- India

- /

- Consumer Durables

- /

- NSEI:BOROLTD

Borosil Limited's (NSE:BOROLTD) Popularity With Investors Is Under Threat From Overpricing

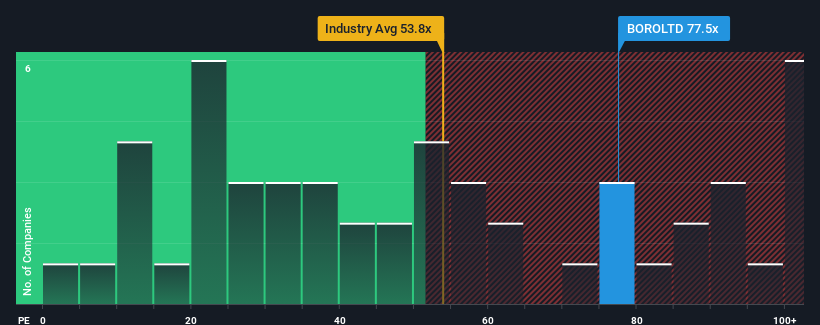

Borosil Limited's (NSE:BOROLTD) price-to-earnings (or "P/E") ratio of 77.5x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 32x and even P/E's below 18x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Borosil hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Borosil

Is There Enough Growth For Borosil?

The only time you'd be truly comfortable seeing a P/E as steep as Borosil's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 9.7% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 41% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 10.0% over the next year. With the market predicted to deliver 26% growth , the company is positioned for a weaker earnings result.

With this information, we find it concerning that Borosil is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Borosil's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Borosil currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Borosil that you should be aware of.

If these risks are making you reconsider your opinion on Borosil, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Borosil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BOROLTD

Borosil

Manufactures, sells, and trades in consumer ware products in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives