- India

- /

- Construction

- /

- NSEI:VOLTAS

Voltas (NSEI:VOLTAS) Eyes Growth with New Product Launches Amid High Valuation Concerns

Reviewed by Simply Wall St

Voltas (NSEI:VOLTAS) is poised for significant growth, with an impressive earnings forecast of 27.7% annually, and a strengthened net profit margin from 1.9% to 3.9% over the past year. However, the company faces hurdles such as a low Return on Equity and high valuation concerns. This report will explore Voltas's core advantages, challenges, growth opportunities, and external threats, providing a comprehensive overview of the company's current standing and future prospects.

Take a closer look at Voltas's potential here.

Core Advantages Driving Sustained Success for Voltas

With a strong earnings growth forecast of 27.7% annually, Voltas showcases its ability to outperform the construction industry average of 36.8% in past earnings growth. This positive trajectory is further supported by high-quality earnings, as evidenced by an improved net profit margin from 1.9% to 3.9% over the past year. The company's financial health is strong, with more cash than total debt, ensuring a solid cash runway for future operations. Such financial stability, coupled with a lack of significant shareholder dilution, underscores Voltas's commitment to maintaining shareholder value. The company's leadership, under the guidance of Pradeep Bakshi, CEO, has been pivotal in steering strategic initiatives that align with market demands.

Challenges Constraining Voltas's Potential

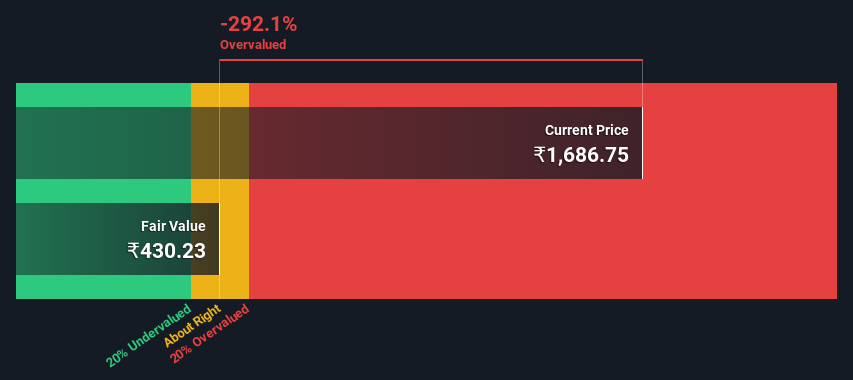

However, Voltas faces challenges with a low Return on Equity of 8.7%, which is below the acceptable threshold of 20%. This is compounded by a historical earnings decline of 11.2% annually over the past five years. The volatility in dividend payments, with an annual drop exceeding 20% over the last decade, further highlights financial hurdles. Additionally, the dividend yield of 0.32% falls short compared to the top 25% of dividend payers in the Indian market, which stands at 1.15%. The company's valuation, with a Price-To-Earnings Ratio of 102x, is notably higher than the peer average of 56.6x and the industry average of 25.9x, making it appear expensive.

Growth Avenues Awaiting Voltas

Looking ahead, Voltas has promising opportunities with a revenue growth forecast of 13.8% annually, outpacing the Indian market's 10.5%. The potential for significant earnings growth over the next three years, with expectations of surpassing 20% annually, is particularly noteworthy. The company is set to launch new product lines in the upcoming quarter, which are anticipated to drive further growth. Additionally, targeted marketing campaigns have shown promising results in attracting new customer segments, reflecting a strategic focus on expanding its customer base.

External Factors Threatening Voltas

Despite these opportunities, Voltas must navigate external threats such as economic headwinds that could impact consumer spending. The company remains cautious about potential regulatory changes that might affect operations and compliance costs. Furthermore, ongoing supply chain disruptions pose risks to product availability, necessitating proactive management to mitigate these challenges. The unstable dividend track record may also deter potential investors, emphasizing the need for Voltas to stabilize its financial offerings to maintain investor confidence.

Conclusion

Voltas's strong earnings growth forecast and improved profit margins highlight its potential to maintain a competitive edge, supported by sound financial health and strategic leadership. However, its low Return on Equity and historical earnings decline pose challenges that could hinder long-term profitability. The company's ambitious revenue growth plans and new product launches indicate promising future prospects, yet these must be balanced against external threats such as economic fluctuations and supply chain disruptions. Despite these growth avenues, the current high Price-To-Earnings Ratio suggests that the market may have already priced in much of this potential, making the stock appear expensive relative to peers and industry standards. This valuation concern underscores the importance of stabilizing dividends and improving financial metrics to sustain investor confidence and justify its market position.

Seize The Opportunity

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NSEI:VOLTAS

Voltas

Operates as an air conditioning and engineering solution provider primarily in India, the Middle East, Africa, and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.