Stock Analysis

- India

- /

- Professional Services

- /

- NSEI:QUESS

Have Insiders Sold Quess Corp Limited (NSE:QUESS) Shares Recently?

Anyone interested in Quess Corp Limited (NSE:QUESS) should probably be aware that a company insider, Prithiv George, recently divested ₹7.9m worth of shares in the company, at an average price of ₹698 each. Equally important, that sale actually reduced their holding by a full 100% which hardly makes us feel bullish about the stock.

See our latest analysis for Quess

Quess Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider purchase was by Chairman & MD Ajit Isaac for ₹34m worth of shares, at about ₹375 per share. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of ₹678. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

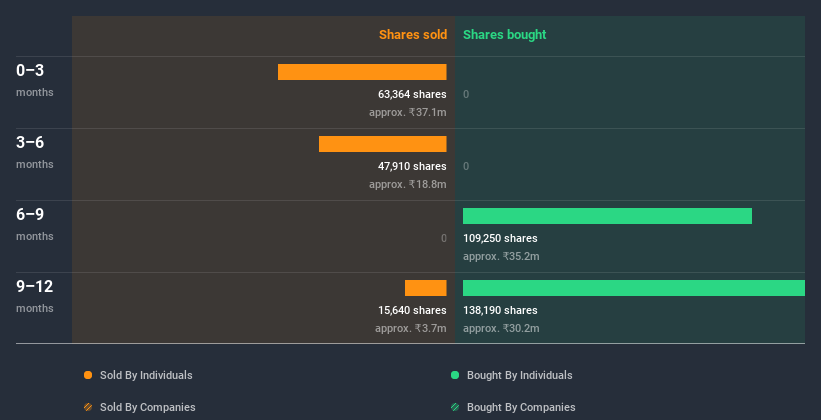

Happily, we note that in the last year insiders paid ₹69m for 247.44k shares. On the other hand they divested 126.91k shares, for ₹60m. In the last twelve months there was more buying than selling by Quess insiders. They paid about ₹278 on average. It is certainly positive to see that insiders have invested their own money in the company. However, we do note that they were buying at significantly lower prices than today's share price. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Quess is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Does Quess Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Quess insiders own 14% of the company, currently worth about ₹15b based on the recent share price. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At Quess Tell Us?

Insiders sold stock recently, but they haven't been buying. In contrast, they appear keener if you look at the last twelve months. On top of that, insiders own a significant portion of the company. So we're happy to look past recent trading. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. In terms of investment risks, we've identified 2 warning signs with Quess and understanding these should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Quess or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Quess is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:QUESS

Quess

Operates as a business services provider in India, South East Asia, the Middle East, and North America.

Flawless balance sheet with reasonable growth potential and pays a dividend.