- India

- /

- Metals and Mining

- /

- NSEI:GPIL

Emerging Indian Small Caps Including BLS International Services With Strong Potential

Reviewed by Simply Wall St

In the last week, the Indian market has risen by 2.8%, and over the past 12 months, it has surged by an impressive 48%, with earnings projected to grow by 16% annually over the next few years. In this buoyant environment, identifying promising small-cap stocks like BLS International Services can offer significant growth potential for investors seeking opportunities in emerging markets.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| 3B Blackbio Dx | 0.38% | 3.93% | 3.59% | ★★★★★★ |

| Deep Industries | 10.38% | 10.66% | 28.71% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 17.21% | 33.34% | ★★★★★★ |

| Le Travenues Technology | 8.99% | 36.48% | 63.83% | ★★★★★★ |

| Indo Tech Transformers | 2.30% | 20.60% | 62.92% | ★★★★★☆ |

| Genesys International | 10.57% | 13.38% | 27.53% | ★★★★★☆ |

| Abans Holdings | 91.73% | -25.26% | 17.68% | ★★★★★☆ |

| Kalyani Investment | NA | 18.19% | 3.65% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Rir Power Electronics | 53.98% | 13.52% | 31.41% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

BLS International Services (NSEI:BLS)

Simply Wall St Value Rating: ★★★★★★

Overview: BLS International Services Limited specializes in outsourcing and administrative tasks for visa, passport, and consular services to various diplomatic missions, with a market cap of ₹149.88 billion.

Operations: BLS International Services Limited generates revenue primarily from Visa and Consular Services (₹13.62 billion) and Digital Services (₹3.34 billion).

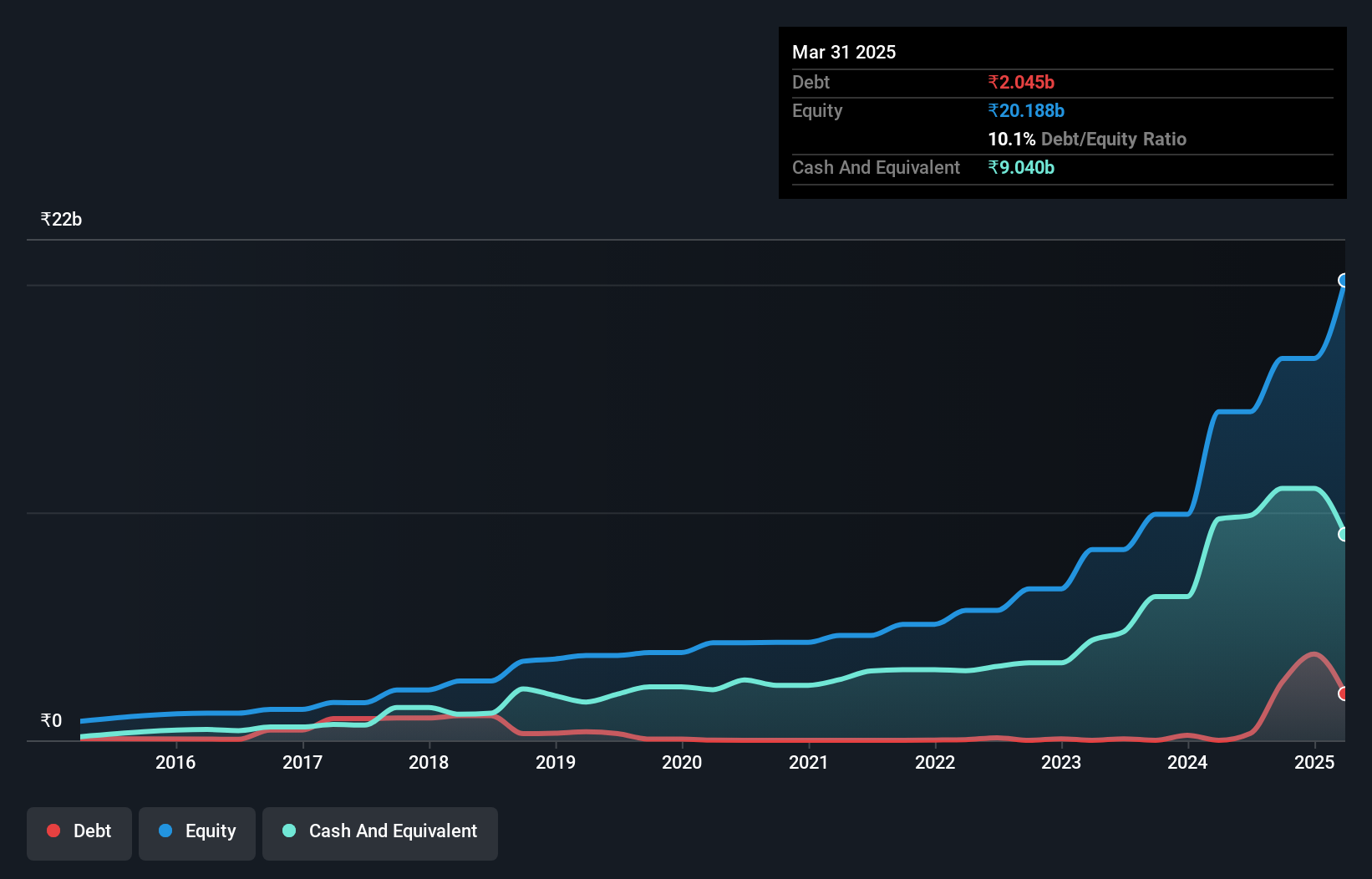

BLS International Services, a small cap entity, has shown remarkable earnings growth of 55.9% over the past year, outpacing the Professional Services industry’s 9.4%. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 10.1%. Recently, BLS expanded by incorporating a wholly-owned subsidiary in Turkey with a share capital of 700 million Turkish Liras and declared a final dividend of ₹0.50 per share for FY2023-24.

Godawari Power & Ispat (NSEI:GPIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Godawari Power & Ispat Limited, along with its subsidiaries, is involved in iron ore mining operations in India and has a market cap of ₹145.19 billion.

Operations: GPIL generates revenue primarily from its iron ore mining operations in India. The company has a market cap of ₹145.19 billion.

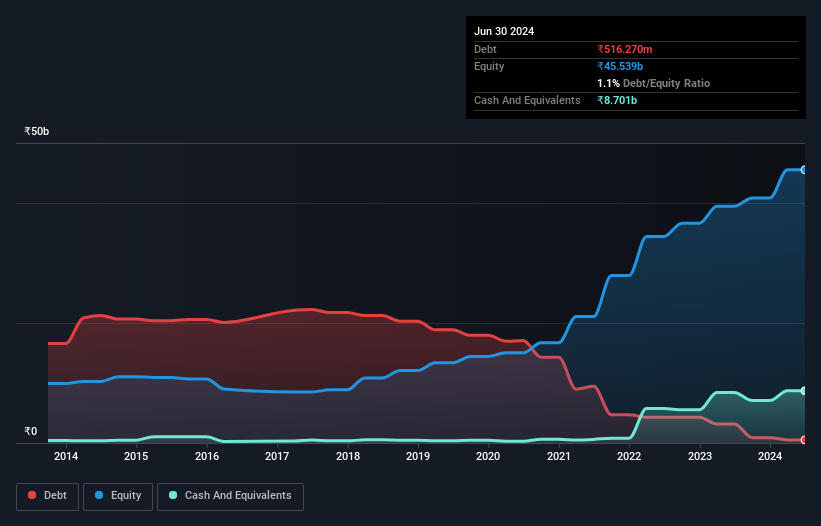

Godawari Power & Ispat (GPIL) has demonstrated robust financial health and strategic growth. The debt to equity ratio has significantly reduced from 141.1% to 1.1% over five years, indicating effective debt management. Its price-to-earnings ratio stands at 15.5x, well below the Indian market's 34.9x, suggesting good value for investors. Recent expansion plans include a new 2 million ton pellet plant in Raipur, while earnings grew by 18% last year, outpacing industry growth of 17.4%.

- Click here to discover the nuances of Godawari Power & Ispat with our detailed analytical health report.

Assess Godawari Power & Ispat's past performance with our detailed historical performance reports.

Suryoday Small Finance Bank (NSEI:SURYODAY)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suryoday Small Finance Bank Limited operates as a small finance bank primarily serving the unserved and underserved with a focus on financial inclusion in India, with a market cap of ₹20.96 billion.

Operations: Suryoday Small Finance Bank generates revenue primarily from Retail Banking (₹17.05 billion), Treasury operations (₹2.07 billion), and Corporate banking (₹1.00 billion). The bank also earns from Other Banking Operations, contributing ₹317.30 million to its total revenue streams.

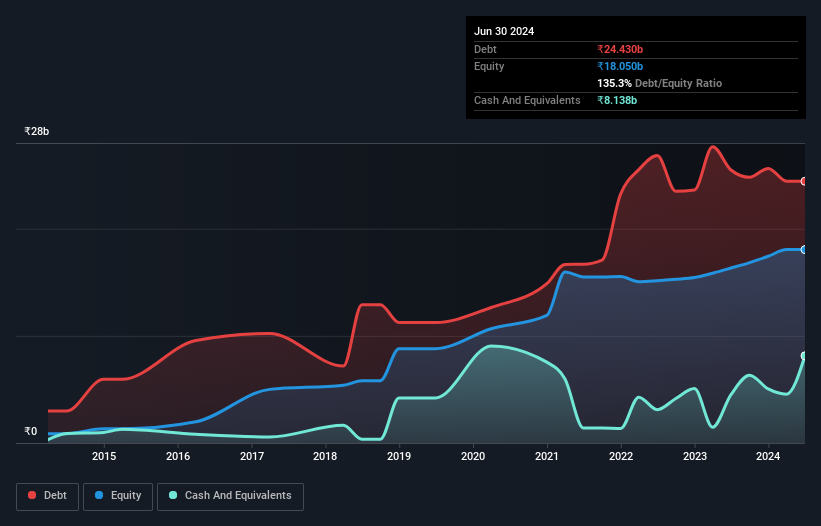

Suryoday Small Finance Bank, with total assets of ₹123.8B and equity of ₹18.0B, has seen its earnings grow by 178% over the past year, outpacing the industry average of 25.3%. The bank's net income for Q1 2024 was ₹700.6M compared to ₹476M a year ago, reflecting strong performance. Trading at a P/E ratio of 9.7x against the Indian market's 34.9x, it offers good value while managing a high level of bad loans at 3%.

Key Takeaways

- Delve into our full catalog of 456 Indian Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GPIL

Flawless balance sheet with high growth potential.