- India

- /

- Professional Services

- /

- NSEI:DYNAMIC

Take Care Before Jumping Onto Dynamic Services & Security Limited (NSE:DYNAMIC) Even Though It's 25% Cheaper

Dynamic Services & Security Limited (NSE:DYNAMIC) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

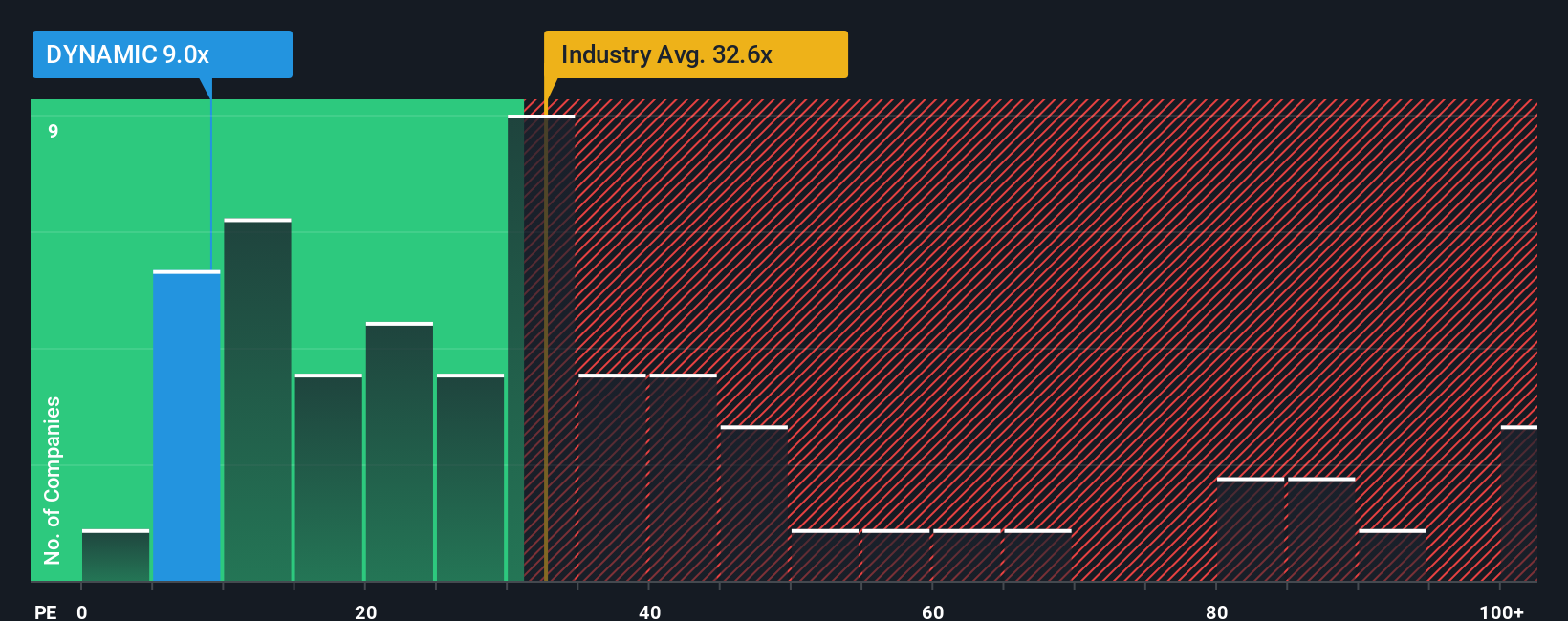

Since its price has dipped substantially, Dynamic Services & Security's price-to-earnings (or "P/E") ratio of 9x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 29x and even P/E's above 55x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

The earnings growth achieved at Dynamic Services & Security over the last year would be more than acceptable for most companies. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for Dynamic Services & Security

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Dynamic Services & Security's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a decent 8.7% gain to the company's bottom line. Pleasingly, EPS has also lifted 673% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that Dynamic Services & Security is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Having almost fallen off a cliff, Dynamic Services & Security's share price has pulled its P/E way down as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Dynamic Services & Security revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for Dynamic Services & Security (1 is a bit concerning!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DYNAMIC

Dynamic Services & Security

Provides security guarding and manpower solutions in India.

Excellent balance sheet and good value.

Market Insights

Community Narratives