- India

- /

- Electrical

- /

- NSEI:TARIL

Read This Before Considering Transformers and Rectifiers (India) Limited (NSE:TRIL) For Its Upcoming ₹0.10 Dividend

Transformers and Rectifiers (India) Limited (NSE:TRIL) is about to trade ex-dividend in the next 3 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Therefore, if you purchase Transformers and Rectifiers (India)'s shares on or after the 2nd of September, you won't be eligible to receive the dividend, when it is paid on the 6th of October.

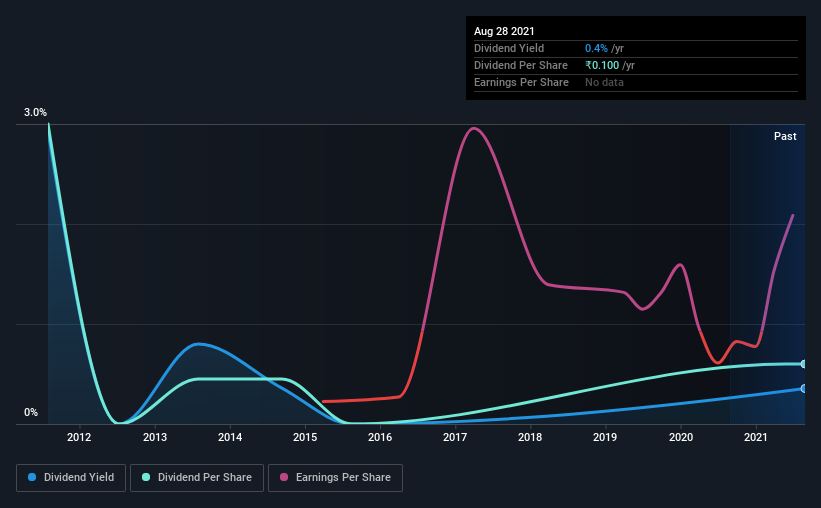

The company's upcoming dividend is ₹0.10 a share, following on from the last 12 months, when the company distributed a total of ₹0.10 per share to shareholders. Based on the last year's worth of payments, Transformers and Rectifiers (India) stock has a trailing yield of around 0.4% on the current share price of ₹28.15. If you buy this business for its dividend, you should have an idea of whether Transformers and Rectifiers (India)'s dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Transformers and Rectifiers (India)

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Transformers and Rectifiers (India) is paying out just 9.9% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Transformers and Rectifiers (India)'s earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 47% a year over the past five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Transformers and Rectifiers (India) has seen its dividend decline 15% per annum on average over the past 10 years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

The Bottom Line

Is Transformers and Rectifiers (India) worth buying for its dividend? Earnings per share have shrunk noticeably in recent years, although we like that the company has a low payout ratio. This could suggest a cut to the dividend may not be a major risk in the near future. Overall, Transformers and Rectifiers (India) looks like a promising dividend stock in this analysis, and we think it would be worth investigating further.

On that note, you'll want to research what risks Transformers and Rectifiers (India) is facing. Every company has risks, and we've spotted 4 warning signs for Transformers and Rectifiers (India) (of which 2 don't sit too well with us!) you should know about.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Transformers and Rectifiers (India), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Transformers and Rectifiers (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:TARIL

Transformers and Rectifiers (India)

Manufactures and sells transformers in India.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives