What Titagarh Rail Systems Limited's (NSE:TITAGARH) P/S Is Not Telling You

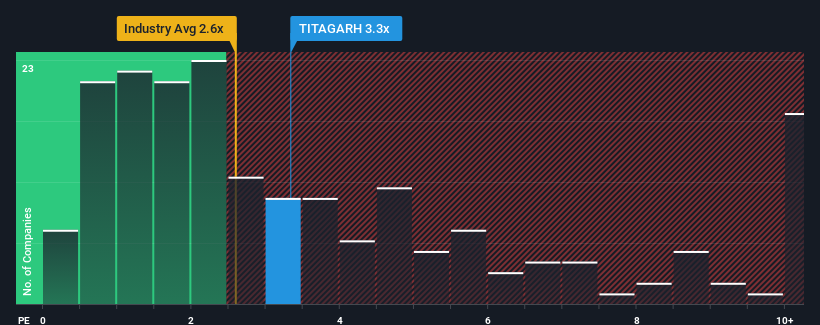

When close to half the companies in the Machinery industry in India have price-to-sales ratios (or "P/S") below 2.6x, you may consider Titagarh Rail Systems Limited (NSE:TITAGARH) as a stock to potentially avoid with its 3.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Titagarh Rail Systems

What Does Titagarh Rail Systems' P/S Mean For Shareholders?

Titagarh Rail Systems certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Titagarh Rail Systems will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Titagarh Rail Systems would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 40%. Pleasingly, revenue has also lifted 151% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 9.7% as estimated by the four analysts watching the company. With the industry predicted to deliver 12% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Titagarh Rail Systems' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Titagarh Rail Systems' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Titagarh Rail Systems trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Titagarh Rail Systems is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Titagarh Rail Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TITAGARH

Titagarh Rail Systems

Engages in the manufacture and sale of freight and passenger rail systems in India and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives