Stock Analysis

- India

- /

- Professional Services

- /

- NSEI:QUESS

Investors Who Bought Quess (NSE:QUESS) Shares A Year Ago Are Now Up 42%

Diversification is a key tool for dealing with stock price volatility. Of course, in an ideal world, all your stocks would beat the market. Quess Corp Limited (NSE:QUESS) has done well over the last year, with the stock price up 42% beating the market return of 41% (not including dividends). In contrast, the longer term returns are negative, since the share price is 28% lower than it was three years ago.

See our latest analysis for Quess

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months Quess went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. It may be that the company has done well on other metrics.

However the year on year revenue growth of 5.1% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

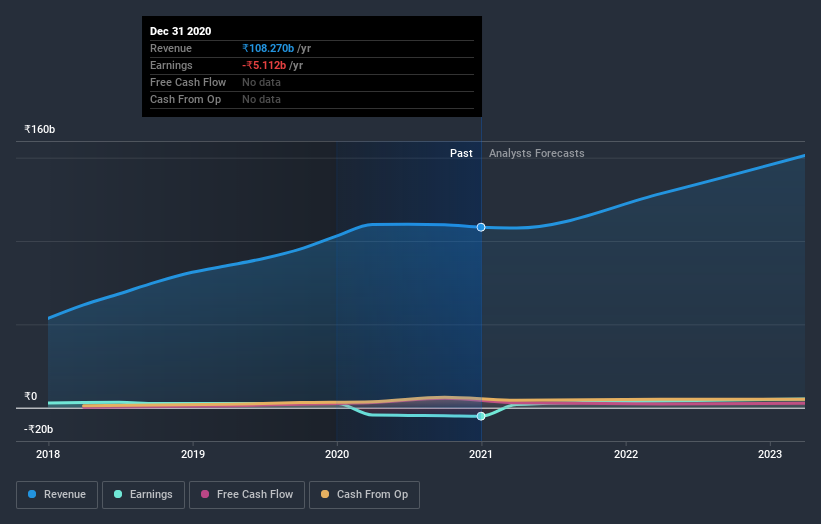

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Quess will earn in the future (free profit forecasts).

A Different Perspective

While the market return was 43% in the last year, Quess returned 42% to shareholders. Shareholders can take comfort that it's certainly better than the yearly loss of about 9% per year endured over the last three years. It could well be that the business is getting back on track. It's always interesting to track share price performance over the longer term. But to understand Quess better, we need to consider many other factors. For instance, we've identified 2 warning signs for Quess that you should be aware of.

Quess is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Quess, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Quess is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:QUESS

Quess

Operates as a business services provider in India, South East Asia, the Middle East, and North America.

Flawless balance sheet with reasonable growth potential and pays a dividend.