- India

- /

- Interactive Media and Services

- /

- NSEI:NAUKRI

3 Indian Growth Companies With Up To 37% Insider Ownership

Reviewed by Simply Wall St

The market has climbed by 2.6% over the past week, with every sector up and the Financials sector leading the way. The market is up 44% over the last 12 months, with earnings forecast to grow by 17% annually. In this thriving environment, stocks with high insider ownership often signal strong confidence from those closest to the company, making them compelling choices for investors seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 35% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 36.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 21.8% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.7% |

| KEI Industries (BSE:517569) | 19.1% | 20.4% |

| Aether Industries (NSEI:AETHER) | 31.1% | 43.6% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

Let's uncover some gems from our specialized screener.

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dixon Technologies (India) Limited offers electronic manufacturing services in India and has a market cap of ₹764.71 billion.

Operations: Dixon Technologies' revenue segments include Home Appliances (₹12.51 billion), Lighting Products (₹7.92 billion), Mobile & EMS Division (₹143.16 billion), and Consumer Electronics & Appliances (₹41.21 billion).

Insider Ownership: 24.6%

Dixon Technologies (India) Limited demonstrates strong growth potential with earnings forecasted to grow at 36.06% per year, significantly outpacing the Indian market's 16.9%. The company reported robust Q1 2024 results, with sales and revenue nearly doubling to ₹65.80 billion (US$0.79 billion) and net income rising to ₹1.34 billion (US$16 million). High insider ownership aligns management interests with shareholders, fostering confidence in its continued expansion trajectory.

- Unlock comprehensive insights into our analysis of Dixon Technologies (India) stock in this growth report.

- In light of our recent valuation report, it seems possible that Dixon Technologies (India) is trading beyond its estimated value.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

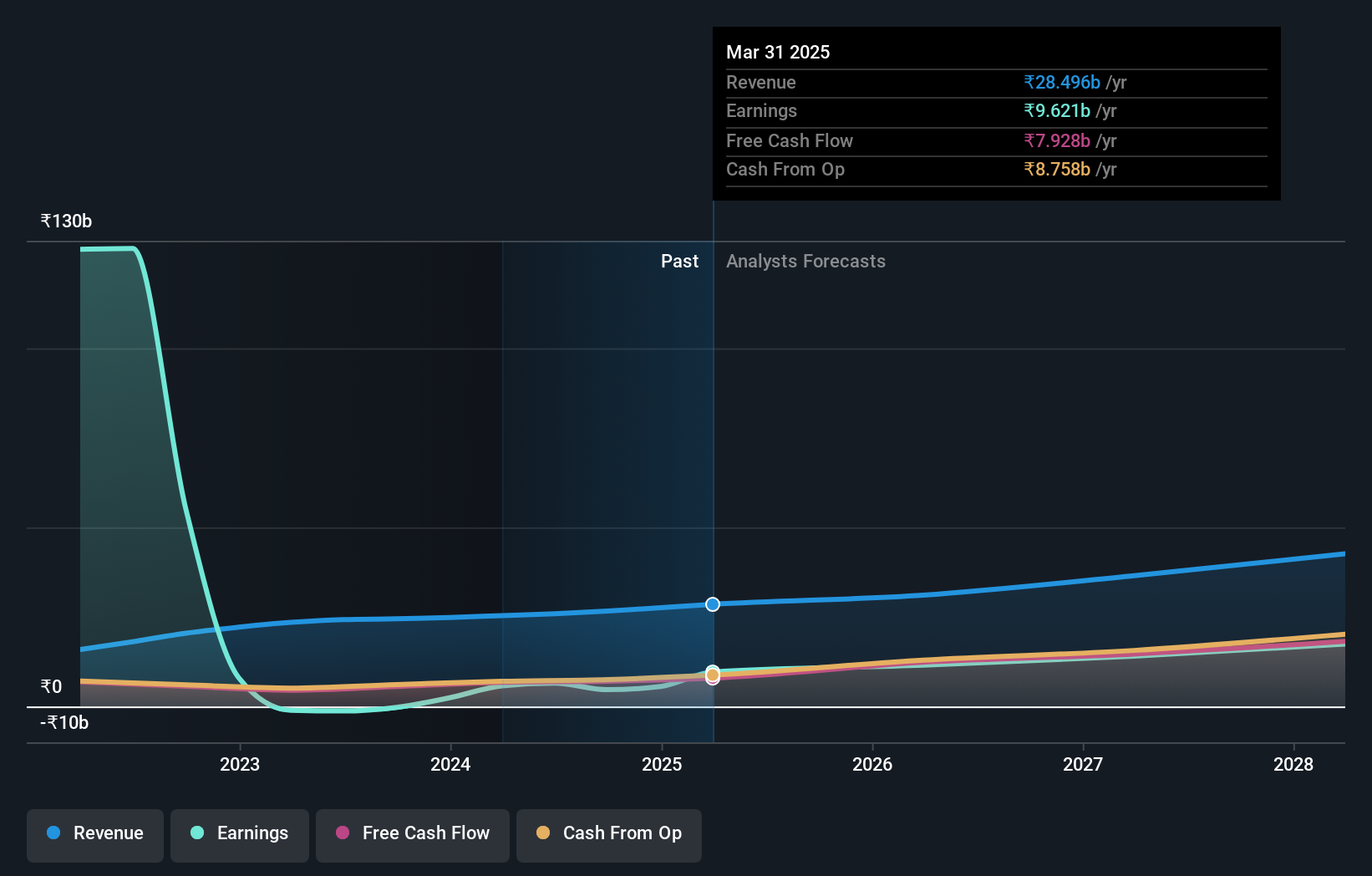

Overview: Info Edge (India) Limited operates as an online classifieds company in recruitment, matrimony, real estate, and education services both in India and internationally, with a market cap of ₹954.69 billion.

Operations: The company's revenue segments include ₹19.05 billion from recruitment solutions and ₹3.67 billion from 99acres for real estate.

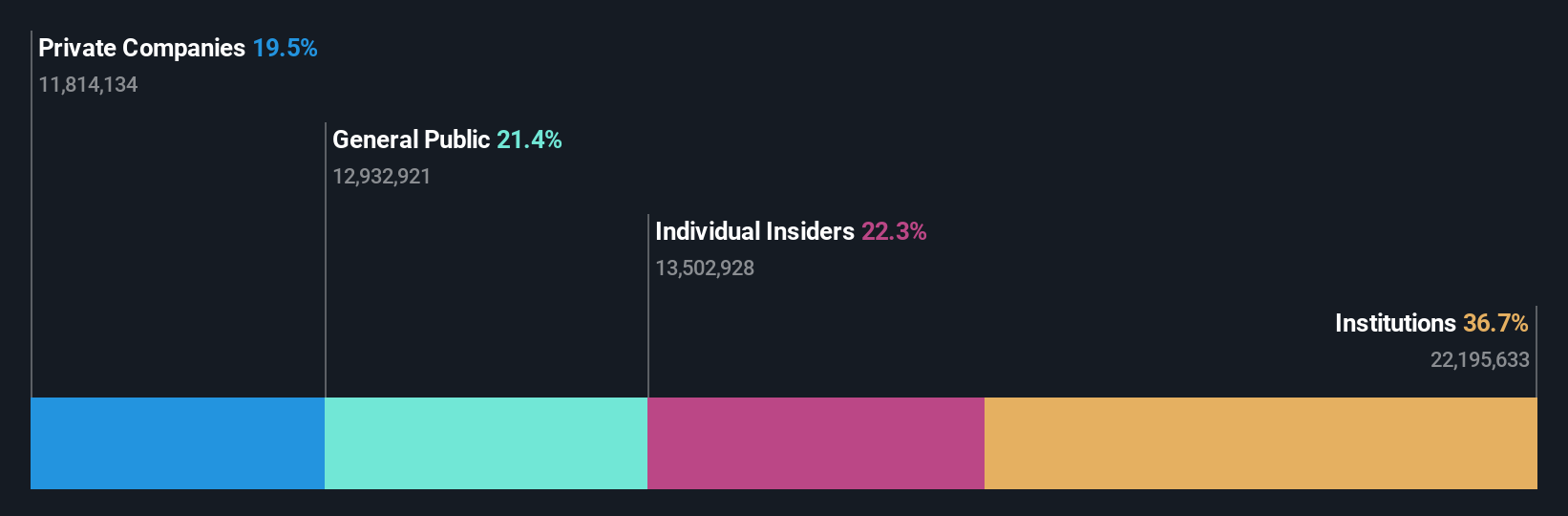

Insider Ownership: 37.9%

Info Edge (India) Limited is experiencing robust growth, with Q1 2024 revenue rising to ₹8.28 billion (US$0.10 billion) and net income increasing to ₹2.33 billion (US$28 million). Despite significant insider selling in the past three months, earnings are forecasted to grow at 23.62% annually over the next three years, outpacing the Indian market's 16.9%. Recent executive changes aim to bolster its revenue growth strategy further, enhancing its long-term prospects.

- Delve into the full analysis future growth report here for a deeper understanding of Info Edge (India).

- Upon reviewing our latest valuation report, Info Edge (India)'s share price might be too optimistic.

One97 Communications (NSEI:PAYTM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: One97 Communications Limited offers payment, commerce and cloud, and financial services to consumers and merchants in India, with a market cap of ₹364.55 billion.

Operations: The company's revenue segments include Data Processing, which generated ₹91.38 billion.

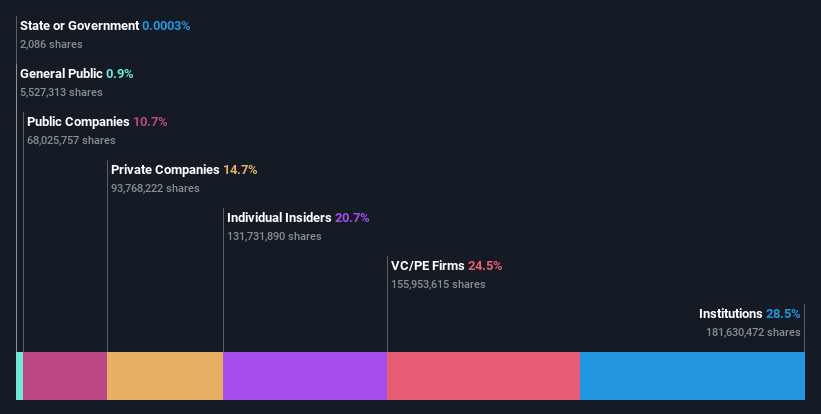

Insider Ownership: 20.7%

One97 Communications, the parent company of Paytm, has seen significant insider ownership and is expected to become profitable within the next three years. Despite recent regulatory penalties totaling ₹4.71 million (US$57,000) for non-payment of stamp duty, the company continues to expand its offerings with strategic partnerships like FlixBus and new product launches such as 'Paytm Health Saathi.' However, recent earnings reports indicate a decline in revenue and increased net losses compared to last year.

- Dive into the specifics of One97 Communications here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of One97 Communications shares in the market.

Seize The Opportunity

- Click here to access our complete index of 94 Fast Growing Indian Companies With High Insider Ownership.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NAUKRI

Info Edge (India)

Operates as an online classifieds company in the areas of recruitment, matrimony, real estate, and education and related services in India and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.