- India

- /

- Oil and Gas

- /

- NSEI:BPCL

Top Dividend Stocks On The Indian Exchange For August 2024

Reviewed by Simply Wall St

The Indian market has shown remarkable resilience, with a 44% increase over the past year and a notable 5.2% gain in the Information Technology sector last week, despite overall market stability. In such an environment, dividend stocks that offer consistent returns and robust earnings growth potential can be particularly appealing to investors seeking both income and capital appreciation.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.19% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 4.04% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.01% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.07% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.47% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.13% | ★★★★★☆ |

| Bharat Petroleum (NSEI:BPCL) | 6.01% | ★★★★★☆ |

| NMDC (BSE:526371) | 3.23% | ★★★★★☆ |

| Hindustan Zinc (BSE:500188) | 3.12% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.77% | ★★★★★☆ |

Click here to see the full list of 17 stocks from our Top Indian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bharat Petroleum (NSEI:BPCL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bharat Petroleum Corporation Limited primarily engages in refining crude oil and marketing petroleum products in India and internationally, with a market cap of ₹1.49 trillion.

Operations: Bharat Petroleum Corporation Limited generates revenue from two main segments: ₹5.07 billion from Downstream Petroleum and ₹1.92 million from Exploration & Production of Hydrocarbons.

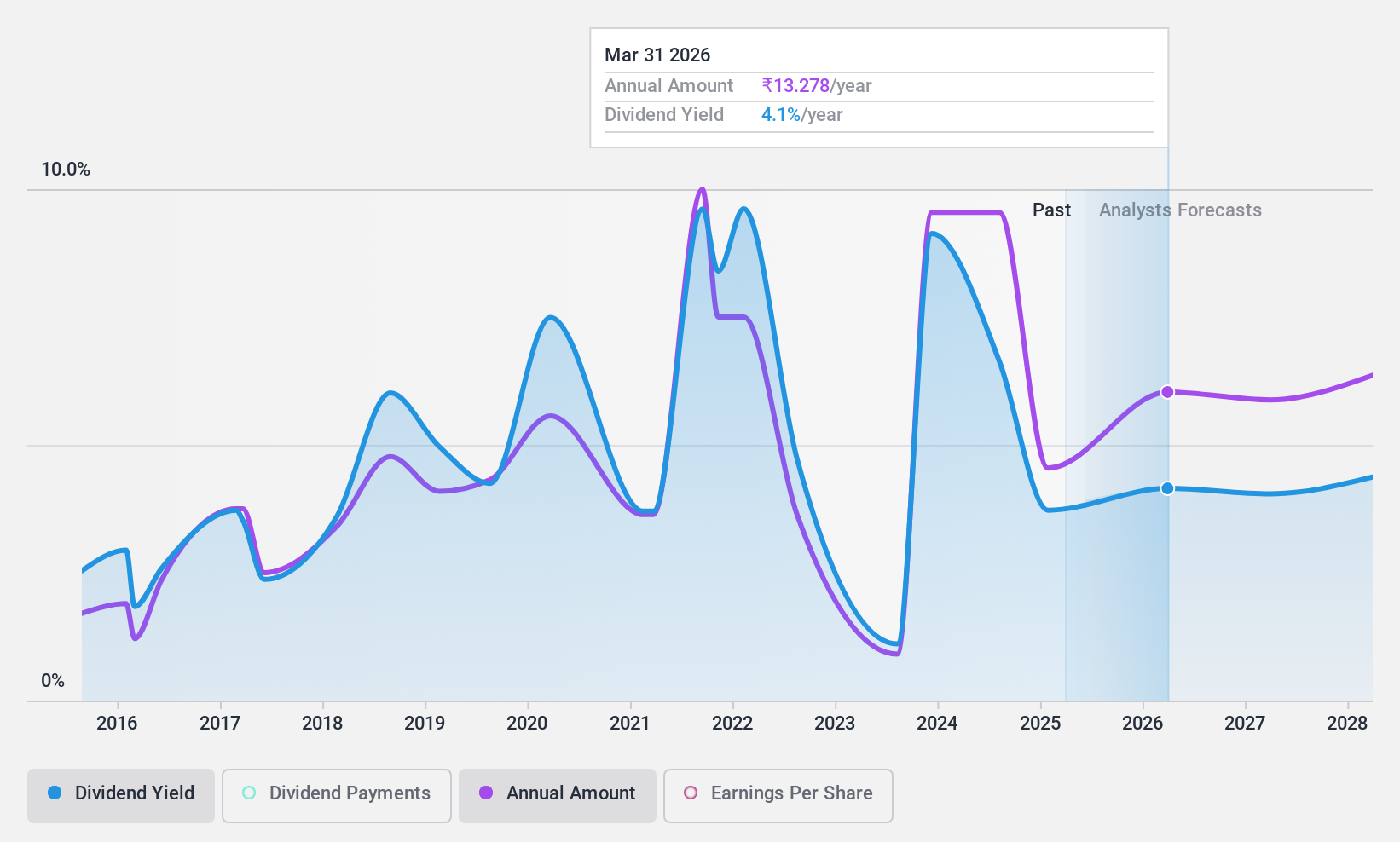

Dividend Yield: 6%

Bharat Petroleum's dividend payments have been volatile over the past decade, reflecting an unstable track record. Despite this, the company maintains a low payout ratio of 33.3%, ensuring dividends are well-covered by earnings and cash flows. Trading at a P/E ratio of 8x, BPCL is valued attractively compared to peers and the broader Indian market. Recent financial results show stable revenues but a significant drop in net income year-over-year, which could impact future dividend stability.

- Take a closer look at Bharat Petroleum's potential here in our dividend report.

- The analysis detailed in our Bharat Petroleum valuation report hints at an deflated share price compared to its estimated value.

HCL Technologies (NSEI:HCLTECH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HCL Technologies Limited provides software development, business process outsourcing, and infrastructure management services globally, with a market cap of ₹4.56 trillion.

Operations: HCL Technologies Limited's revenue segments include $1.42 billion from HCL Software, $9.91 billion from IT and Business Services, and $2.16 billion from Engineering and R&D Services.

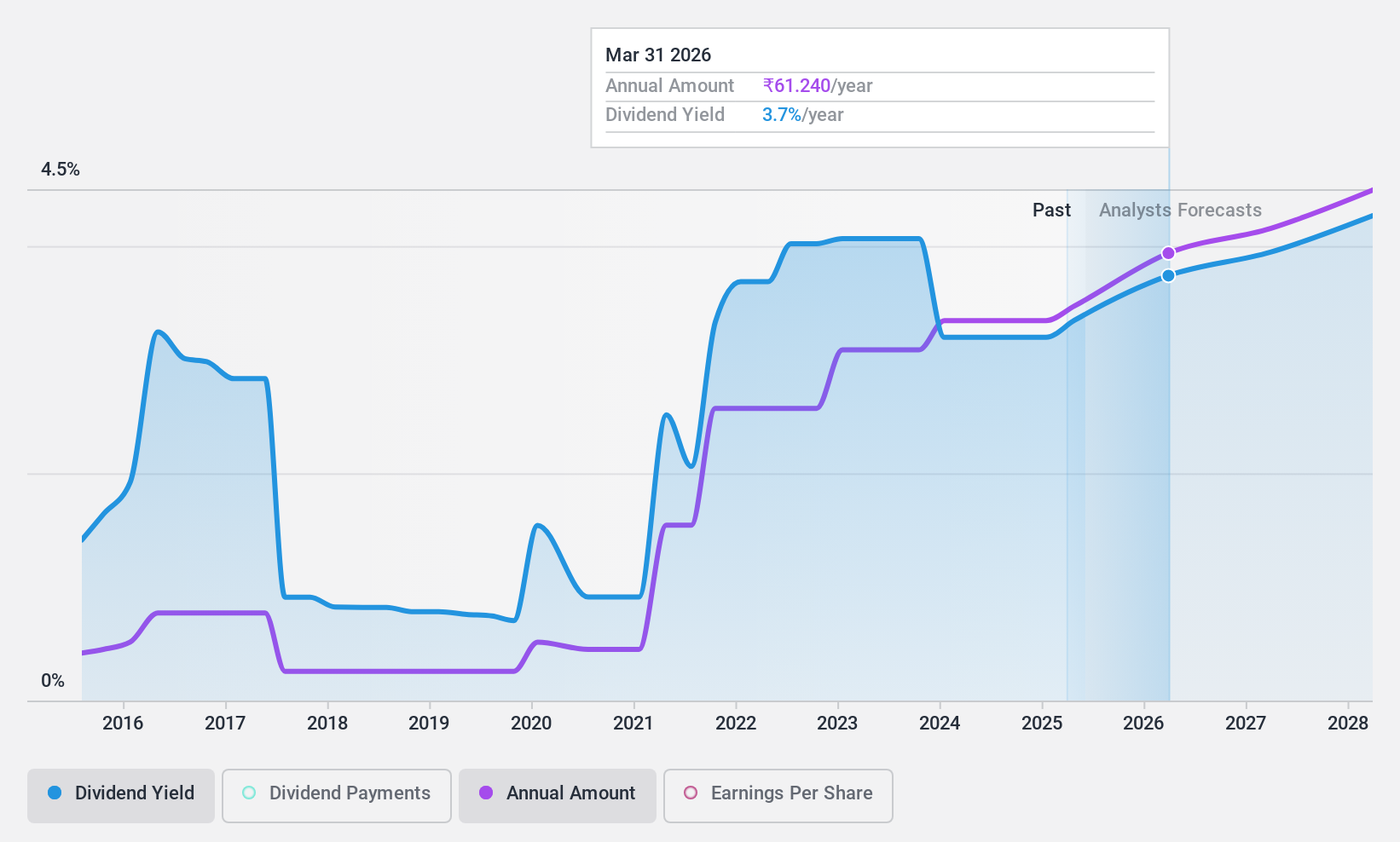

Dividend Yield: 3.1%

HCL Technologies offers a dividend yield of 3.07%, placing it in the top 25% of Indian market payers. Despite a high payout ratio of 85.7%, dividends are covered by both earnings and cash flows (64.3%). However, its dividend history over the past decade has been volatile, indicating an unstable track record. Trading at a P/E ratio of 27.8x, HCL is valued favorably compared to the broader Indian market (32.9x). Recent executive changes might impact future financial strategies and performance.

- Navigate through the intricacies of HCL Technologies with our comprehensive dividend report here.

- The valuation report we've compiled suggests that HCL Technologies' current price could be quite moderate.

Monte Carlo Fashions (NSEI:MONTECARLO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Monte Carlo Fashions Limited manufactures and trades wool, cotton, cotton blended, knitted, and woven apparels in India and internationally with a market cap of ₹13.64 billion.

Operations: Monte Carlo Fashions Limited generates revenue primarily through the manufacturing and trading of textile garments, amounting to ₹10.49 billion.

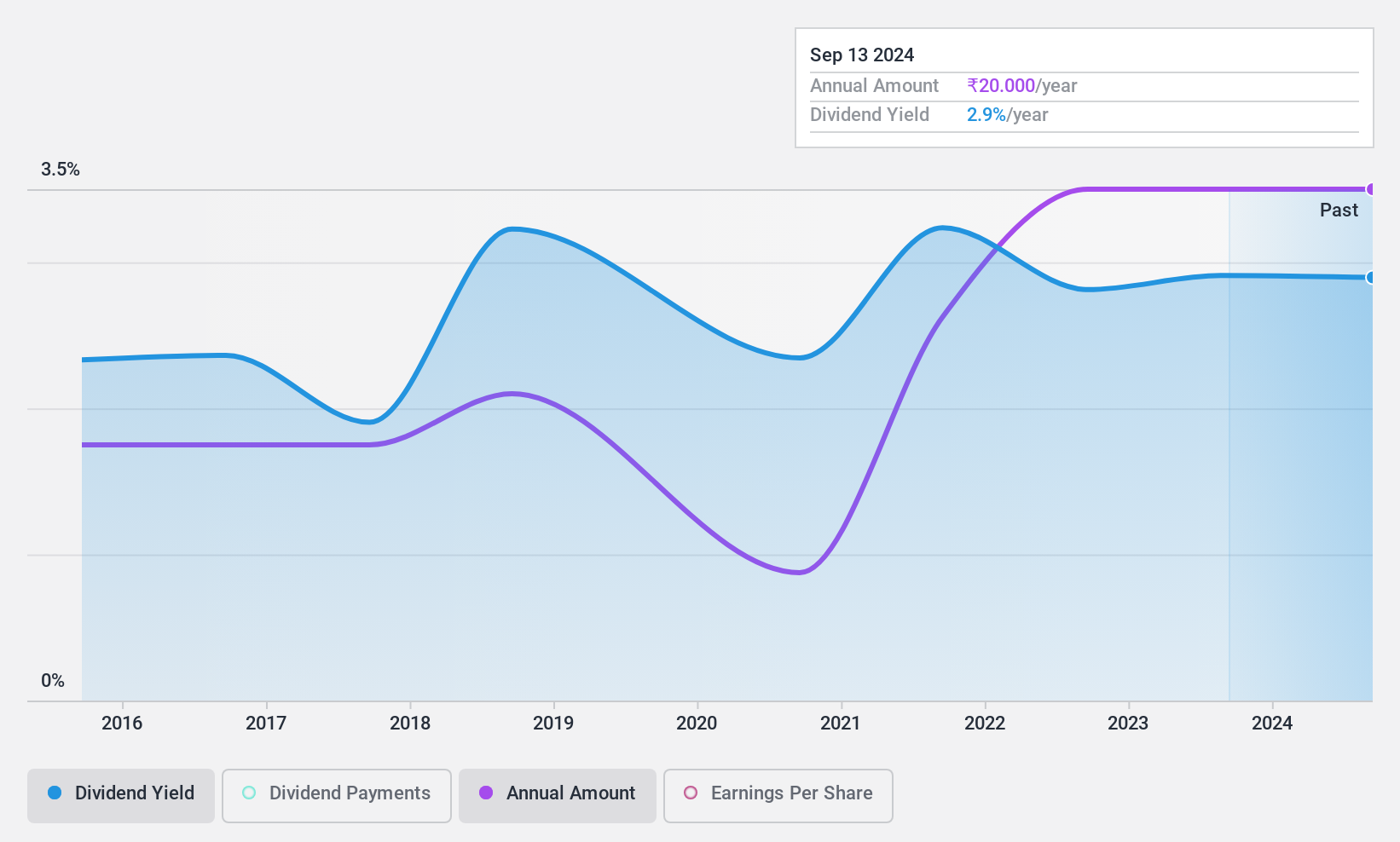

Dividend Yield: 3%

Monte Carlo Fashions declared a final dividend of INR 20 per share for FY 2023-24, despite reporting a net loss of INR 132.7 million for Q1 2024. The company's dividend payments are covered by earnings (69.2% payout ratio) and cash flows (88.8% cash payout ratio), but its nine-year history shows volatility in payments. Recent executive changes, including the cessation of three independent directors, could influence future strategy and stability.

- Unlock comprehensive insights into our analysis of Monte Carlo Fashions stock in this dividend report.

- The valuation report we've compiled suggests that Monte Carlo Fashions' current price could be inflated.

Summing It All Up

- Gain an insight into the universe of 17 Top Indian Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bharat Petroleum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BPCL

Bharat Petroleum

Engages in refining crude oil and marketing petroleum products in India and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives