Stock Analysis

Page Industries (NSE:PAGEIND) Has A Pretty Healthy Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Page Industries Limited (NSE:PAGEIND) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Page Industries

What Is Page Industries's Net Debt?

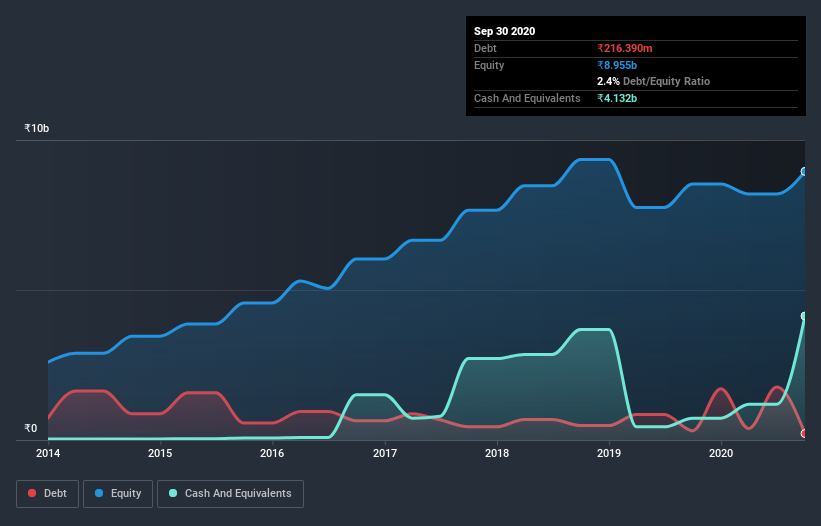

The image below, which you can click on for greater detail, shows that Page Industries had debt of ₹216.4m at the end of September 2020, a reduction from ₹303.3m over a year. But it also has ₹4.13b in cash to offset that, meaning it has ₹3.92b net cash.

A Look At Page Industries's Liabilities

Zooming in on the latest balance sheet data, we can see that Page Industries had liabilities of ₹6.24b due within 12 months and liabilities of ₹1.15b due beyond that. Offsetting this, it had ₹4.13b in cash and ₹951.3m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹2.31b.

This state of affairs indicates that Page Industries's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the ₹253.8b company is short on cash, but still worth keeping an eye on the balance sheet. Despite its noteworthy liabilities, Page Industries boasts net cash, so it's fair to say it does not have a heavy debt load!

It is just as well that Page Industries's load is not too heavy, because its EBIT was down 54% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Page Industries will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Page Industries has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Page Industries produced sturdy free cash flow equating to 72% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

We could understand if investors are concerned about Page Industries's liabilities, but we can be reassured by the fact it has has net cash of ₹3.92b. And it impressed us with free cash flow of ₹5.4b, being 72% of its EBIT. So we are not troubled with Page Industries's debt use. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Page Industries , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Page Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Page Industries is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:PAGEIND

Page Industries

Manufactures, markets, and distributes textile garments and clothing accessories for men, women, and junior girls and boys in India and internationally.

Flawless balance sheet with proven track record and pays a dividend.