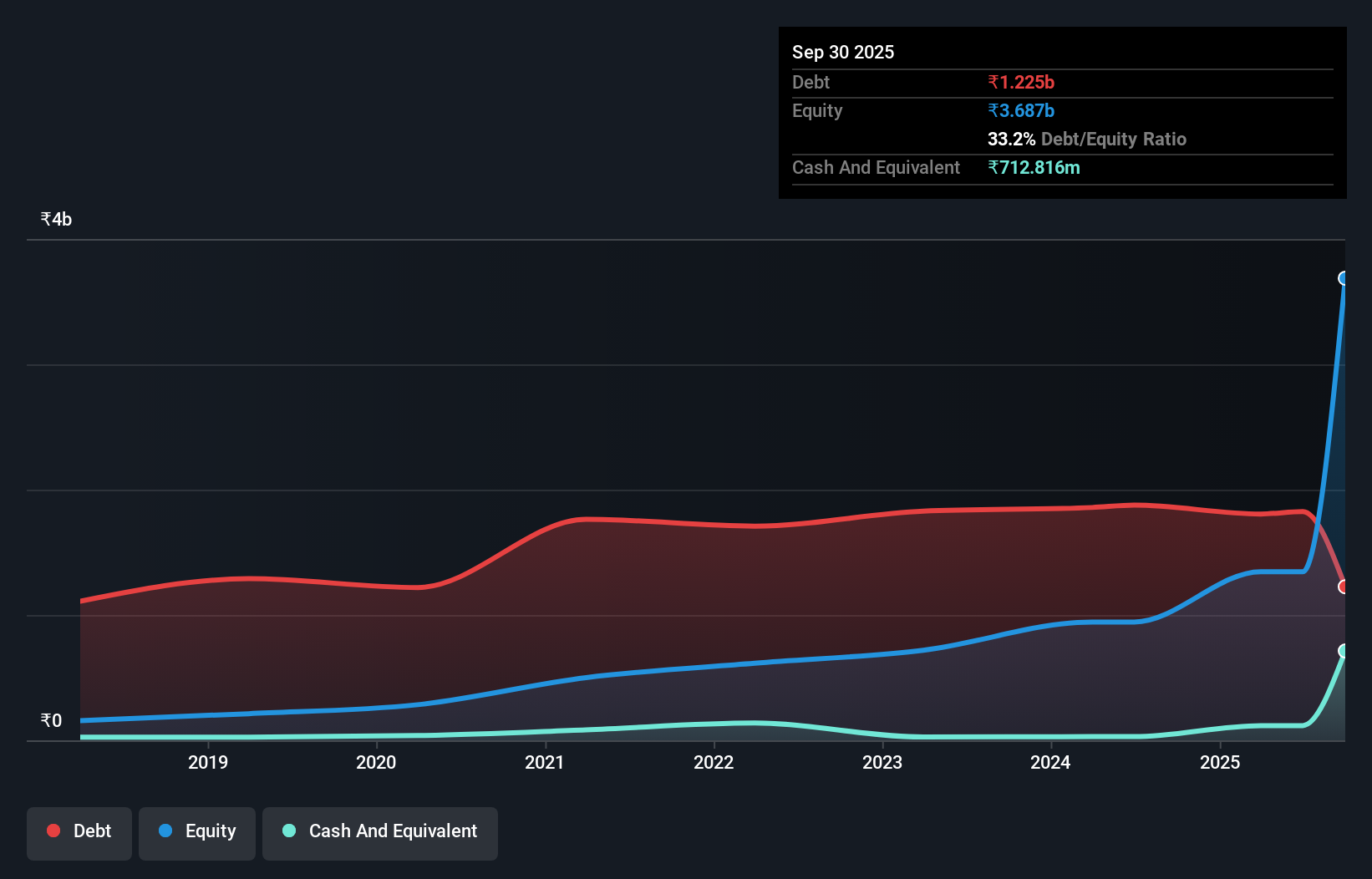

The image below, which you can click on for greater detail, shows that Patel Retail had debt of ₹1.23b at the end of September 2025, a reduction from ₹1.88b over a year. On the flip side, it has ₹712.8m in cash leading to net debt of about ₹512.4m.

How Strong Is Patel Retail's Balance Sheet?

The latest balance sheet data shows that Patel Retail had liabilities of ₹1.60b due within a year, and liabilities of ₹244.1m falling due after that. Offsetting this, it had ₹712.8m in cash and ₹1.28b in receivables that were due within 12 months. So it actually has ₹148.0m more liquid assets than total liabilities.

This state of affairs indicates that Patel Retail's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the ₹8.57b company is struggling for cash, we still think it's worth monitoring its balance sheet.

Check out our latest analysis for Patel Retail

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Looking at its net debt to EBITDA of 0.84 and interest cover of 3.6 times, it seems to us that Patel Retail is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. One way Patel Retail could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 10%, as it did over the last year. There's no doubt that we learn most about debt from the balance sheet. But it is Patel Retail's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Patel Retail saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Based on what we've seen Patel Retail is not finding it easy, given its conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. In particular, we thought its net debt to EBITDA was a positive. Looking at all this data makes us feel a little cautious about Patel Retail's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Patel Retail (of which 1 can't be ignored!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PATELRMART

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success