Stock Analysis

High Insider Ownership Growth Companies On Indian Exchange In June 2024

Reviewed by Simply Wall St

The Indian stock market has shown robust growth recently, with a 1.4% increase in the last week and an impressive 45% rise over the past year. In light of these conditions, stocks with high insider ownership can be particularly compelling as they often indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

| Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 28.6% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

| Aether Industries (NSEI:AETHER) | 31.1% | 32% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 35.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dixon Technologies (India) Limited, an electronic manufacturing services provider in India, has a market capitalization of approximately ₹59.15 billion.

Operations: The company's revenue is generated from several segments, including home appliances (₹12.05 billion), security systems (₹6.33 billion), lighting products (₹7.87 billion), mobile and EMS division (₹109.19 billion), and consumer electronics & appliances (₹41.48 billion).

Insider Ownership: 24.9%

Dixon Technologies, a prominent player in India's electronics manufacturing sector, demonstrates robust growth with significant insider ownership. Recently, the company reported a substantial year-over-year increase in quarterly and annual revenues and profits, highlighting strong operational performance. Additionally, Dixon has entered into an MOU with Acerpure for manufacturing consumer appliances, potentially expanding its product offerings and market reach. This strategic move aligns with its impressive forecasted revenue and earnings growth rates that notably exceed market averages.

- Dive into the specifics of Dixon Technologies (India) here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Dixon Technologies (India)'s share price might be too optimistic.

Jupiter Wagons (NSEI:JWL)

Simply Wall St Growth Rating: ★★★★★★

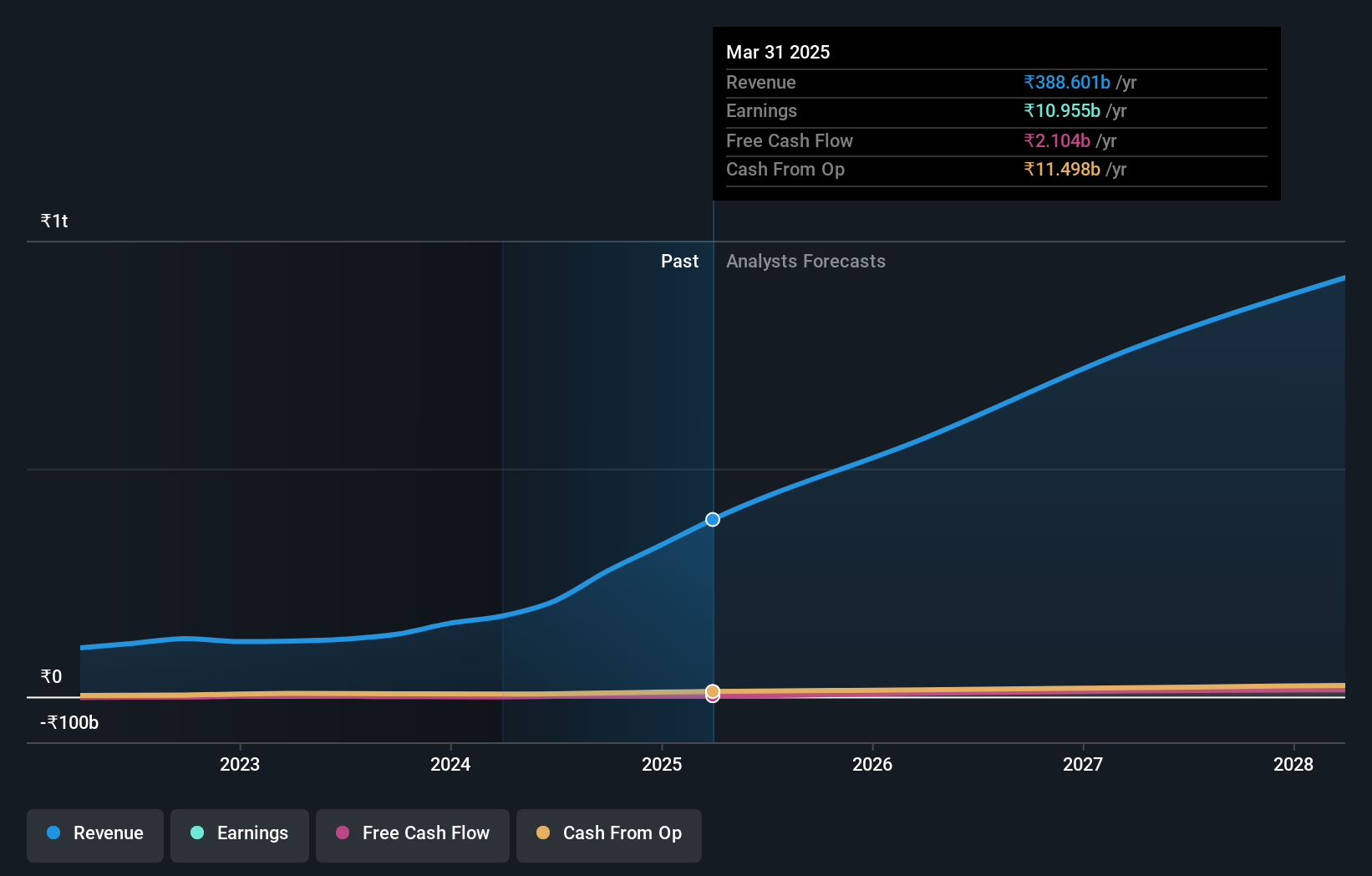

Overview: Jupiter Wagons Limited is a company based in India that manufactures and sells mobility solutions both domestically and internationally, with a market cap of approximately ₹266.84 billion.

Operations: The revenue from auto manufacturers for the mobility solutions provider totals ₹36.44 billion.

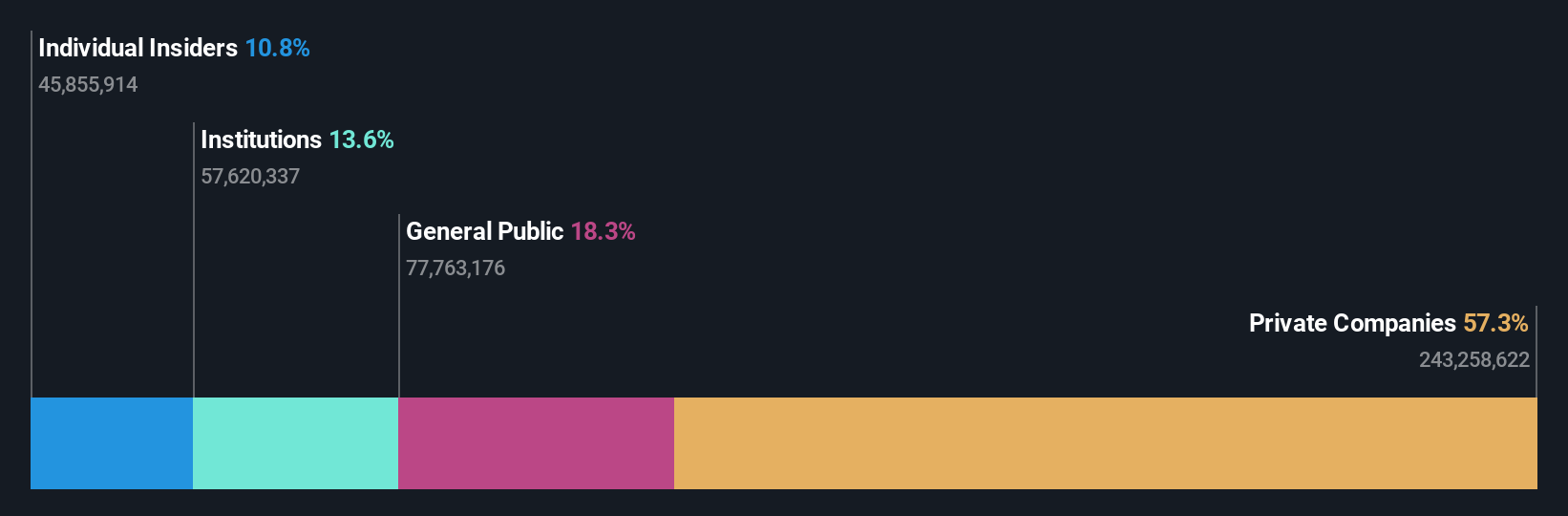

Insider Ownership: 11.1%

Jupiter Wagons Limited, a key entity in India's railway manufacturing sector, recently secured a substantial INR 9.57 billion contract from the Ministry of Railways, underscoring its pivotal role in enhancing the nation's rail infrastructure. Despite a recent dividend cut to 3%, the company's financial performance has shown remarkable improvement with year-over-year earnings and revenue growth. Moreover, Jupiter Wagons is actively expanding its business scope through strategic acquisitions and significant private placements aimed at bolstering its market position amidst high insider ownership.

- Delve into the full analysis future growth report here for a deeper understanding of Jupiter Wagons.

- Our valuation report unveils the possibility Jupiter Wagons' shares may be trading at a premium.

Titagarh Rail Systems (NSEI:TITAGARH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Titagarh Rail Systems Limited, with a market capitalization of ₹201.00 billion, is engaged in the manufacturing and sale of freight and passenger rail systems both in India and globally.

Operations: The company generates revenue from two primary segments: Passenger Rail Systems at ₹4.36 billion and Freight Rail Systems, which includes shipbuilding, bridges, and defense, at ₹34.18 billion.

Insider Ownership: 24.3%

Titagarh Rail Systems Limited, while experiencing shareholder dilution last year, shows promising growth with earnings and revenue forecasted to increase significantly above market rates over the next three years. Recent leadership changes and a substantial dividend recommendation indicate active management and potential for continued expansion. However, insider trading has not shown substantial buying or selling in recent months, suggesting a cautious approach from insiders amidst these positive developments.

- Unlock comprehensive insights into our analysis of Titagarh Rail Systems stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Titagarh Rail Systems shares in the market.

Seize The Opportunity

- Investigate our full lineup of 79 Fast Growing Indian Companies With High Insider Ownership right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Jupiter Wagons is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JWL

Jupiter Wagons

Manufactures and sells mobility solutions in India and internationally.

Exceptional growth potential with solid track record.