Stock Analysis

Exploring Dixon Technologies India And Two More Growth Leaders With High Insider Ownership On The Indian Exchange

Reviewed by Simply Wall St

The Indian market has shown robust growth, surging 45% over the last 12 months with earnings expected to grow by 16% annually. In such a thriving environment, stocks like Dixon Technologies India that combine high insider ownership with strong growth prospects stand out as particularly compelling for investors seeking alignment with company leadership and potential for sustained performance.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

| Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 27.9% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| MTAR Technologies (NSEI:MTARTECH) | 38.4% | 46.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

We'll examine a selection from our screener results.

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dixon Technologies (India) Limited specializes in providing electronic manufacturing services across India, with a market capitalization of approximately ₹55.64 billion.

Operations: Revenue segments for the company include Home Appliances at ₹12.05 billion, Security Systems at ₹6.33 billion, Lighting Products at ₹7.87 billion, Mobile & EMS Division at ₹109.19 billion, and Consumer Electronics & Appliances at ₹41.48 billion.

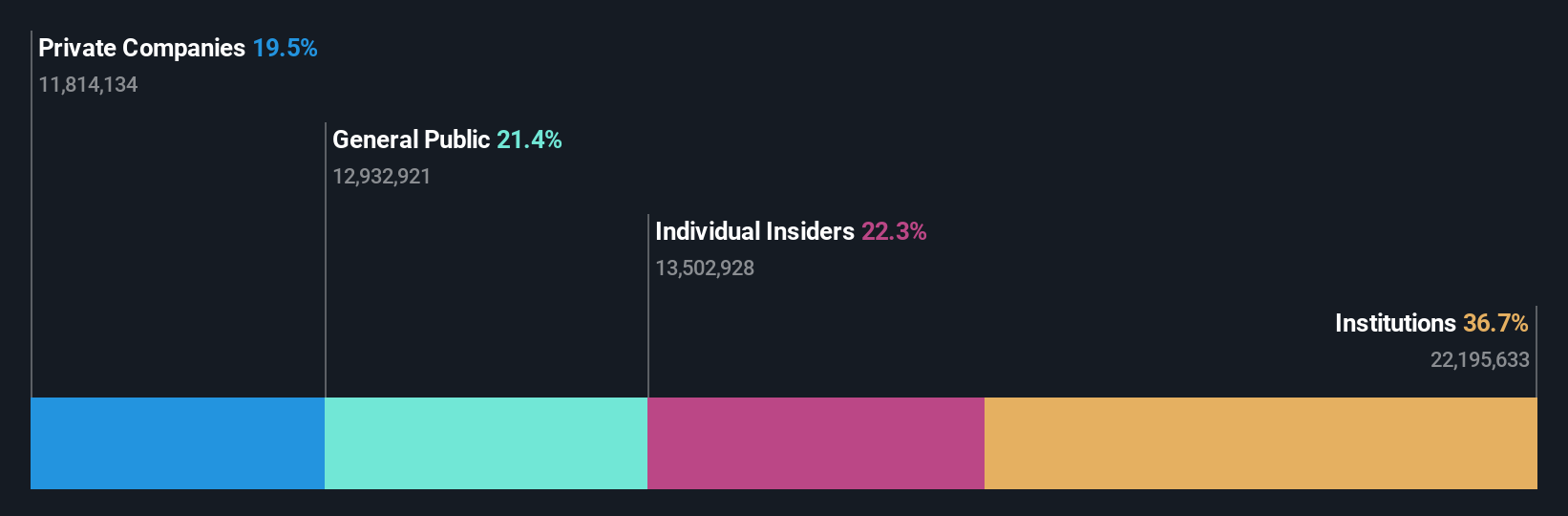

Insider Ownership: 24.9%

Dixon Technologies, a key player in the Indian electronics manufacturing sector, has shown robust financial and operational growth. With earnings increasing by 43.9% over the past year and forecasts indicating continued annual revenue growth of 22.2%, Dixon outpaces market averages significantly. Recent strategic moves include a MOU with Acerpure for manufacturing consumer appliances, enhancing its production capabilities and potentially boosting future revenues. Despite no recent insider buying or selling reported, the company's high return on equity forecast at 30.1% underscores strong management efficacy and potential for sustained profitability.

- Dive into the specifics of Dixon Technologies (India) here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Dixon Technologies (India) shares in the market.

Indoco Remedies (NSEI:INDOCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Indoco Remedies Limited, with a market cap of ₹28.67 billion, operates in the pharmaceutical sector by manufacturing, marketing, and selling formulations and active pharmaceutical ingredients both in India and globally.

Operations: The company generates ₹18.17 billion in revenue from its pharmaceuticals segment.

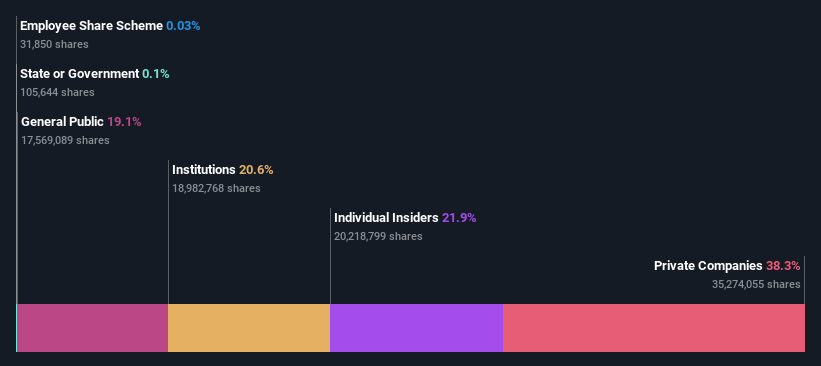

Insider Ownership: 21.7%

Indoco Remedies, a pharmaceutical company in India, faces mixed prospects. While its earnings are expected to grow significantly at 29.2% annually, surpassing the Indian market average, it grapples with low return on equity projections and declining profit margins from 8.5% to 5.4%. Recent regulatory challenges include a Show Cause Notice regarding GST liabilities potentially impacting financials by INR 2.254 million. Despite these hurdles, Indoco's lower price-to-earnings ratio compared to the market suggests relative undervaluation.

- Take a closer look at Indoco Remedies' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Indoco Remedies is trading behind its estimated value.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited, with a market cap of ₹817.44 billion, operates as an online classifieds company in India and internationally, focusing on recruitment, matrimony, real estate, and education-related services.

Operations: The company's revenue is primarily generated from recruitment solutions (₹18.80 billion) and real estate services through 99acres (₹3.51 billion).

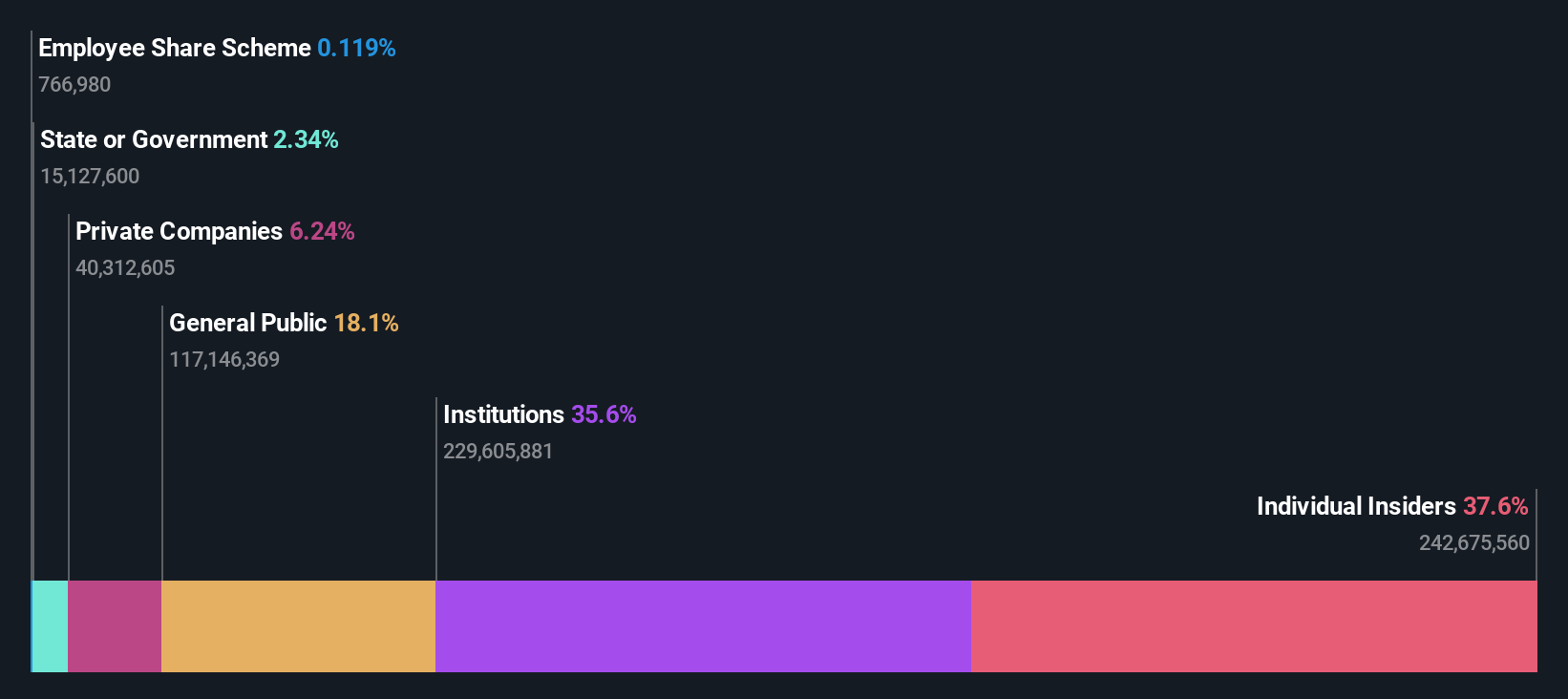

Insider Ownership: 37.9%

Info Edge (India) Limited, a key player in India's tech sector, demonstrated a strong recovery with its recent financial results. For the fiscal year ending March 2024, the company reported a significant turnaround to net income of INR 5.75 billion from a previous loss, alongside robust revenue growth to INR 29.50 billion. Despite this positive trajectory and high insider ownership suggesting committed leadership, concerns linger due to an unstable dividend track record and low forecasted return on equity at 6.6%. Additionally, no substantial insider buying in the past three months could indicate cautious optimism among insiders about future performance.

- Click here to discover the nuances of Info Edge (India) with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Info Edge (India) is priced higher than what may be justified by its financials.

Summing It All Up

- Explore the 79 names from our Fast Growing Indian Companies With High Insider Ownership screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Indoco Remedies is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:INDOCO

Indoco Remedies

Manufactures, markets, and sells formulations and active pharmaceutical ingredients in India and internationally.

Adequate balance sheet with moderate growth potential.