- India

- /

- Construction

- /

- NSEI:TPHQ

Subdued Growth No Barrier To Teamo Productions HQ Limited (NSE:TPHQ) With Shares Advancing 36%

Teamo Productions HQ Limited (NSE:TPHQ) shareholders have had their patience rewarded with a 36% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 67%.

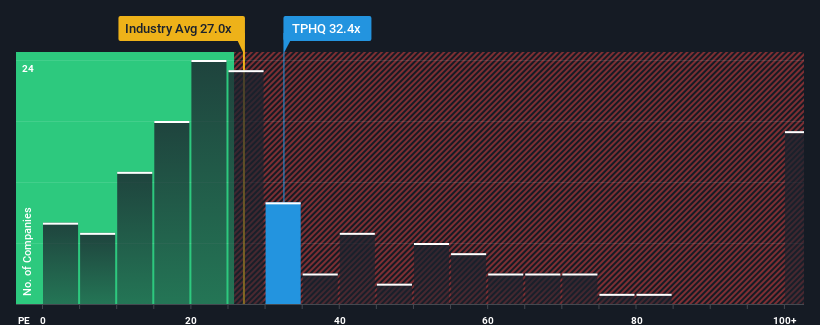

Although its price has surged higher, there still wouldn't be many who think Teamo Productions HQ's price-to-earnings (or "P/E") ratio of 32.4x is worth a mention when the median P/E in India is similar at about 33x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

The earnings growth achieved at Teamo Productions HQ over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for Teamo Productions HQ

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Teamo Productions HQ would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a worthy increase of 8.7%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Teamo Productions HQ's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

Teamo Productions HQ appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Teamo Productions HQ revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 3 warning signs for Teamo Productions HQ (1 is a bit concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Teamo Productions HQ, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Teamo Productions HQ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TPHQ

Teamo Productions HQ

Provides film production, distribution, and related media services in India and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives