- India

- /

- Metals and Mining

- /

- NSEI:JAIBALAJI

Undiscovered Gems in India to Watch This August 2024

Reviewed by Simply Wall St

In the last week, the Indian market is up 2.8% and has seen an impressive 48% increase over the last 12 months, with earnings forecasted to grow by 16% annually. In this thriving environment, identifying stocks with strong growth potential and solid fundamentals can offer significant opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| 3B Blackbio Dx | 0.38% | 3.93% | 3.59% | ★★★★★★ |

| Vidhi Specialty Food Ingredients | 7.07% | 13.43% | 5.94% | ★★★★★★ |

| Le Travenues Technology | 8.99% | 36.48% | 63.83% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| Gallantt Ispat | 18.85% | 38.22% | 31.27% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.78% | 39.75% | ★★★★★☆ |

| Nibe | 33.91% | 81.20% | 80.04% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Share India Securities | 24.23% | 37.66% | 48.98% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

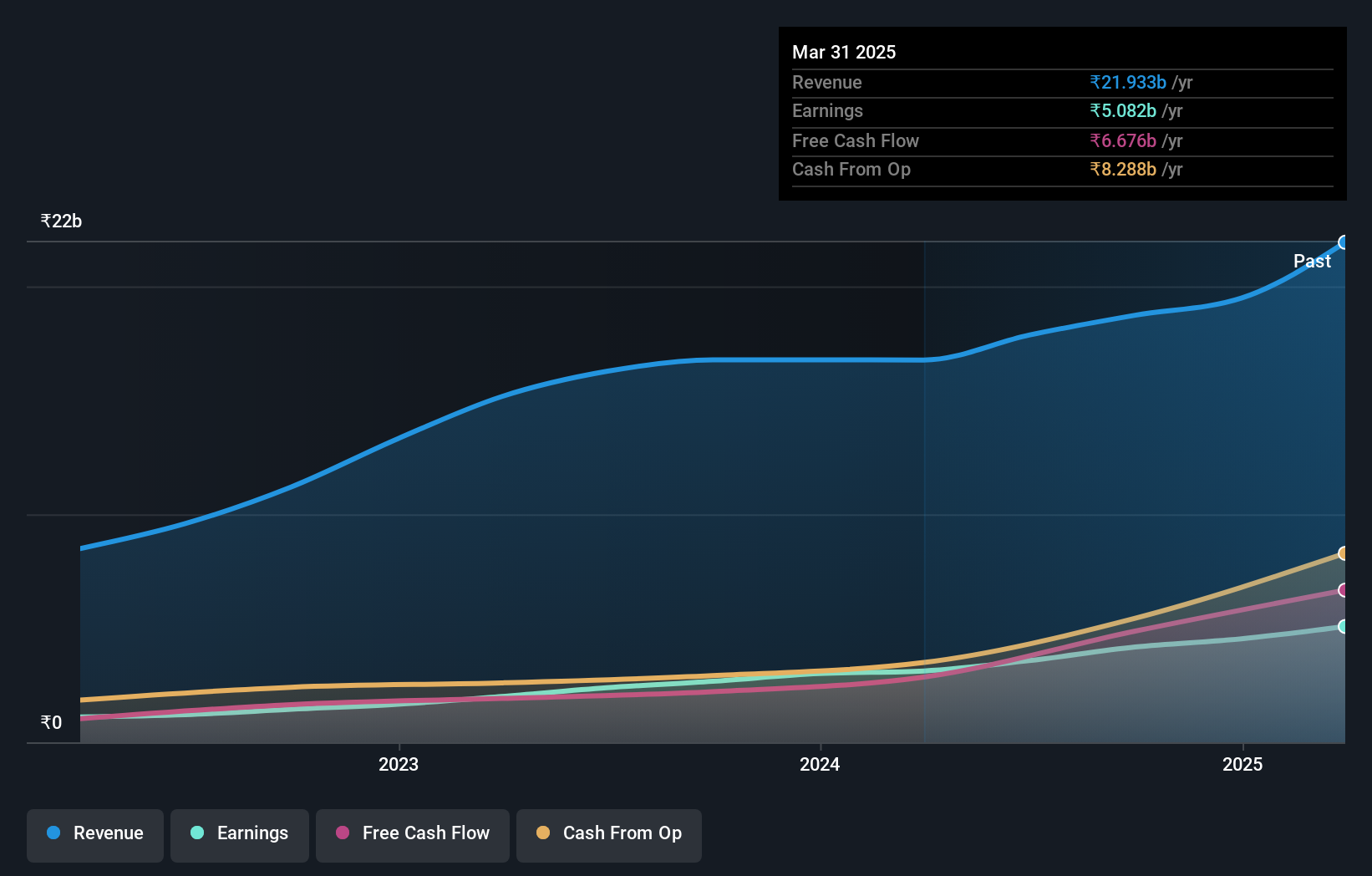

BLS International Services (NSEI:BLS)

Simply Wall St Value Rating: ★★★★★★

Overview: BLS International Services Limited specializes in outsourcing and administrative tasks for visa, passport, and consular services to various diplomatic missions, with a market cap of ₹147.92 billion.

Operations: BLS International Services Limited generates revenue primarily from Visa and Consular Services (₹13.62 billion) and Digital Services (₹3.34 billion).

BLS International Services has shown impressive growth, with earnings surging 55.9% in the past year, outperforming the Professional Services industry’s 8.3%. Notably, BLS is debt-free now compared to a debt-to-equity ratio of 10.1% five years ago. The company also proposed a final dividend of INR 0.50 per share for FY2023-24 and recently expanded by incorporating BLS International Holding Anonim Sirketi in Turkey with a share capital of ₺700 million (US$26 million).

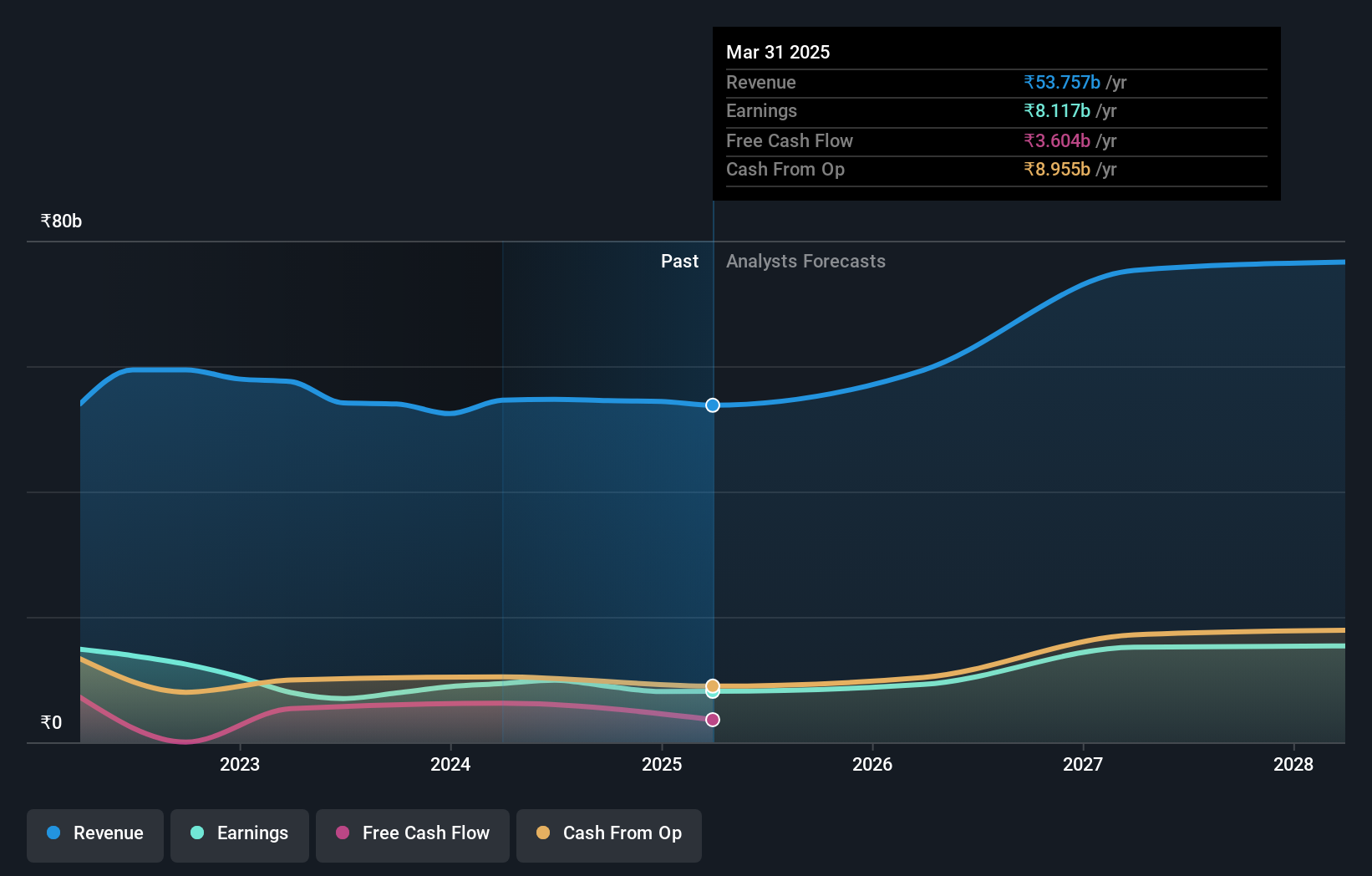

Godawari Power & Ispat (NSEI:GPIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Godawari Power & Ispat Limited, together with its subsidiaries, engages in the mining of iron ores in India and has a market cap of ₹145.19 billion.

Operations: GPIL generates revenue primarily from mining iron ores. The company's net profit margin has been recorded at 15.25%.

Godawari Power & Ispat (GPIL) has shown impressive financial health and growth. The company’s debt to equity ratio dropped significantly from 141.1% to 1.1% over five years, indicating strong fiscal management. Earnings grew by 18% last year, surpassing the Metals and Mining industry average of 17.7%. Additionally, GPIL repurchased 2,150,000 shares for INR 3 billion in July 2024, enhancing shareholder value. With a P/E ratio of 15.5x below the Indian market's average of 34.9x and robust interest coverage at nearly 20 times EBIT, GPIL looks well-positioned for continued stability and growth in its sector.

- Delve into the full analysis health report here for a deeper understanding of Godawari Power & Ispat.

Learn about Godawari Power & Ispat's historical performance.

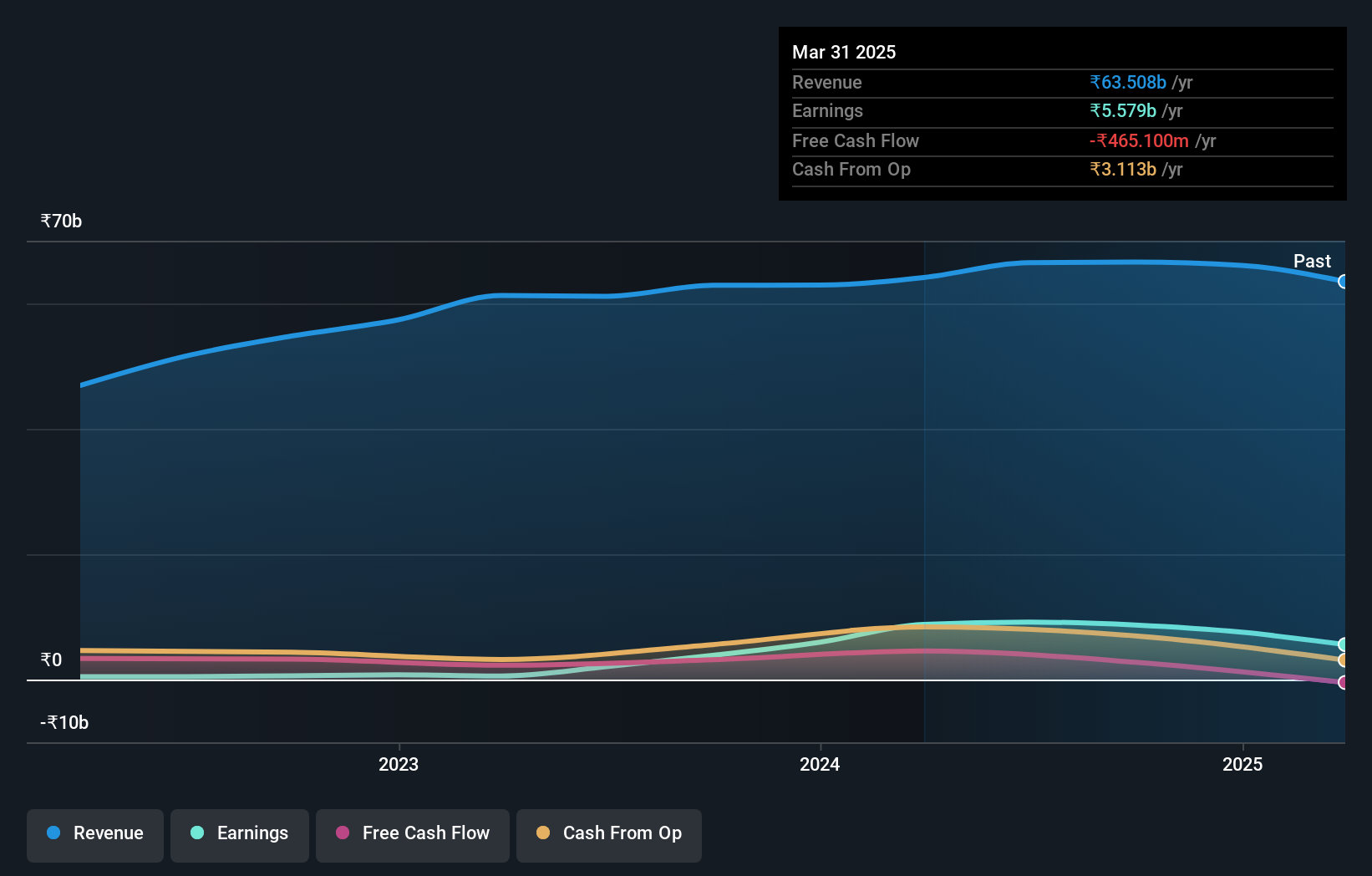

Jai Balaji Industries (NSEI:JAIBALAJI)

Simply Wall St Value Rating: ★★★★★★

Overview: Jai Balaji Industries Limited manufactures and markets iron and steel products primarily in India, with a market cap of ₹160.76 billion.

Operations: The company generates revenue primarily from its iron and steel segment, amounting to ₹49.48 billion.

Jai Balaji Industries has shown impressive growth, with earnings surging by 344.7% over the past year, outpacing the Metals and Mining industry's 17.7%. The company’s interest payments are well covered by EBIT at 13.9x, indicating robust financial health. Despite shareholder dilution in the past year, Jai Balaji's net debt to equity ratio stands at a satisfactory 25.4%, and its price-to-earnings ratio of 17.5x is below the Indian market average of 34.9x.

- Dive into the specifics of Jai Balaji Industries here with our thorough health report.

Assess Jai Balaji Industries' past performance with our detailed historical performance reports.

Key Takeaways

- Reveal the 460 hidden gems among our Indian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JAIBALAJI

Jai Balaji Industries

Manufactures and markets iron and steel products primarily in India.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives