- India

- /

- Commercial Services

- /

- NSEI:IRCTC

Here's Why We Think Indian Railway Catering & Tourism (NSE:IRCTC) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Indian Railway Catering & Tourism (NSE:IRCTC). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Indian Railway Catering & Tourism with the means to add long-term value to shareholders.

See our latest analysis for Indian Railway Catering & Tourism

Indian Railway Catering & Tourism's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that Indian Railway Catering & Tourism has grown EPS by 45% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

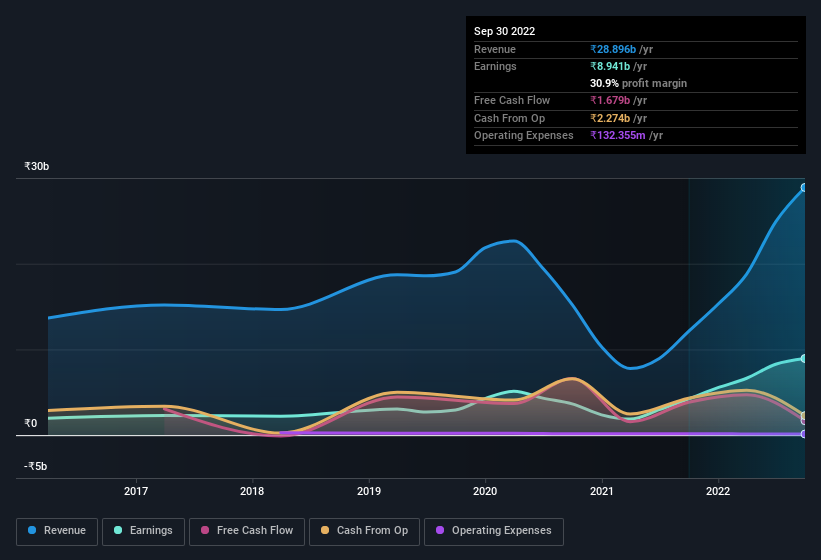

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. On the one hand, Indian Railway Catering & Tourism's EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Indian Railway Catering & Tourism's balance sheet strength, before getting too excited.

Are Indian Railway Catering & Tourism Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations between ₹327b and ₹981b, like Indian Railway Catering & Tourism, the median CEO pay is around ₹65m.

The CEO of Indian Railway Catering & Tourism only received ₹8.9m in total compensation for the year ending March 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Indian Railway Catering & Tourism Deserve A Spot On Your Watchlist?

Indian Railway Catering & Tourism's earnings per share have been soaring, with growth rates sky high. Such fast EPS growth prompts the question: has the business reached an inflection point? Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. It will definitely require further research to be sure, but it does seem that Indian Railway Catering & Tourism has the hallmarks of a quality business; and that would make it well worth watching. Still, you should learn about the 1 warning sign we've spotted with Indian Railway Catering & Tourism.

Although Indian Railway Catering & Tourism certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IRCTC

Indian Railway Catering & Tourism

Engages in the provision of catering and hospitality, Internet ticketing, travel and tourism, and packaged drinking water services in India.

Flawless balance sheet with moderate growth potential.