- India

- /

- Consumer Durables

- /

- NSEI:PREMIERPOL

Premier Polyfilm Ltd. (NSE:PREMIERPOL) Screens Well But There Might Be A Catch

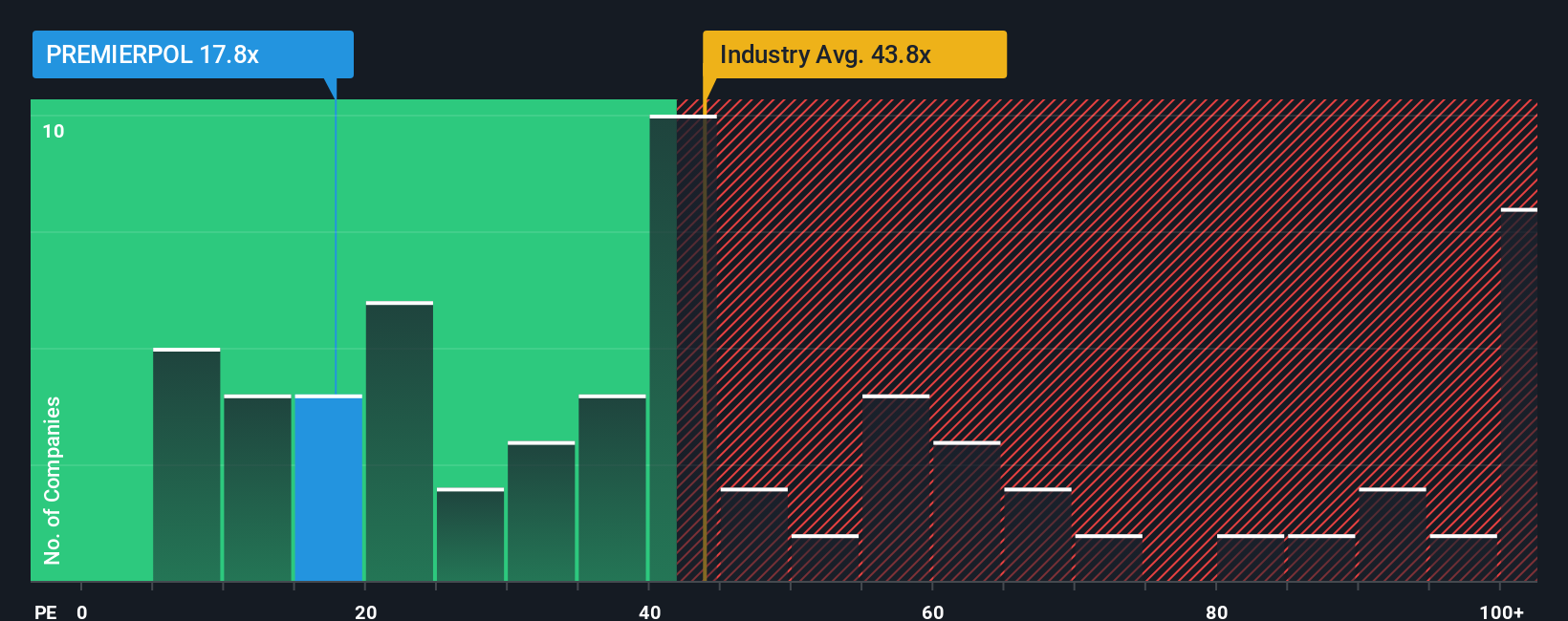

With a price-to-earnings (or "P/E") ratio of 17.8x Premier Polyfilm Ltd. (NSE:PREMIERPOL) may be sending bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 27x and even P/E's higher than 51x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Premier Polyfilm's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Premier Polyfilm

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Premier Polyfilm would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 24%. Even so, admirably EPS has lifted 215% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Premier Polyfilm is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Premier Polyfilm's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Premier Polyfilm currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Premier Polyfilm that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PREMIERPOL

Premier Polyfilm

Engages in the manufacture and sale of vinyl flooring, sheeting, and artificial leather cloths in India.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives