Raj Rayon Industries Limited (NSE:RAJRILTD) Shares May Have Slumped 31% But Getting In Cheap Is Still Unlikely

To the annoyance of some shareholders, Raj Rayon Industries Limited (NSE:RAJRILTD) shares are down a considerable 31% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 35% share price drop.

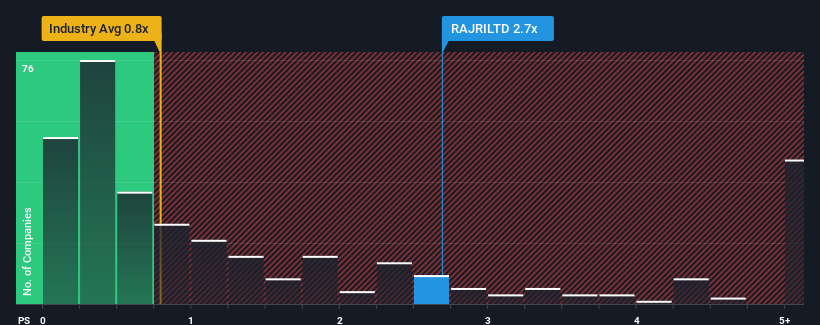

In spite of the heavy fall in price, given close to half the companies operating in India's Luxury industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider Raj Rayon Industries as a stock to potentially avoid with its 2.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Raj Rayon Industries

How Raj Rayon Industries Has Been Performing

Recent times have been quite advantageous for Raj Rayon Industries as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Raj Rayon Industries will help you shine a light on its historical performance.How Is Raj Rayon Industries' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Raj Rayon Industries' to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 13% shows it's noticeably less attractive.

With this information, we find it concerning that Raj Rayon Industries is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Raj Rayon Industries' P/S?

Raj Rayon Industries' P/S remain high even after its stock plunged. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Raj Rayon Industries currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Raj Rayon Industries that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RAJRILTD

Raj Rayon Industries

Manufactures and trades in polyester chips, and polyester and processed yarns in India.

Solid track record with imperfect balance sheet.

Market Insights

Community Narratives