- India

- /

- Electrical

- /

- NSEI:VOLTAMP

With EPS Growth And More, Voltamp Transformers (NSE:VOLTAMP) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Voltamp Transformers (NSE:VOLTAMP). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Voltamp Transformers

Voltamp Transformers' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that Voltamp Transformers has grown EPS by 46% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

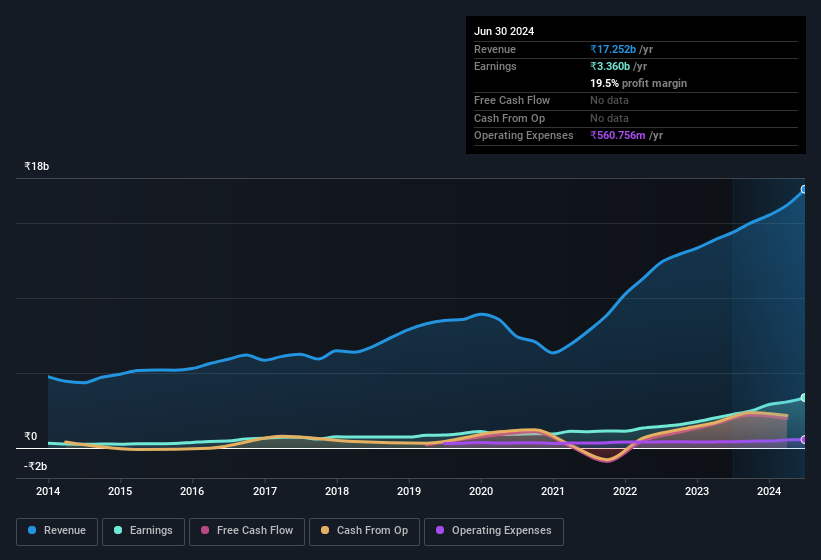

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Voltamp Transformers shareholders is that EBIT margins have grown from 16% to 20% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Voltamp Transformers' forecast profits?

Are Voltamp Transformers Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Voltamp Transformers will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 38% of the shares, making insiders a very influential shareholder group. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. ₹52b That level of investment from insiders is nothing to sneeze at.

Is Voltamp Transformers Worth Keeping An Eye On?

Voltamp Transformers' earnings per share growth have been climbing higher at an appreciable rate. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Voltamp Transformers for a spot on your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Voltamp Transformers is trading on a high P/E or a low P/E, relative to its industry.

Although Voltamp Transformers certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Indian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VOLTAMP

Voltamp Transformers

Manufactures and sells electrical transformers in India.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives