Stock Analysis

- India

- /

- Consumer Durables

- /

- NSEI:DIXON

Top Indian Growth Companies With High Insider Ownership In May 2024

Reviewed by Simply Wall St

The Indian market has shown robust growth, with a 1.7% increase in the past week and an impressive 45% rise over the last year, alongside forecasts predicting annual earnings growth of 16%. In such a thriving environment, stocks with high insider ownership can be particularly appealing as they often signal strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

| Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 27.9% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| MTAR Technologies (NSEI:MTARTECH) | 38.4% | 46.2% |

| Aether Industries (NSEI:AETHER) | 31.1% | 32% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 35.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Apollo Hospitals Enterprise Limited operates a network of healthcare services both in India and internationally, with a market capitalization of approximately ₹85.04 billion.

Operations: The company generates revenue primarily through three segments: Healthcare Services (₹95.87 billion), Retail Health & Diagnostics (₹13.19 billion), and Digital Health & Pharmacy Distribution (₹75.99 billion).

Insider Ownership: 10.4%

Revenue Growth Forecast: 15.7% p.a.

Apollo Hospitals Enterprise, a key player in India's healthcare sector, is experiencing significant growth and high insider ownership. Recent executive changes and strategic M&A activities underscore its dynamic management approach. Although the company carries a high level of debt, earnings have grown 26.5% annually over the past five years and are expected to increase by 35.49% annually going forward. Revenue growth projections stand at 15.7% per year, outpacing the Indian market forecast of 9.4%.

- Click to explore a detailed breakdown of our findings in Apollo Hospitals Enterprise's earnings growth report.

- The analysis detailed in our Apollo Hospitals Enterprise valuation report hints at an inflated share price compared to its estimated value.

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

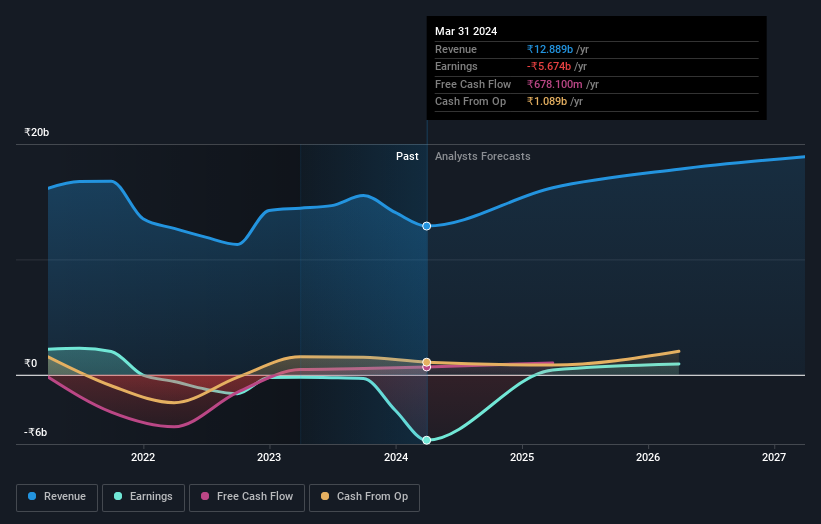

Overview: Dixon Technologies (India) Limited specializes in providing electronic manufacturing services across India and has a market capitalization of approximately ₹556.36 billion.

Operations: The company's revenue is generated from various segments including Home Appliances (₹12.05 billion), Security Systems (₹6.33 billion), Lighting Products (₹7.87 billion), Mobile & EMS Division (₹109.19 billion), and Consumer Electronics & Appliances (₹41.48 billion).

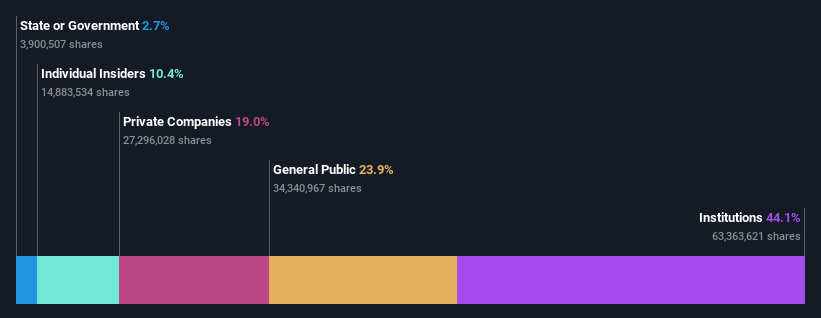

Insider Ownership: 24.9%

Revenue Growth Forecast: 22.2% p.a.

Dixon Technologies, an electronics manufacturer in India, reported a substantial increase in annual revenue to INR 177.13 billion and net income to INR 3.68 billion as of March 2024. The company is poised for continued growth with earnings expected to rise by 27.9% annually, outstripping the broader Indian market's forecast of 16%. Additionally, Dixon has recently partnered with Acerpure India for manufacturing consumer appliances, signaling expansion and diversification in its operations. Despite these positives, there is no recent data on insider trading activities which could provide deeper insights into insider confidence levels.

- Navigate through the intricacies of Dixon Technologies (India) with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Dixon Technologies (India) implies its share price may be too high.

Solara Active Pharma Sciences (NSEI:SOLARA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Solara Active Pharma Sciences Limited is engaged in the manufacturing and distribution of active pharmaceutical ingredients (APIs) in India, with a market capitalization of approximately ₹22.25 billion.

Operations: The company generates its revenue primarily from the manufacturing and distribution of active pharmaceutical ingredients (APIs).

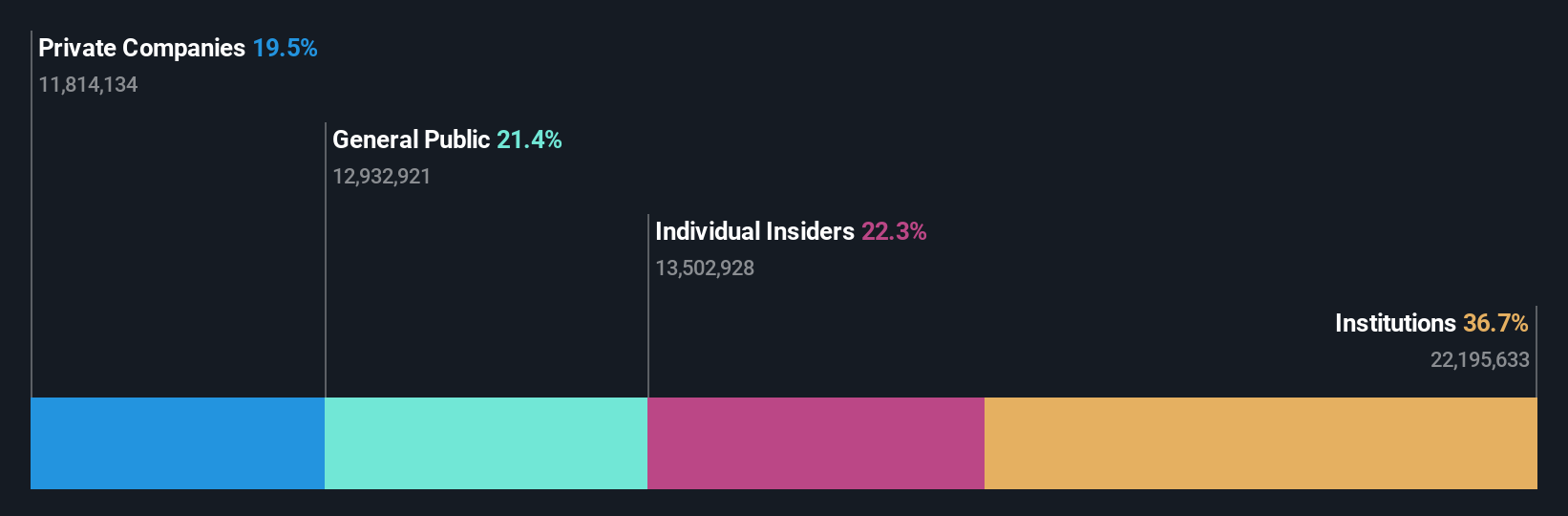

Insider Ownership: 10.4%

Revenue Growth Forecast: 12.3% p.a.

Solara Active Pharma Sciences, amid recent executive appointments and a rights issue raising INR 4.50 billion, is navigating a period of significant change. The company is projected to turn profitable within three years, with earnings growth expected to be robust at 111% annually. However, its debt levels are concerning as they are poorly covered by operating cash flow, and the share price has shown high volatility recently. Despite these challenges, Solara's revenue growth is forecasted to outpace the broader Indian market.

- Click here to discover the nuances of Solara Active Pharma Sciences with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Solara Active Pharma Sciences' current price could be quite moderate.

Where To Now?

- Take a closer look at our Fast Growing Indian Companies With High Insider Ownership list of 80 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Dixon Technologies (India) is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DIXON

Dixon Technologies (India)

Provides electronic manufacturing services in India.

Exceptional growth potential with flawless balance sheet.