Stock Analysis

- India

- /

- Professional Services

- /

- NSEI:QUESS

Quess Corp Limited (NSE:QUESS) Analysts Are Pretty Bullish On The Stock After Recent Results

It's been a good week for Quess Corp Limited (NSE:QUESS) shareholders, because the company has just released its latest quarterly results, and the shares gained 4.8% to ₹580. Quess reported ₹28b in revenue, roughly in line with analyst forecasts, although statutory earnings per share (EPS) of ₹2.79 beat expectations, being 3.0% higher than what the analysts expected. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Quess

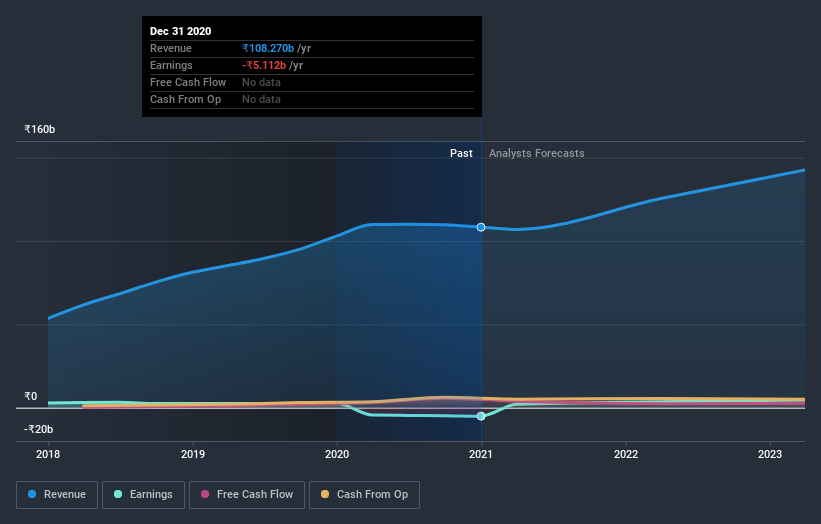

After the latest results, the nine analysts covering Quess are now predicting revenues of ₹125.5b in 2022. If met, this would reflect a meaningful 16% improvement in sales compared to the last 12 months. Earnings are expected to improve, with Quess forecast to report a statutory profit of ₹23.80 per share. Before this earnings report, the analysts had been forecasting revenues of ₹125.5b and earnings per share (EPS) of ₹24.41 in 2022. The analysts seem to have become a little more negative on the business after the latest results, given the minor downgrade to their earnings per share numbers for next year.

Despite cutting their earnings forecasts,the analysts have lifted their price target 19% to ₹632, suggesting that these impacts are not expected to weigh on the stock's value in the long term. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Quess at ₹782 per share, while the most bearish prices it at ₹493. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that Quess' revenue growth is expected to slow, with forecast 16% increase next year well below the historical 26%p.a. growth over the last five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 12% next year. Even after the forecast slowdown in growth, it seems obvious that Quess is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Fortunately, they also reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Quess analysts - going out to 2023, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Quess that you should be aware of.

If you decide to trade Quess, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Quess is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:QUESS

Quess

Operates as a business services provider in India, South East Asia, the Middle East, and North America.

Flawless balance sheet with reasonable growth potential and pays a dividend.