The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Lux Industries Limited (NSE:LUXIND) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Lux Industries

What Is Lux Industries's Net Debt?

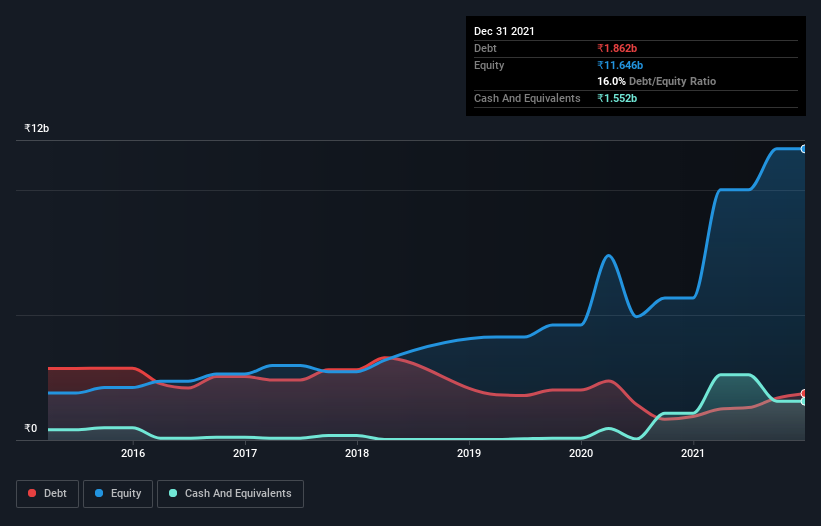

As you can see below, at the end of September 2021, Lux Industries had ₹1.86b of debt, up from ₹941.9m a year ago. Click the image for more detail. However, it does have ₹1.55b in cash offsetting this, leading to net debt of about ₹310.4m.

A Look At Lux Industries' Liabilities

According to the last reported balance sheet, Lux Industries had liabilities of ₹5.79b due within 12 months, and liabilities of ₹447.8m due beyond 12 months. Offsetting this, it had ₹1.55b in cash and ₹5.79b in receivables that were due within 12 months. So it actually has ₹1.11b more liquid assets than total liabilities.

This state of affairs indicates that Lux Industries' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the ₹71.5b company is short on cash, but still worth keeping an eye on the balance sheet. Carrying virtually no net debt, Lux Industries has a very light debt load indeed.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Lux Industries has very little debt (net of cash), and boasts a debt to EBITDA ratio of 0.064 and EBIT of 125 times the interest expense. So relative to past earnings, the debt load seems trivial. Better yet, Lux Industries grew its EBIT by 107% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Lux Industries will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Lux Industries recorded free cash flow of 27% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Lux Industries's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. Zooming out, Lux Industries seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Lux Industries has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LUXIND

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives