- India

- /

- Consumer Durables

- /

- NSEI:JCHAC

Update: Johnson Controls-Hitachi Air Conditioning India (NSE:JCHAC) Stock Gained 69% In The Last Five Years

Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the Johnson Controls-Hitachi Air Conditioning India Limited (NSE:JCHAC) share price is up 69% in the last 5 years, clearly besting the market return of around 31% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 12%.

See our latest analysis for Johnson Controls-Hitachi Air Conditioning India

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

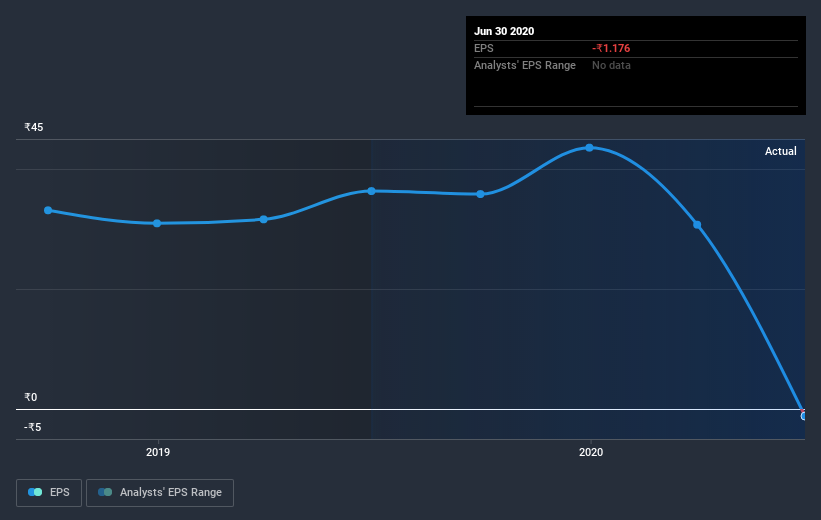

During five years of share price growth, Johnson Controls-Hitachi Air Conditioning India achieved compound earnings per share (EPS) growth of 3.2% per year. This EPS growth is lower than the 11% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Johnson Controls-Hitachi Air Conditioning India's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Johnson Controls-Hitachi Air Conditioning India has rewarded shareholders with a total shareholder return of 12% in the last twelve months. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 11%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Johnson Controls-Hitachi Air Conditioning India, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bosch Home Comfort India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:JCHAC

Bosch Home Comfort India

Manufactures and distributes air conditioners, chillers, refrigerators, air purifiers, and variable refrigerant flow systems in India and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives