It's A Story Of Risk Vs Reward With Texmaco Rail & Engineering Limited (NSE:TEXRAIL)

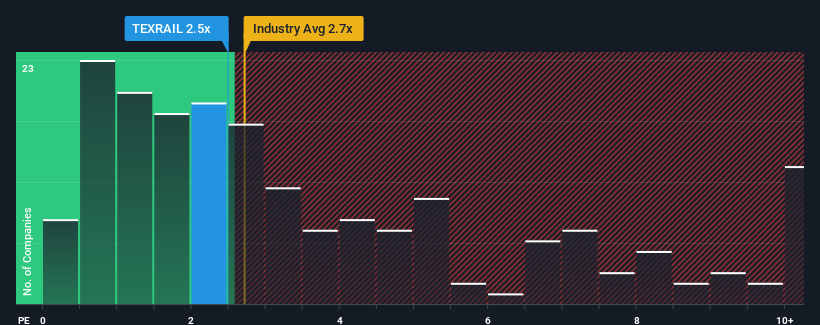

There wouldn't be many who think Texmaco Rail & Engineering Limited's (NSE:TEXRAIL) price-to-sales (or "P/S") ratio of 2.5x is worth a mention when the median P/S for the Machinery industry in India is similar at about 2.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Texmaco Rail & Engineering

How Texmaco Rail & Engineering Has Been Performing

Texmaco Rail & Engineering certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Texmaco Rail & Engineering's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Texmaco Rail & Engineering?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Texmaco Rail & Engineering's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 72%. Pleasingly, revenue has also lifted 84% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 13%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Texmaco Rail & Engineering's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Texmaco Rail & Engineering currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Texmaco Rail & Engineering (1 is significant!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Texmaco Rail & Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TEXRAIL

Texmaco Rail & Engineering

Manufactures, sells, and provides services for rail and rail related products in India and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives