We Ran A Stock Scan For Earnings Growth And Zenith Exports (NSE:ZENITHEXPO) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Zenith Exports (NSE:ZENITHEXPO). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Zenith Exports

How Fast Is Zenith Exports Growing Its Earnings Per Share?

Over the last three years, Zenith Exports has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Impressively, Zenith Exports' EPS catapulted from ₹1.59 to ₹4.74, over the last year. Year on year growth of 198% is certainly a sight to behold.

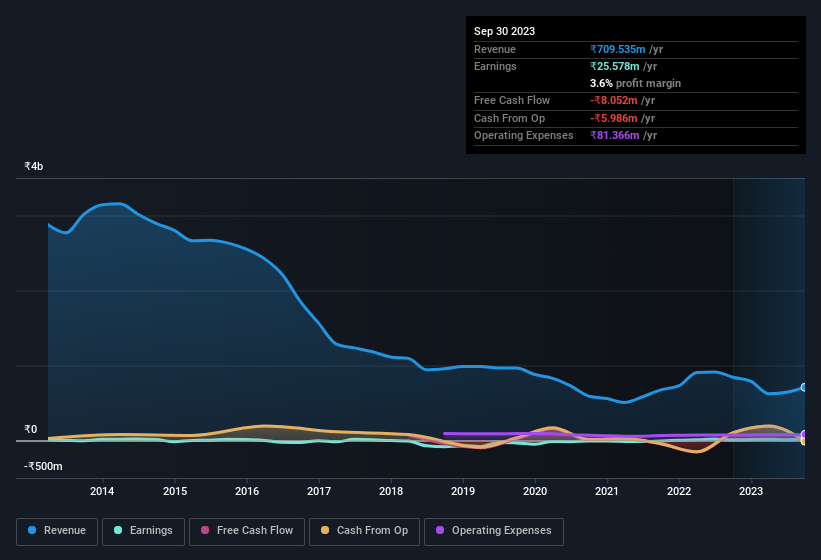

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While Zenith Exports may have maintained EBIT margins over the last year, revenue has fallen. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Zenith Exports isn't a huge company, given its market capitalisation of ₹997m. That makes it extra important to check on its balance sheet strength.

Are Zenith Exports Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that Zenith Exports insiders own a meaningful share of the business. In fact, they own 39% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Valued at only ₹997m Zenith Exports is really small for a listed company. That means insiders only have ₹393m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Should You Add Zenith Exports To Your Watchlist?

Zenith Exports' earnings have taken off in quite an impressive fashion. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, Zenith Exports is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. You should always think about risks though. Case in point, we've spotted 2 warning signs for Zenith Exports you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zenith Exports might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZENITHEXPO

Zenith Exports

Engages in the leather goods and textile fabrics businesses for the home and apparel industries in India and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives