Bannari Amman Spinning Mills (NSE:BASML) Posted Healthy Earnings But There Are Some Other Factors To Be Aware Of

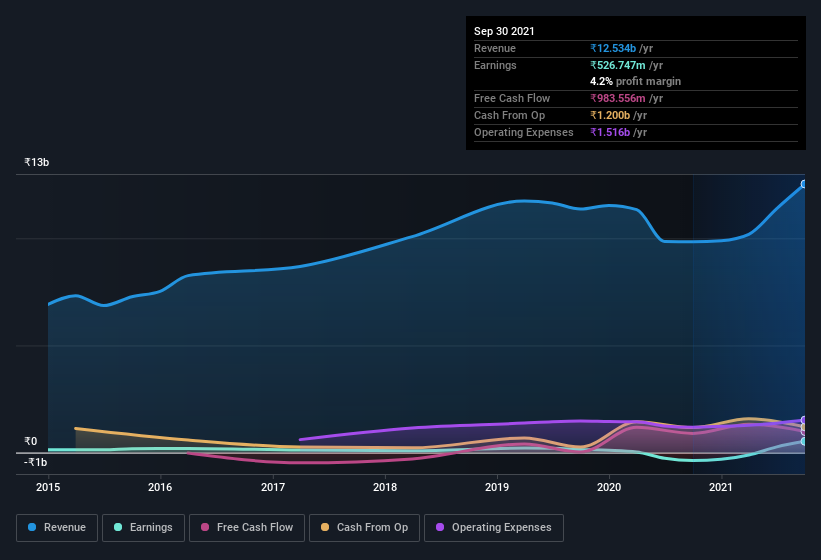

Bannari Amman Spinning Mills Ltd (NSE:BASML) announced strong profits, but the stock was stagnant. We did some digging, and we found some concerning factors in the details.

Check out our latest analysis for Bannari Amman Spinning Mills

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Bannari Amman Spinning Mills issued 111% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Bannari Amman Spinning Mills' historical EPS growth by clicking on this link.

How Is Dilution Impacting Bannari Amman Spinning Mills' Earnings Per Share? (EPS)

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. So you can see that the dilution has had a fairly significant impact on shareholders.

In the long term, if Bannari Amman Spinning Mills' earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Bannari Amman Spinning Mills.

Our Take On Bannari Amman Spinning Mills' Profit Performance

Bannari Amman Spinning Mills issued shares during the year, and that means its EPS performance lags its net income growth. As a result, we think it may well be the case that Bannari Amman Spinning Mills' underlying earnings power is lower than its statutory profit. The good news is that it earned a profit in the last twelve months, despite its previous loss. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about Bannari Amman Spinning Mills as a business, it's important to be aware of any risks it's facing. To that end, you should learn about the 5 warning signs we've spotted with Bannari Amman Spinning Mills (including 3 which make us uncomfortable).

This note has only looked at a single factor that sheds light on the nature of Bannari Amman Spinning Mills' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Bannari Amman Spinning Mills might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:BASML

Bannari Amman Spinning Mills

Engages in the textile business in India and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives